Gold Knocked for a Loop

Commodities / Gold and Silver 2016 Feb 17, 2016 - 10:39 AM GMTBy: Dan_Norcini

This looks to me more like an overreaction to the down side in gold based off a sort of mini-panic out of the safe haven trades.

This looks to me more like an overreaction to the down side in gold based off a sort of mini-panic out of the safe haven trades.

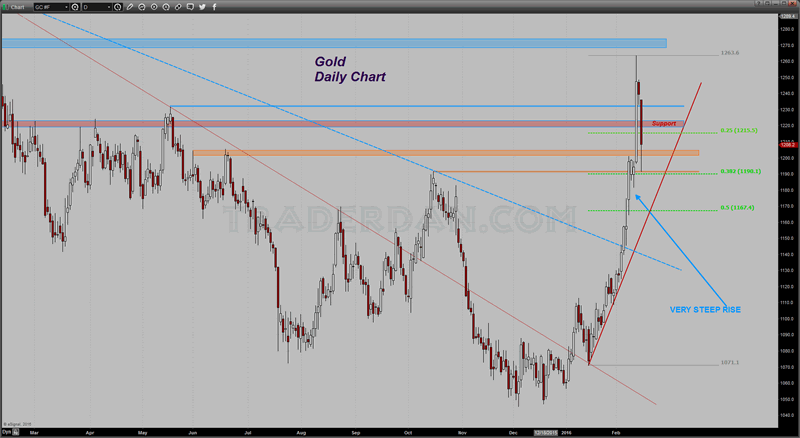

From a fundamental standpoint, nothing has changed in regards to the concerns about negative interest rates nor the chaotic nature of the forex markets. While today’s move in gold certainly was certainly unsettling, it should be kept in mind that this market has rallied nearly straight up since January 14 putting on almost $190 in a month. That is one impressive rally!

The setback, though violent, reached a mere 38.2% retracement of that entire move. That is insignificant. I would suspect that if this market were to try to test the 50% retracement level of the recent rally near $1168, buyers would be more than abundant.

The steepness of the rising trendline beneath these lows cannot be sustained indefinitely as that is just too much, too quickly WITHOUT a constant stream of bullish developments. As soon as the market got a whiff of RISK ON movement, the feed pushing the bull higher faded and you got the reaction lower.

We should now see some backing and filling up here while the market sifts through the various news stories that will be coming our way.

I would watch that session low made in the overnight market that stopped just above the 38.2% retracement level at $1190. That was pretty solid support based on the way the market jumped back off of it. It is also the high made last October and thus the REVERSING POLARITY principle was on full display [Former resistance on the way up reverses polarity and becomes support on the way down].

As long as the miners do not completely fall apart, I would expect this region to hold if tested again. If not, and it does give way, that would set up the 50% level near $1168 as the next zone where support can be expected to emerge.

Days like this are bizarre and used to be relatively uncommon in years gone by. Now, it seems like more and more they are becoming the norm. Massive rallies which soon give way to sharp collapses and vice versa.

I have been complaining a lot about this of late when it comes to the cattle market. It has gotten so bad in that pit that the entire industry has been in an uproar and complaining to the CME about it. I don’t think they can do anything to stop the insane madness because this is what happens when the algos take over and obliterate everyone and everything that happens to be on the other side of their mindless buying or selling on any given day. Unless the exchanges are willing to get rid of those damned things, we are stuck with this sort of lunacy from here on out as far as the eye can see.

This is the reason that the CME hiked those margins last week. Too much volatility.

It is also the reason I keep repeating until you are probably sick of reading it… TRADE SMALL or NOT AT ALL. These markets are simply too dangerous the bet the farm on any trade. If you do, chances are you will end up as a sharecropper.

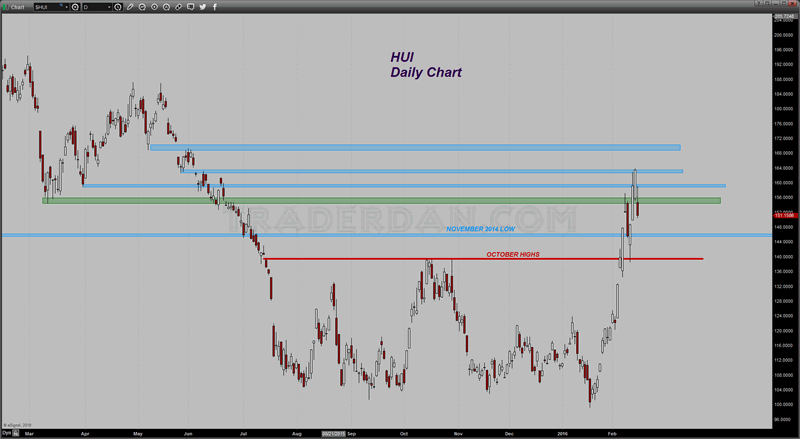

A brief look at the HUI.. not much here either. Just a move lower after the torrid gains of the last month.

I would look for support first near 146 and then again at the October highs if that were to fail. Watch to see how it acts near these levels.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.