Square Holes and Currency Pegs

Stock-Markets / Financial Markets 2016 Jan 22, 2016 - 08:48 PM GMTBy: Raul_I_Meijer

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years. In the same vein, though the Automatic Earth has been talking about deflation (for 8 years, it’s our anniversary today) and the looming China Ponzi disaster for a long time, now that these things actually play out, everybody talks as if they own the story, and present it as new (because, for one thing, well, after all for them it is new…).

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years. In the same vein, though the Automatic Earth has been talking about deflation (for 8 years, it’s our anniversary today) and the looming China Ponzi disaster for a long time, now that these things actually play out, everybody talks as if they own the story, and present it as new (because, for one thing, well, after all for them it is new…).

And that’s alright, it’s how people live, and function, they always have, and no-one’s going to change that. It’s just that for me, I’ve been wondering a little about what to write lately, because I’ve already written the deflation and China stories, many times, before most others tuned into them. But still, it’s strange to now, as markets start plunging, read things like ‘Deflation is Here’, as if deflation is something new on the block.

Deflation has been playing out for years. Central bank largesse has largely kept it at bay in the public eye, but that now seems over. Debt deflation is inevitable when -debt- bubbles burst, and when these bubbles are large enough, there’s nothing that can stop the process, not even miracle growth. But you’re not going to understand this if and when you look only at falling prices as the main sign of deflation; they’re merely a small part of the process, and a lagging one at that.

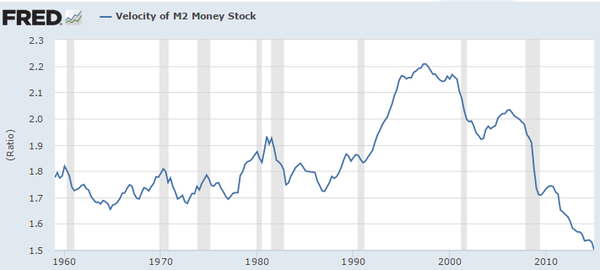

A much better indicator of deflation is the velocity of money, the speed at which ‘consumers’ spend money. And velocity has been going down for years. That’s where and how you notice deflation, when combined with the money and credit supply. Which have soared in most places, but were no match for a much faster declining velocity. People have much less money to spend. Which shouldn’t be a surprise if, just to name an example, new US jobs pay 23% less than the ones they’re -supposedly- replacing.

As I said a few weeks ago, it’s probably only fitting, given its pivotal role in our economies and societies, that it’s oil that’s leading the way down. Other commodities are not far behind, because demand for -and spending on- them has been plummeting too, as overproduction and overinvestment, especially in China, do the rest.

However you look at present global debt, percentage wise, or in absolute numbers, you name it, there’s never been anything like it. We outdid ourselves by so much we don’t have the rational or probably even subconscious ability to oversee what we’ve done. We live in the world’s biggest bubble ever by a margin of god only knows how much. And that bubble will deflate. It is already doing just that.

The next steps in the debt deflation process will of necessity be chaotic. A substantial part of that chaos is bound to emerge from denial, and the reluctance to accept reality. Which often rise from a poor understanding of the processes taking place. It certainly looks as if there’s lots of that in China, where both the working principles of financial markets and the grip authorities -can- have on them, seem to be met with a huge dose of incomprehension.

Mind you, given the levels of comprehension vs outright ‘theoretical religion’ among leading western politicians and economists, the ones who most often rise to decision-making positions in governments and financial institutions, we have nothing on China when it comes to truth and denial.

From all that follows what will be the next leg down in the ‘magnificent slump’: the awfully messy demise of currency pegs.

In a short explainer for the uninitiated, allow me to steal a few words from Investopedia: “There are two types of currency exchange rates—floating and fixed, still in existence. Major currencies, such as the Japanese yen, euro, and the US dollar, are floating currencies—their values change according to how the currency is being traded on forex markets. Fixed currencies, on the other hand, derive value by being fixed (or pegged) to another currency.”

While there are more currency pegs in the world today than we should care to mention -there are dozens-, it seems fair to say that in today’s deflationary environment, practically all are under siege. Most African currencies are pegged to the euro, and they do have to wonder how smart that is going forward. Still, the main, and immediate, problems seem to arise in pegs to the US dollar (with one interesting exception: the Swiss franc – more in a bit).

Most oil producing Gulf nations are pegged to the greenback. So is Hong Kong. And, for all intents and purposes, so is China, though you have to wonder what a peg truly is if you change it on a daily basis. China is on its way to a peg vs a basket of currencies, but that seriously interferes with its stated intention to become a reserve currency -of sorts-. If your currency can’t stand on its own two feet, i.e. float, you’re per definition weak.

China’s vice president Li Yuanchao said this week in Davos that Beijing has no plans to devalue the yuan, i.e. to cut the peg to the dollar. Then again, he also stated that “central command” would ‘look after’ stock market investors. Put the two statements together and you have to wonder what the one on the yuan (couldn’t help myself there) is worth.

The first “link in the chain” that appears vulnerable is the Hong Kong dollar, which is stuck between China and the US, and unlike the yuan still has a solid dollar peg, but, obviously, also has a strong link to the yuan. The issue is that if China continues on its current course of daily small yuan devaluations, the difference with the HKD will grow so large that ever more investments and savings will move to Hong Kong, despite a maze of laws designed to keep just that from happening.

