Gold COTs Most Bullish for 14 Years, Call for a Sizeable Tradable Rally Soon...

Commodities / Gold and Silver 2015 Dec 02, 2015 - 03:03 PM GMTBy: Clive_Maund

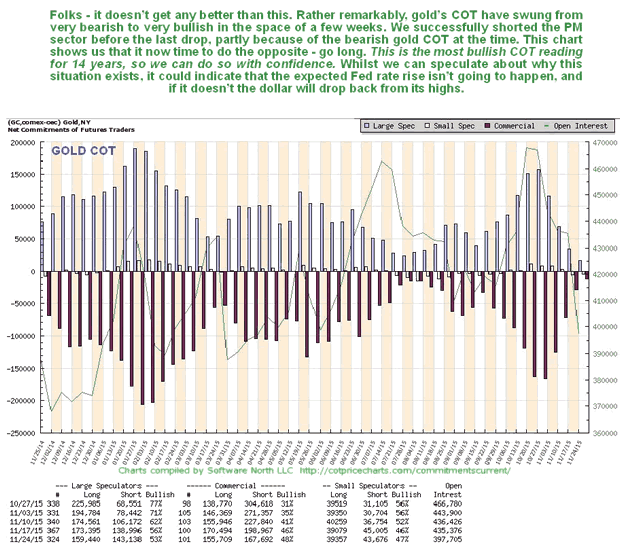

There is no need to mince words or beat around the bush with this update. The latest COTs for gold released yesterday showed another marked improvement so that they are now strongly and unequivocally bullish - in fact they are at their most positive since late 2001, that's 14 years.

There is no need to mince words or beat around the bush with this update. The latest COTs for gold released yesterday showed another marked improvement so that they are now strongly and unequivocally bullish - in fact they are at their most positive since late 2001, that's 14 years.

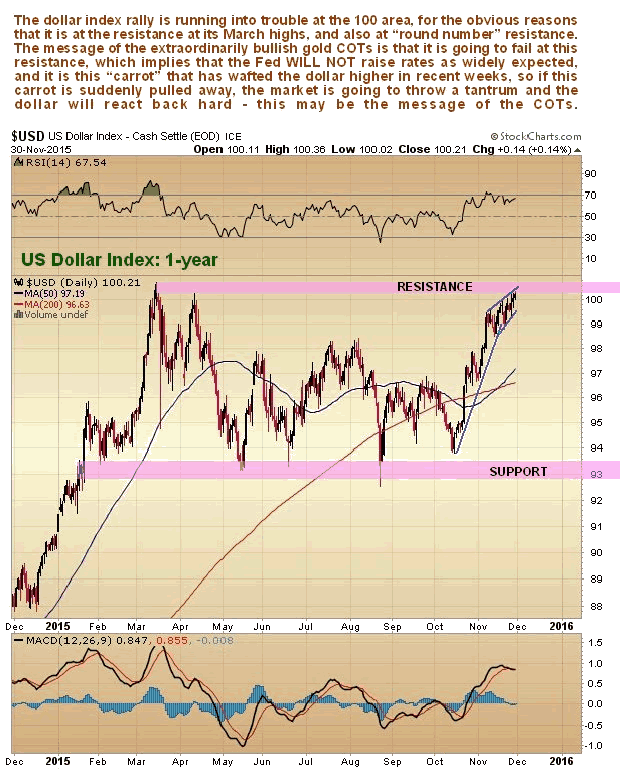

We are not going to waste our time trying to figure out the reason or reasons for this, but possibly this situation suggests that the Fed is not going to raise rates this month as widely expected. If they don't, the dollar, which has wafted back to its highs on this expectation, will drop and the PM sector will rally.

