Why Central Banks Will Buy Silver

Commodities / Gold and Silver 2016 Feb 24, 2016 - 07:51 PM GMTBy: Hubert_Moolman

Money is a store of value (or wealth), a medium of exchange as well as a unit of account. In order for money to be effective in the above it has to have the following properties:

Money is a store of value (or wealth), a medium of exchange as well as a unit of account. In order for money to be effective in the above it has to have the following properties:

- divisible - should be divisible in smaller units

- portable - able to carry it around therefore a high value should be able to be contained in a small space and weight

- homogenous - one unit should be the same as any another unit

- durable - should not be able to be easily destroyed or eroded

- valuable - should have intrinsic value, normally because it is desirable. Should not be able to be created or discovered without reasonable effort (normally a commodity itself).

Gold has all the above properties. It is for this reason that gold has been used as money for centuries. It is for this reason that central banks hold gold as part of their reserves. In fact, it is through holding gold that they could get people to use and trust their fiat currencies.

Silver also has these monetary properties, and it has been used as money for centuries. Furthermore, central banks also used to hold silver as part of their reserves, as well as issue it in the form of coins.

Today, silver has basically been completely demonetized, with virtually no central banks holding silver as part of their reserves. This demonetization happened over a period starting in the 1870s and ran until about the late 60s. The fact that silver was being completely demonetized, while central banks were still holding gold as part of their reserves is a major contributor as to why some see gold as money but silver as a commodity.

The Bretton-Woods was virtually the final nail in the coffin for silver's use as money, when the nations agreed to structure their monetary system around gold and the US dollar (to the exclusion of silver). Today, we are basically in a post Bretton-Woods era, with the monetary landscape having been decimated by the effects (massive credit extension) of Bretton-Woods and that which followed.

Many would say that central banks hate gold , based on the majority of their actions over the last 100 years, at least. However, it is not that central banks hate gold per se, but they hate it when it is in their interest to do so, and they love it when they need it.

For example, they love it, when it gives their currencies credibility, during a time when fiat currencies are being questioned (like during most of the 70s). During this period until about 1976, the central banks were net buyers of gold.

During the 80s, there was still pressure on fiat currencies, which forced central banks to hold on to their gold. During this period, central bank gold reserves remained virtually constant.

By the 90s, the financial landscape had changed to a situation where it was in the interest of most countries to devalue their currencies (to contribute to the great credit bubble). During this period central banks were net sellers of gold and this continued until about 2008/2009.

The 2007/2008 financial crisis brought about a major change in the financial landscape, forcing central banks to become net buyers of gold (which they continue to be). Again, much like the 70s, it is in their interest to buy gold, to support their suspicious currencies.

Since, the 2007/2008 financial crisis, there have been big developments (like the BRICS bank) to replace the US dollar as the reserve currency of world trade. This is set to intensify as more and more currencies are being put under pressure by this continuing financial crisis.

In order for any development to be successful, something like gold has to be used, to provide the necessary credibility. This will (is already) cause a scramble among nations to get as much gold as possible (The US is the exception to this, since it is not in its interest to lose US dollar reserve status).

With this happening, it won't be long before central banks buy silver, especially given that silver has all the monetary properties that gold has. This might seem so unlikely to most, given their recent historical attitude towards silver. However, the only reason they were not interested in silver is because it was in their interest to hate it.

Now, however, it is fast becoming well aligned with their interest of surviving (as a monetary authority or country) and even superseding the current order. After all, it is not like having silver is new thing for them.

Fractal Analysis of the Gold/Silver ratio

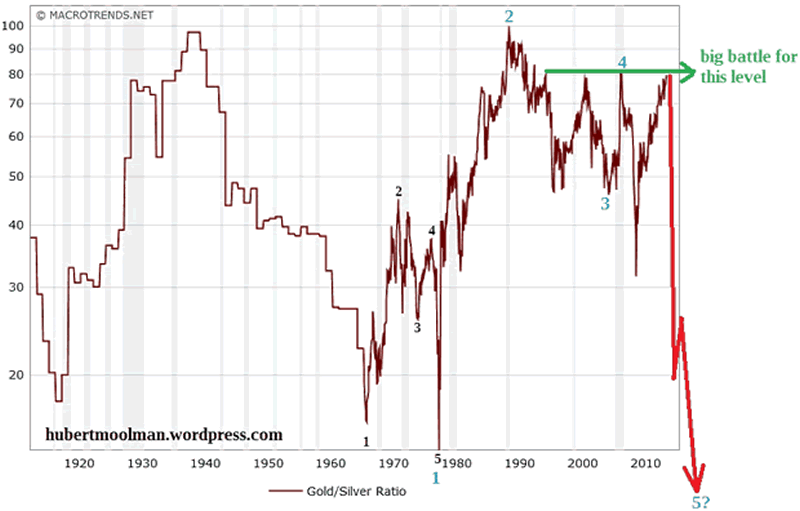

Below, is a 100-year Gold/Silver ratio chart (from macrotrendsnet):

On the chart, I have marked the 70s (gold and silver) bull market with black points 1 to 5. (from the low in the ratio to the high in the ratio), and compared it to the latest bull market, which I have marked with blue points 1 to 5 (from the low in the ratio to the high in the ratio). If point 5 occurs lower than 15 (as illustrated), we will have a very accurate fractal (pattern), similar to the one of the 70s (but bigger).

Both patterns started at the bottom of the 100-year range of this ratio, in fact, at a major bottom (1968 & 1980).

The current pattern has not completed yet, and it would suggest that it will only complete at a point much lower than a ratio of 15. Such a completion of the pattern is consistent with the bullish fundamentals of silver (and gold) in relation to paper money - understanding that a lower ratio will likely mean higher gold and silver prices. Note that there is a major battle for the 80 - level of the ratio.

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.