Parasitic G7 Government Policies of Insolvency- Crack Up BOOM Part4

Interest-Rates / Fiat Currency Jul 10, 2008 - 11:46 AM GMTBy: Ty_Andros

Parasitic governments of the G7 have outgrown the hosts in the private sector and have substituted deficit spending, FIAT currency and credit creation for the policies of wealth creation and growing economies.

Parasitic governments of the G7 have outgrown the hosts in the private sector and have substituted deficit spending, FIAT currency and credit creation for the policies of wealth creation and growing economies.

As the next chapter in the unfolding insolvency of the G7 financial and banking system progresses, the next round of balance sheet destruction is at hand. Look no further than gold and silver, which it appears is about to embark on their next leg higher in confirmation of the next round of monetary debasement that looms directly ahead. “Volatility is Opportunity ” for the prepared investor and it has created opportunities GALORE in all markets: stocks, interest rates, metals, currencies, raw materials, grains, commodity and energy markets. Which side of these opportunities are you on? The positive or the negative? If it's the latter you have homework to do…

Income is collapsing on all levels of the developed G7 economies (public and private) as predicted by the 2008 pattern of the year: WOLF WAVE (See the 2008 Outlook in the Ted bits archives at www.TraderView.com ) . This weeks ISM manufacturers' survey barely made it over the boom and bust level of 50, but the prices paid part of the index approached multi-decade highs near 90. This illustrates the profit squeeze being encountered by American manufacturers as costs rockets higher and revenues FLATLINE.

Let's take a look at Ludvig von Mises description of the "Crack-up Boom" that marks the denouement of all great monetary inflations:

“This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services.

These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.”

Ludvig von Mises' description continues…

“But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The Crack Up Boom appears. Everybody is anxious to swap their money against "real" goods, whether he needs them or not, no matter how much money he has to pay for them. Within a very short time. Within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

This is what happened with the Continental Currencies in America in 1781, with the French Mandats Territoriaux in 1796 and with the German Mark in 1923. It will happen again whenever the same conditions appear.

If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last.”

Consumers are squeezed by inflation which the Gang of 535 (AKA Congress) and the Federal Reserve says is contained and your pocketbook is being strained. Take a look at these inflation rates on common items from a recent edition of Richard Russell's ( www.dowtheoryletters.com ) excellent commentary:

Scoreboard so far in 2008 for commodities…

(all items below are plus except for pork bellies and wheat)

Do you think this is a picture of altered price relationships? This is the definition of collapsing income as your dollars, Euros and Pounds buy less. Purchasing power is evaporating, fast… Of course it's nice to know the CPI (consumer price index) year over year is 4% and core is a little under 3%. Somehow these cost increases are not reaching you, thank God. Keeps you warm at night, doesn't it? PUBLIC servant and mainstream media headline illusions to keep dumbed down constituents docile and improperly focused on the SCAPEGOATS of their “politically correct” (politically correct means practically incorrect) policy errors, gross mismanagement and malfeasance -- by whom else? Your elected representatives and public servants.

This week's missive will be short as I am preparing to go to Freedom Fest and have been writing a lot on my and Clyde Harrison's upcoming book Myths, Madness and Markets , which you will love. It is an exhaustive look at the unfolding evolution of the globe known as GLOBALIZATION and what you need to do to avoid being a victim of it.

This week's essay is on the POLICIES of INSOLVENCY, which are now the deadweights around our necks, and they are everywhere. What are they? They are the policies of consuming more than you produce, to which the “something for nothing” G7 citizens and their Public servants believe they are ENTITLED. They are the definition of moral and fiscal BANKRUPTCY.