And that is the overall danger to currency pegs as they still exist in today’s rapidly changing global financial world: all economies are falling, but some are falling -much- faster than others.

Not so long ago, the World Bank called on Saudi Arabia to defend its USD peg with its FX reserves. It even looked as if they meant it. But Saudi Arabia has no choice but to deplete those reserves to prevent other nasty things from happening that are much more important than a currency peg. Like social chaos.

It’s somewhat wonderfully ironic that the main most recent experience with abandoning a peg comes from a source that faced -and now feels- the exact opposite of what nations like Saudi Arabia and China do. That is, it became too costly and risky for Switzerland to keep its franc pegged (or ‘capped’, to be precise) to the euro any longer a year ago, because of upward, not downward pressure.

Since then, the euro went from 1.20 franc to 1.09 or thereabouts, which perhaps doesn’t look all that crazy, and many ‘experts’ seek to downplay the effects of the move, but it’s still estimated to have cost the Swiss some $25 billion. For comparison, the US has 40 times as many people as Switzerland’s 8 million, so the per capita bill would be close to $1 trillion stateside. That wouldn’t have added to Yellen’s popularity. Currency pegs and caps can be expensive hobbies.

And that’s why the Saudis and Chinese are so anxious about letting go of their pegs. That and pride. In their cases, their respective currencies wouldn’t, like the franc, rise versus the one they’re pegged to, they would instead lose a lot of value. And in the fake markets we live in today, where price discovery has long since been left behind, there’s no telling how much. Well, unless they seek to keep control, but then it would be just a matter of time until they need to rinse and repeat.

Even if it seems obvious to make a particular move, and if everybody knows you really should, showing what can be perceived as real weakness could be a killer when everything else around you is manipulated to the bone.

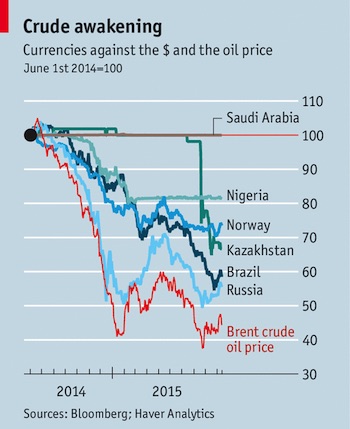

Still, neither Beijing nor Riyadh stand a chance in a frozen-over hell, to ultimately NOT sharply devalue their currencies or just simply let go of their pegs. Simply because China’s economy is falling to pieces, and the Saudi’s dependence on oil prices is dragging it into a financial gutter. Just look at what falling prices had done to the riyal vs non-pegged oil producer currencies by October 2015, when Brent was still at $45:

The Saudis could have been paid for their oil in a currency worth perhaps twice as much as their own, the one their domestic economy runs on. That’s overly simplistic, because the Saudi tie to the USD runs far and deep, but that doesn’t make it untrue.

What will bring down the Chinese and Saudi pegs, along with a long list of other pegs, is, how appropriately, the very same markets they’ve been relying on to NOT function. The bets against Hong Kong’s ability to maintain its USD peg have already started, and China is next, along with the House of Saud (the latter two just take more fire-power). Which of course is exactly why they speak their soothing ‘confident’ words. Words that are today interpreted as the very sign of weakness they’re meant to circumvent.

What worked for George Soros in his bet vs the Bank of England and the pound sterling in 1992, will work again unless these countries are ahead of the game and swallow their pride and -ultimately- smaller losses.

Granted, so much will have to be recalibrated if the yuan devalues by 50% or so, and the riyal does something similar (it’s very hard to see either not happening), that it will take some serious time before everyone knows where they -and others- stand. And since volatility tends to feed on itself once there’s enough of it, it seems to make sense that governments would seek control. But that doesn’t mean they -can- actually have any.

Today’s major currency pegs are remnants of a land of long ago lore; they have no place in this world, they are financial misfits. Who’ve been allowed to persist only because central banks and governments have been able to distort markets for as long as they have. But that ability is not infinite, and it’s in nobody’s longer term interest that it would be.

Not even those that now seem to profit most from it. We will end up with societies that function no better for the ridiculous Davos elites than they do for the bottom rung. But no elite will ever see that, let alone admit it voluntarily.

Deflation and foreign exchange chaos. There’s your future. As for stocks and oil, who’s left to buy any? Not the consumer who’s 70% of US and perhaps 60% of EU GDP, they’re maxed out on private debt. So why would investors put their money in either? And if they don’t, where do you see prices go?

Even more importantly, deflation makes a lot of money, and even much more virtual money, vanish into overnight thin air. That’s what everyone is running into when all these currencies, China, Saudi, Gulf states et al, are forced to recalibrate. $17 trillion disappeared from global equities markets in the past 6 months.

How much vanished from the value of ‘official’ oil reserves? How much from iron ore and aluminum? How much do all the world’s behemoth corporations and banks and commodity-exporting countries have their resource ‘wealth’ on their books for in their sunny creative accounting models? And how much of that is just thin hot air too?

We’re about to find out.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.