Will the Crude Oil Price Crash become even Worse in 2016?

Commodities / Crude Oil Jan 20, 2016 - 06:42 PM GMTBy: Sol_Palha

A patient mind is the best remedy for trouble-

Plaut

A patient mind is the best remedy for trouble-

Plaut

2015 was not a good year for speculators trying to time the oil markets. Oil kept cutting through each support level like a hot knife cutting through butter. It would give the appearance that it was ready to mount a rally, but that rally would fade, and oil prices would drift lower. We penned an article in Nov of last year, where we stated that oil would have to close above $50 on a weekly basis for it to see higher prices. However, it failed to do that and drifted lower. When it closed below $32 on a weekly basis, it neutralized any tiny bullish signals it was issuing in 2015. Is oil close to putting in a bottom or will it once again let everyone down and plunge into a series of new lows. There is a saying that the cure for low prices is lower prices and vice versa; having said, that we expect one final wave of selling before oil bottoms out and starts to trend slowly upwards. We do not expect any violent upward reversals unless the situation between Iran and Saudi heats up to the point that a new war breaks out.

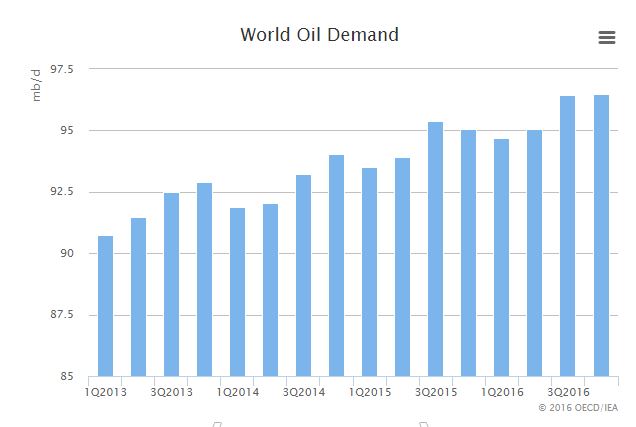

According to the IEA, oil demand for 2016 is expected to remain almost unchanged from 2015. In 2015, it stood at 96.43 million barrels per day (Mb/d) and in 2016, it is expected to be 96.49 Mb/d.

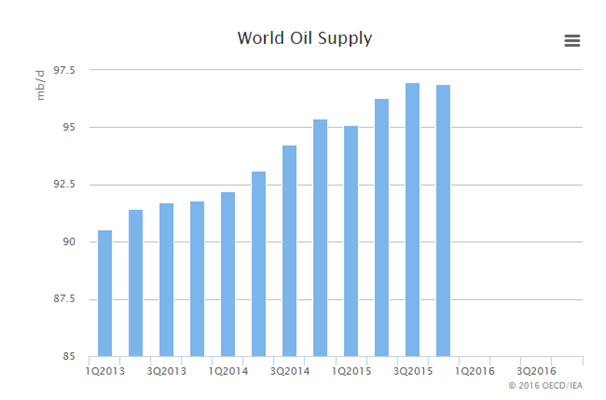

The interesting part is that the IEA expects supplies to drop from 96.97 Mb/d to 96.88 Mb/d; the IEA is generally notorious for missing its projections. We are not sure that the current projections fully factor in the new supply of Iranian oil set to hit the markets. Additionally, Russia has stated that they have nointention of cutting down oil supplies and the same holds true for Saudi.

Russia pumped a record 534 million tons of crude oil in 2016, and the country’s oil and gas condensate production increased by 1.4% year-on-year.

Bloomberg noted that Russia’s oil production was poised to challenge its post-soviet record in the last of week of 2015 and surge to 10.86 million barrels per day. On the same token, Saudi Arabia instead of cutting production has been pumping oil close to its maximum capacity. From the supply side, there are no positive factors that would contribute to a sustainable upward trend for oil.

What you need to remember is that the oil market tanked suddenly, and this occurred while the Top Analysts were making calls for higher prices and also by the Peak Oil theory experts. What happened to the peak oil theory by the way? Instead of oil production peaking, we seem to be awash with oil. And the Peak Oil experts have vanished into the woodwork. Hence, just as the oil market collapsed when everybody was proclaiming higher prices, oil will probably stabilize sometime in 2016 as everyone expects it to keep crashing. As it has broken through several levels of support, it will need to trend sideways for an extended period before it has any hope of breaking out.

As it has closed below the psychological level of $30 on a weekly basis, it is likely it will experience one more downward wave before a tradable bottom is in place. A move to the $23-$25 ranges is now a strong possibility, and as long as oil does not close below $23.00 on a weekly basis, oil will start putting in a slow bottoming formation. Once a bottom is in, do not expect miracles from oil, trading will probably be limited to a tight range of $24.00-$36.00 for some time. Only a monthly close above $40 will signal that the trading range is going to shift to a slightly higher zone of $36.00-$58.00 with a possible overshoot to $65.00.

Two small bullish factors; MACD’s putting in a series of higher lows, and so they are diverging from the price of oil and RSI is holding steady; it has not dipped to new lows yet.

The carnage is not over yet, and so we would hold off getting into oil stocks as many companies are going to go belly-up as their debt becomes unserviceable; this will create great opportunities in this sector, but, for now, it would be better to hold onto your gunpowder.

A better play for speculators (the keyword being speculators) would be to play this sector directly via ETF’s such as UCO, OIL, and USO, but we would wait till oil, at least, trades down to $25 or better before deploying any funds into this sector.

Conservative players would be better off waiting for the dust to settle down. There will be many great stocks to purchase later on in the year. Many companies in the oil sector will go bankrupt as they will soon be unable to service their debt and then you will be able to come in and pick up the players best poised to benefit from higher oil prices.

An ounce of patience is worth a pound of brains.

Dutch Proverb

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.