BIS Warns of ‘Uneasy Calm’ in Financial Markets Before Possible Debt Storm

Commodities / Gold and Silver 2015 Dec 07, 2015 - 03:11 PM GMTBy: GoldCore

The Bank for International Settlements (BIS) has warned in its latest quarterly review that the current ‘uneasy calm’ in financial markets might be short lived, threatened by the Fed’s widely expected interest rate hike – the first rate increase in a decade.

The Bank for International Settlements (BIS) has warned in its latest quarterly review that the current ‘uneasy calm’ in financial markets might be short lived, threatened by the Fed’s widely expected interest rate hike – the first rate increase in a decade.

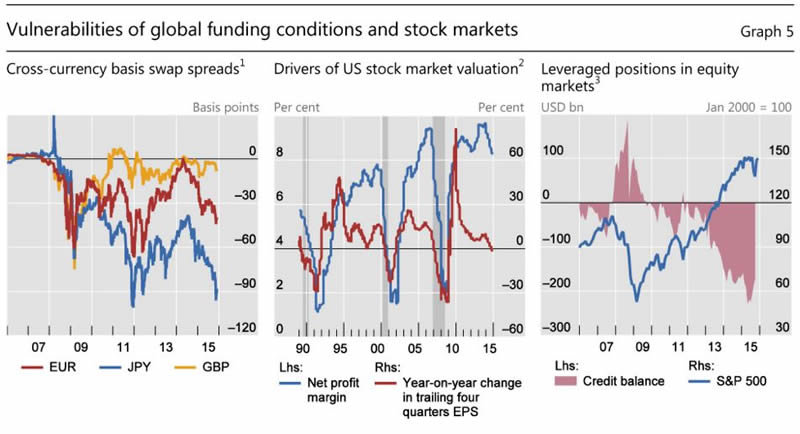

Source: BIS Quarterly Review

This latest warning comes after BIS – the central bank of central banks – had previously cautioned that recent economic turmoil in the global stock markets “showed how developed and emerging markets were exposed to the unwinding of financial vulnerabilities built up since the 2008 crisis.” See: “BIS Warns of ‘Major Faultlines’ In Global Debt Bubble”.

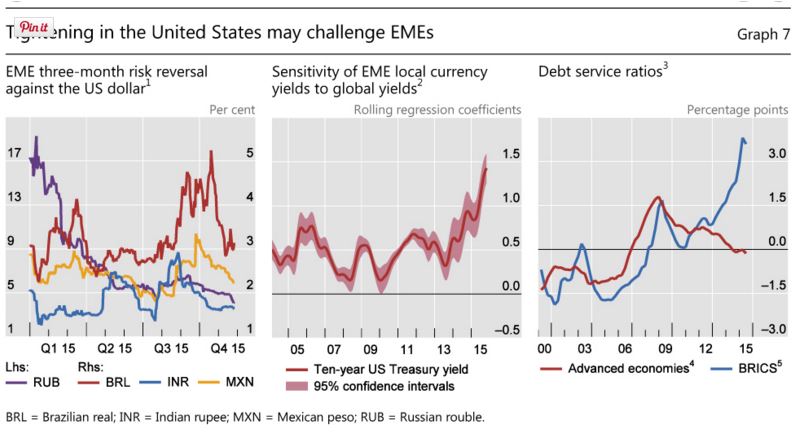

“The short-lived market response might suggest that EMEs (emerging market economies) could ride out the prospect of US monetary tightening. However, less favourable financial market conditions, combined with a weaker macroeconomic outlook and increased sensitivity to US interest rates, heighten the risk of negative spillovers to EMEs once US rates do start to rise in the United States”. BIS Quarterly report December 6th

Again, BIS warns that investors remain “hooked on every word and deed” of central banks and that recent turmoil in markets was not caused by isolated incidents but rather “the release of pressure that has gradually accumulated over the years along major fault lines”.

According to the the Telegraph today, “The central bank watchdog said emerging market households and businesses reliant on cheap debt faced a credit crunch that could trigger panic in a world of evaporating liquidity and fewer market makers.”

Public and private debt in the developed world has risen 36% since the crisis and is now 265% of GDP and the post-crisis problems have been dealt with with the same ineffectual policies that caused the crisis – prolonged ultra low interest rates and easy monetary policy.

Source: BIS Quarterly Review

Quoting Claudio Borio, head of the economic department at the BIS, the Telegraph report, ‘“Expectations of further ECB easing had led traders to place bets on the euro that caused huge market swings when the central bank was perceived as failing to deliver. “Against this backdrop, it is hard to imagine how the calm could be anything but uneasy. There is a clear tension between the markets’ behaviour and underlying economic conditions.’ ‘”At some point, it will have to be resolved”, said Mr Borio’.

Read more from The Telegraph: “Uneasy’ market calm masks debt timebomb, BIS warns”

Other Sources:

BIS Quarterly Review, December 2015

BIS Warns of ‘Major Faultlines’ In Global Debt Bubble

DAILY PRICES

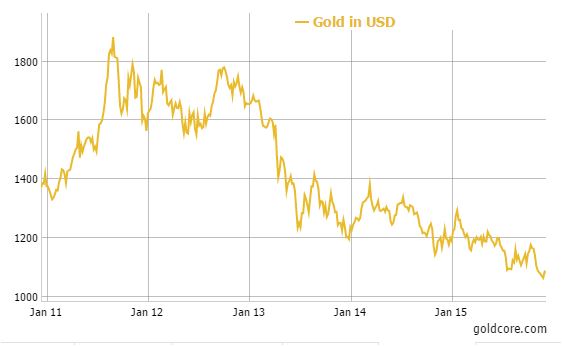

Today’s Gold Prices: USD 1082.70, EUR 1001.80 and GBP 718.26 per ounce.

Friday’s Gold Prices: USD 1063.00, EUR 977.56 and GBP 702.60 per ounce.

(LBMA AM)

Gold in Euro – 1 Year

Gold enjoyed a decent gain on Friday closing up $22.00 to close at $1085.20 for the weekend, a gain of 2.51% for the week. Silver was also up on Friday closing at $14.55, a gain of 3.19% for the week. Platinum jumped $34 to close at $878.

Must-read guides to international bullion storage:

Download Essential Guide to Gold Storage in Singapore

Download Essential Guide To Storing Gold In Switzerland

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.