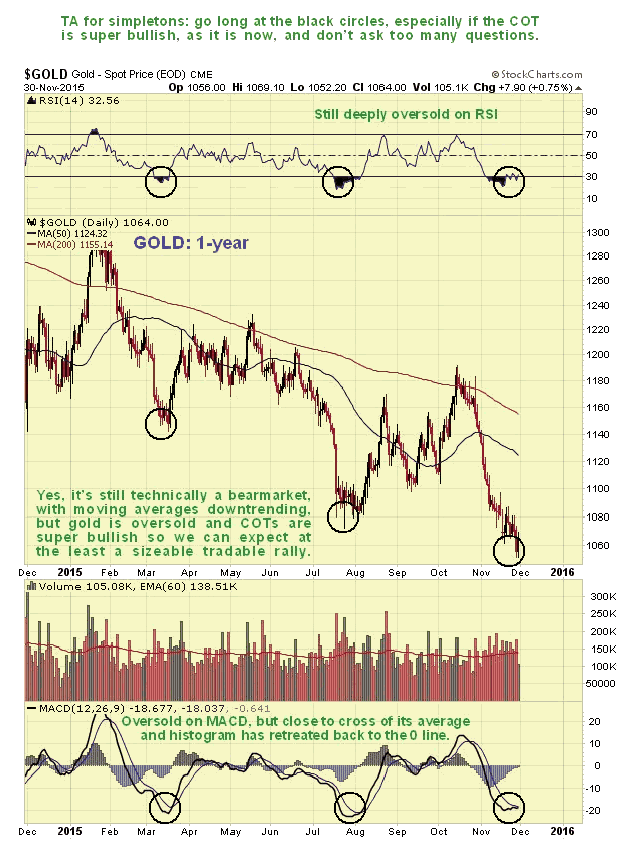

Without further ado let's look at this latest COT now, with the 1-year chart for gold stacked above it for direct comparison. What is rather remarkable about gold's COTs in the recent past is how readings rapidly ballooned to bearish levels by early November, leading us to adopt a bearish stance and short the sector, which was the correct action, but in recent weeks Commercial short and Large Spec long positions have collapsed back rapidly towards the zero line, so that the picture has quickly switched from quite strongly bearish to strongly bullish in the space of a few weeks. We know from experience that the extremely low Commercial short position that now exists means that a sizeable and tradable rally is just around the corner, regardless of whether the long-term downtrend has ended or not, and we can therefore position ourselves accordingly.

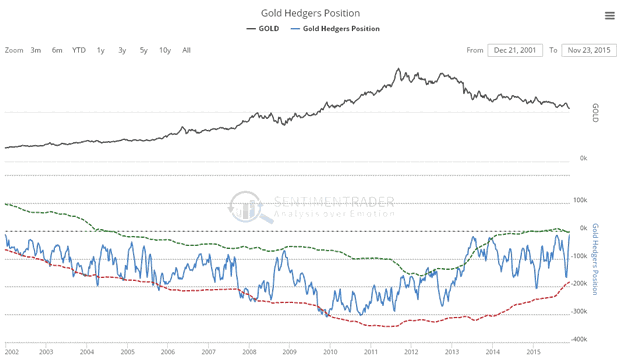

On the long-term Hedgers chart, which is a form of COT chart, we can see that we have the most positive readings since late 2001. So we should at least see a tradable rally, and these readings could mark the end of the bearmarket in gold, or rather the resumption of the long-term bullmarket after a long and deep correction. Certainly this is suggested as likely by the bombed out grossly undervalued mining stocks.