The Policies of Insolvency

- Raising the loan limits for Fannie Mae, Freddie Mac and the federal housing administration to $600,000 dollars and reducing the amount of deposit required to 3 to 5% of the value of the loan when home prices are plummeting (approximately 14% year over year, Case-Shiller) thus guaranteeing negative equity for purchases of a new home within weeks, if not months. There are about 12 million homes worth less than their mortgages, many insured by the same agencies that are operating at almost 50 to 1 leverage if their balance sheets are properly evaluated. A $300 billion dollar bailout of reckless lenders and borrowers is set to: abrogate contracts and disrupt the mortgage markets even further and transfer the cost to YOU! A trillion dollar rescue of the GSOs (government sponsored enterprises) looms before this is resolved.

- Biofuels -- corn based ethanol, which takes a dollar and turns it into 70 cents worth of energy, and then subsidizes its use by a dollar a gallon. This drives prices higher as we put these food crops in our cars rather than onto starving people's plates around the world. Then we prohibit inexpensive sugar-based ethanol from Brazil from being imported. When the Democrats took Congress in 2006 PROMISING lower oil and gas prices corn was $2.00 dollars a bushel. Now its $8.00. Billions and billions of dollars of destruction of capital.

- The farm bill, estimated to cost over 289 billion dollars over 5 years. Subsidies for farmers whose crops have doubled and tripled in price. Acreage set-aside programs that prohibit the growing of food on them. Payments made to farmers who are making over $200,000 a year up to 1.5 million dollars a year.

- Exporting OVER 800 billion dollars a year for energy supplies when they are plentiful in the United States but energy companies are prohibited from exploring for and producing them. Oil shale (reserves as big as Saudi Arabia ), clean coal electricity generation (300 years of power at current consumption rates), billions of barrels of oil and trillions of feet of natural gas in Alaska and on the continental shelf off the coasts. Regulatory prohibitions on refineries, coal and nuclear power. A prominent senator said, “Given our current level of oil consumption, it is clear that modest increases in domestic consumption through off-shore drilling will not solve our energy needs. We cannot drill our way out of this problem. Reducing energy consumption is the key to increasing America 's energy security…drilling is not the answer.” Wow. As Bill King says, that's like telling people who are starving from famine that planting more grain is not the solution, and that they should just eat less. Can you say IMMORAL? I personally believe we would be FAR more secure if that 800 billion dollars we export for energy was staying in the United States going to domestic energy suppliers and REMAINING in the US to drive job growth and industry. Can you imagine another 800 billion dollars sloshing around in the US economy? It would be quite a boost. Can't these people understand – humans are a part of nature, not a virus to it! These senators are saying the public energy needs are a PROBLEM and that we should substitute WINDMILLS for nuclear and CLEAN coal power plants. Can you say back to the Stone Age? Public servants say it will be four to eight years before we get the supplies if we develop our energy resources, and they said that in 1992, 1996, 2000, 2004 and today.

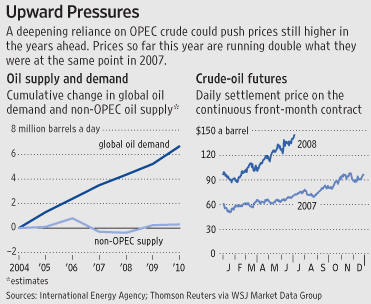

We ALL know we need more energy production, but public servants have voted three times in the last six weeks against allowing drilling in Anwar and Alaska, oil shale exploration and development, and drilling 50 to 200 miles offshore. Take a look at this chart from the International Energy Agency outlining demand and supply fundamentals.

Of course it is; these idiots REALIZE their own votes are GUARANTEEING the unfolding shortages. These votes have gone completely UNREPORTED in the mainstream media and financial press. People would be furious if this information was reported, so it's NOT. Obviously because the mainstream media work for the public servants, collectivists and environmental extremists in Washington who wish to FLEECE you. And public servants PRETEND they can't understand why crude ROCKETS higher after these votes. Instead they contend it is SPECULATORS and, of course, this is reported by the mainstream press. This is an INTENTIONAL energy shortage courtesy of your elected REPRESENTATIVES, AKA Congress.

