Crude Oil Price Bottoms and Blues

Commodities / Crude Oil Feb 05, 2016 - 04:52 PM GMTBy: DeviantInvestor

Crude oil prices have dropped from about $106 in June of 2014 to briefly under $30 in January of 2016 – down about 74% peak to trough. This appears to be an on-going disaster for oil companies, the banks who loaned money to frackers, oil exporting countries, global stock markets and others.

Crude oil prices have dropped from about $106 in June of 2014 to briefly under $30 in January of 2016 – down about 74% peak to trough. This appears to be an on-going disaster for oil companies, the banks who loaned money to frackers, oil exporting countries, global stock markets and others.

Conventional wisdom suggests that crude oil prices will stay low for a long time because of low demand (global recession), huge supply (Iran, fracking, etc.), decline in commodity prices globally, and at least ten more reasons.

Maybe!

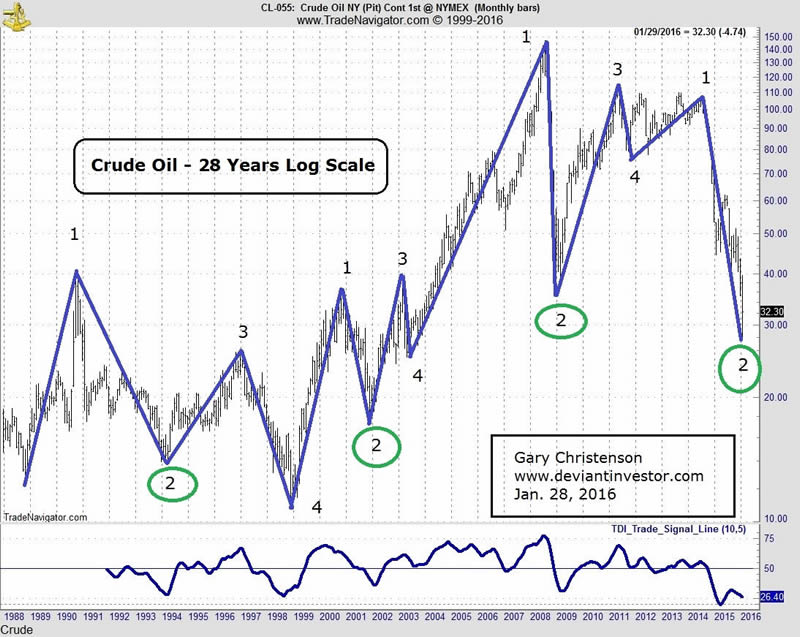

But crude oil prices have crashed before and then rallied. Examine the following chart and the 4 step sequences shown.

Note the following “1” to “2” down legs shown on the chart. They are:

Date High (1) Low (2) % Drop

9/90 – 4/94 40.10 13.90 65%

10/00 – 11/01 36.90 17.12 54%

7/08 – 12/08 147.20 35.35 76%

6/14 – 1/16 106.83 27.56 74%

Note that crude oil has crashed before, and probably will again. But it has also rallied after crashes and probably will again. Note the following rallies:

Date Low High % Rally

4/86 – 8/87 9.95 22.03 121%

6/90 – 9/90 16.57 40.10 142%

12/98 – 10/00 10.75 36.90 243%

1/07 – 7/08 51.00 147.20 188%

12/08 – 11/09 35.35 89.90 154%

1/16 – ? 27.56 ? ?

There have been several substantial rallies from deeply oversold conditions over the past 30 years. At each of those lows I think there were many good reasons why crude oil had crashed and would stay low for years — just like now. And yet crude oil prices rallied, in spite of those many good reasons.

What about Cycles in Crude Oil Prices?

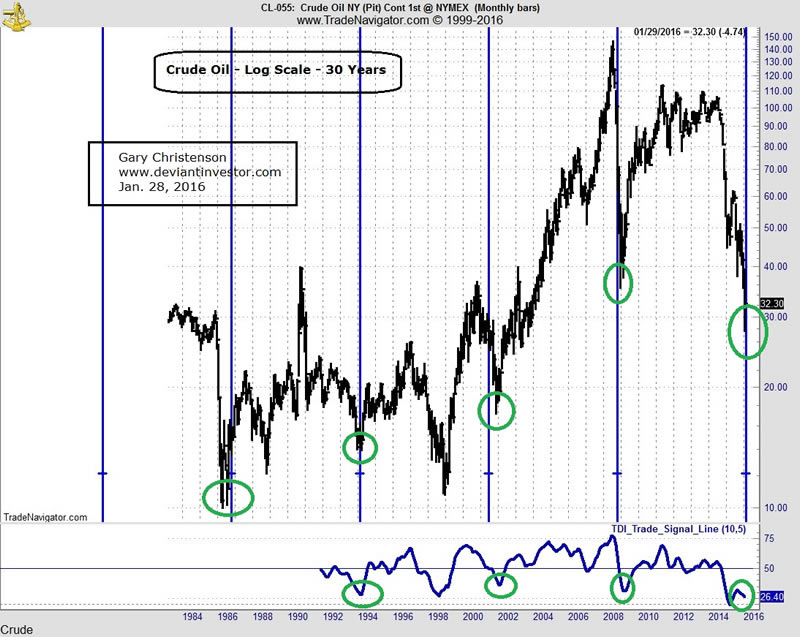

Note that in the graph above the #2 bottoms have been circled with green ovals. Examine the next graph with the 88 month cycle lows shown with green ovals. The bars are compressed slightly more but the #2 bottoms are the same.

There have been six important crude oil bottoms in the last 30 years. Five of those six important lows occurred close to the 88 month cycle bottoms indicated by green ovals and purple vertical lines. The low in 1998 was mid-cycle.

The green ovals and vertical lines as drawn indicate a crude oil price low is due about now. Given that the cycle is 88 months long – more or less – that probably means the low is due in anytime in 2016Q1 or 2016Q2, and perhaps it has already occurred.

What could cause a bottom to occur now and crude oil to rally or fall further from here? Well, there are many possibilities. Consider the reasons for and against a rally from here as listed in: 60 Reason Why Oil Investors Should Hang On from Zerohedge.

From Peter Schiff:

“The bust in commodities should only last as long as the Fed pretends that it is on course to continue raising rates. When it finally admits the truth, after its hand is forced by continued market and economic turmoil, look for the dollar to sell off steeply and commodities and foreign currencies to finally move back up after years of declines. The reality is fairly easy to see, and you don’t need an invitation to Davos to figure it out.”

My Opinion: We will see more currency devaluations, based on 100 years of history, and we will see central banks “doing something” to levitate the stock and bond markets, based on decades of history, and we will see bankers taking care of themselves and the political elite, based on thousands of years of history. Expect higher crude oil prices – eventually – and expect more currency devaluations and higher gold and silver prices in 2016 and 2017.

Expect bankers and politicians to do what they do, and expect gold and silver to protect us from their machinations.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.