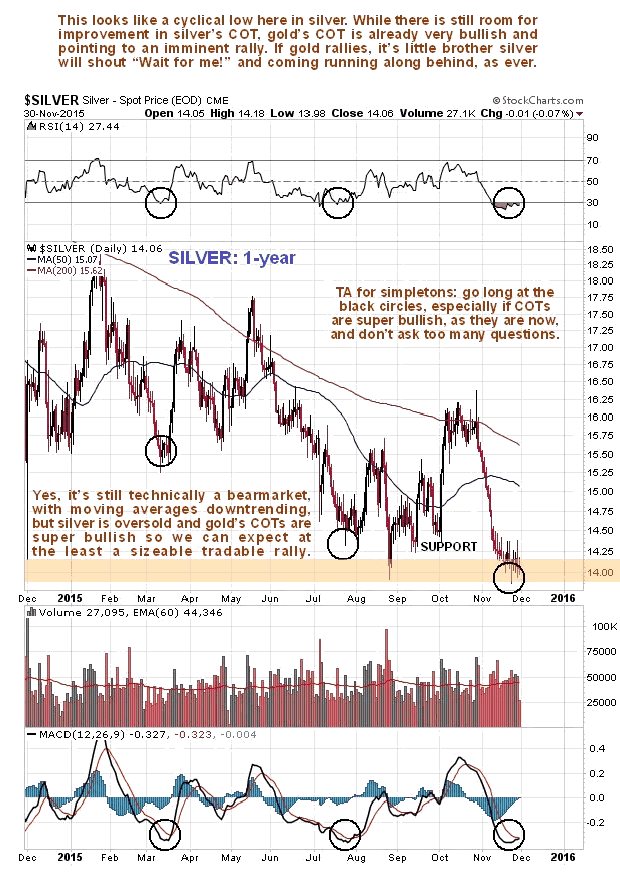

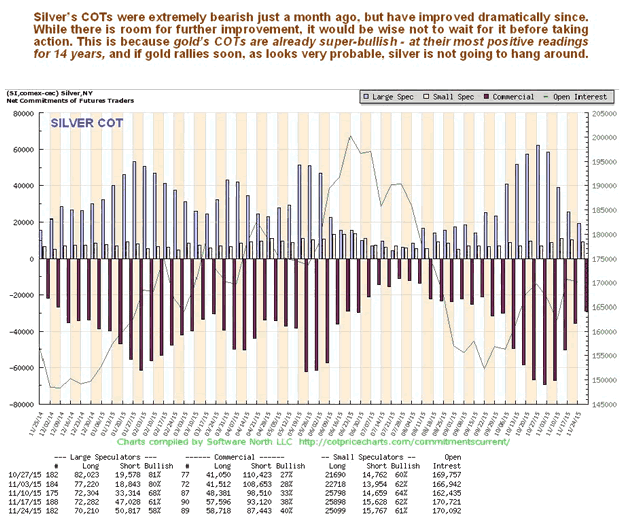

What about silver? - its latest COT charts are not so bullish as those for gold, as they show room for further improvement. That's easy to figure. Gold's latest COT suggests that a rally is imminent, and if it is, "silver is going along for the ride".

On the latest 1-year dollar index chart we can see that it is at a critical juncture, having risen to an important resistance level at its March highs. The "carrot" of a Fed interest rate rise this month is what has wafted the dollar higher in recent weeks, but clearly if this expected rise is not forthcoming, those who have been banking on it are going to throw a tantrum, perhaps like that woman at the airport in Hong Kong who missed her flight , and the dollar could react back hard, which would of course be the occasion for a sizeable rally by gold and silver. However, that doesn't mean that the dollar won't later turn around and break out to new highs. After all, the market always hangs on the Fed, and if they don't raise rates this month, well, maybe they will next month, or the month after that.

Some subscribers have written in to tell me that Martin Armstrong is still very bearish on gold, saying that it will drop to about $700 on a strong dollar. Maybe he's right and that will later happen, but it won't happen with the COTs like they are now, which are calling for an immediate tradable rally. As pragmatic traders we use the COTs to ride the coat tails of the Smart Money, and if they are positioned for a gold rally, then we'll do likewise, just like we did on the sharp drop of recent weeks. Meanwhile, Larry Edelson of Weiss Research, who has a good record, has turned bullish on gold, saying it is bottoming now. I am more inclined to agree with him, especially given the appalling extreme undervaluation of gold stocks right now, as repeatedly and rightly pointed out by Adam Hamilton. A big reason for gold to turn up soon is that the bond markets are no longer a safe haven and will left in tatters by a rolling wave of Sovereign debt defaults. If you want to know where we are in the larger scheme of things, take a look at the following picture, taken from the vantage point of Space.

On the site we will detail a range of ways to capitalize on the upcoming gold rally - gold stocks, ETFs and Call options, to suit whatever level of risk you are comfortable with.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.