Of course it is; these idiots REALIZE their own votes are GUARANTEEING the unfolding shortages. These votes have gone completely UNREPORTED in the mainstream media and financial press. People would be furious if this information was reported, so it's NOT. Obviously because the mainstream media work for the public servants, collectivists and environmental extremists in Washington who wish to FLEECE you. And public servants PRETEND they can't understand why crude ROCKETS higher after these votes. Instead they contend it is SPECULATORS and, of course, this is reported by the mainstream press. This is an INTENTIONAL energy shortage courtesy of your elected REPRESENTATIVES, AKA Congress.

Anybody that utters these words should be instantly RECALLED. Do not vote for these public servants who say these things and mislead you PURPOSELY. My book writing partner Clyde says energy policy in the United States and G7 appears to have been devised by Osama Bin Laden. He is incorrect; it is the G7 public servants who are purposely terrorizing their constituents. They are making fools of you. Their fools… - Deficit spending for CONSUMPTION and general expenses rather the investment in infrastructure which pays for itself. All levels of government borrow money not to pay for infrastructure which pays for itself, instead the money is SPENT on general expenses which do not pay off the borrowing. This should be prohibited by law as this is spending now with your children paying for it with their future income.

- Private sector policy of insolvency: look no further than GM (General motors) for years now they have made cars and LOST an average of 2000 dollars upon them, and actually they only made money on the financing of them. They maintain jobs banks where employees are given FULL pay to stay home and not work. GM in one form or another has 390 BILLION dollars of bonds outstanding. THEY ARE TECHNICALLY INSOLVENT. They will not be allowed to fail as the credit default swaps on these bonds are far in EXCESS of the value of the actual obligations and may have the potential to BLOW UP as the ability of the counterparties to these toxic derivatives to perform is UNKNOWN…

I could write about 500 or more of these, insanity at the highest leadership levels throughout the G7. In the G7 consuming more than you produce is inculcated in all levels of society: Public and private. It is the recipe for bankruptcy, which the Crack up Boom is. It is the bankruptcy moral and fiscal of governments, the Central banks and banking systems which they control. Obligations are far more than the ability to repay, so like all evolving banana republics: They will print the money…

In conclusion: Economists say these problems are caused by a WEAK dollar. I say POPPYCOCK. It is because the parasitic governments of the G7 have outgrown the hosts in the private sector and have substituted deficit spending, FIAT currency and credit creation for the policies of wealth creation and growing economies.

The next wave of balance sheet bombshells are hitting the financial and banking sectors. Interest rates are NEGATIVE worldwide and stimulus is rampant. No central bank will step up to the plate and do the right thing. They are waiting for the Federal Reserve to do so BEFORE they will. So it won't happen as the bombs known as Level 2 and 3 assets swell and stock prices plummet. Thus they can't de-leverage -- the stock market just undoes it in short manner. So they will have to PRINT THE MONEY to fix them and before that is over it will be well over a trillion dollars, Euros, Pounds, etc.

Legislators in the G7 have now written so many BLANK checks and future OBLIGATIONS that the “Crack up Boom” is only a matter of time. You need to learn about the indirect exchange for your paper dollars, Pounds and Euros, and all fiat currencies for that matter. You must learn to short circuit the printing press. It is really rather easy if you know how to do it. Inflation is a policy of government and will remain so.

There are NO shortages of paper currencies in the world. There are trillions and trillions of them sitting in bank accounts melting away from debasement by central banks. And there are trillions more of them slated to roll off the presses from a central bank near you. The Federal Reserve, European Central Bank and the Bank of England have lots of HEAVY printing in front of them to SAVE the money center and investment banks in their countries of responsibility. Many smaller banks are slated for their demise as reckless lending at the top of the credit and property bubble has destroyed any equity that was present when they were financed as asset prices are declining due to the credit crunch. This is also known as LACK of bidders.

These are trillions of opportunities if you prepare yourself properly. These realities MUST be PRICED into markets and that will send them all over the place creating lots of VOLATILITY for you to invest in. VOLATILITY IS OPPORTUNITY for you.

Don't miss the next edition of Ted bits and the Crack up Boom series.

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a Blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.