Why We Won’t See Gold $5,000

Commodities / Gold and Silver 2015 Dec 01, 2015 - 03:51 PM GMTBy: Harry_Dent

I have so many bets on the go with gold bugs like Porter Stansberry (Stansberry Research) and Jeff Clark at Casey Research… and I just keep winning ‘em.

I have so many bets on the go with gold bugs like Porter Stansberry (Stansberry Research) and Jeff Clark at Casey Research… and I just keep winning ‘em.

That’s something to be happy about, right?

But I’m more pained than happy about it because, when I debate these guys (including Peter Schiff), we all agree that we’re in an unprecedented debt and financial bubble with QE adding kerosene to the fire. We all agree that things are about to end very badly.

But we disagree on the outcome of this bubble burst.

They see the dollar collapsing and gold going to $5,000-plus.

I see the dollar strengthening and gold going to as low as $250 an ounce (at the lowest).

This leaves worried investors like you throwing your arms in the air: do you buy gold, or sell it?

My research says to stay away from gold until at least 2023 or $250-$400, whichever comes first. And today I wanted to share just one of my reasons for saying so...

What sets my research apart from those gold bugs I battle is that I study longer term cycles, from where I can see clear oscillations between inflation and deflation – like the extreme deflation of the 1930s and the extreme inflation of the 1970s.

Both extremes, along with demographic downturns in spending, create financial crises and long-term downturns in the economy.

Gold bugs think gold responds in kind to each. They’re wrong. It responds differently.

The two great illusions in the gold camp are that:

- Gold is a crisis hedge, and

- Gold is the only true currency.

The real truth is that gold is the very best inflation hedge.

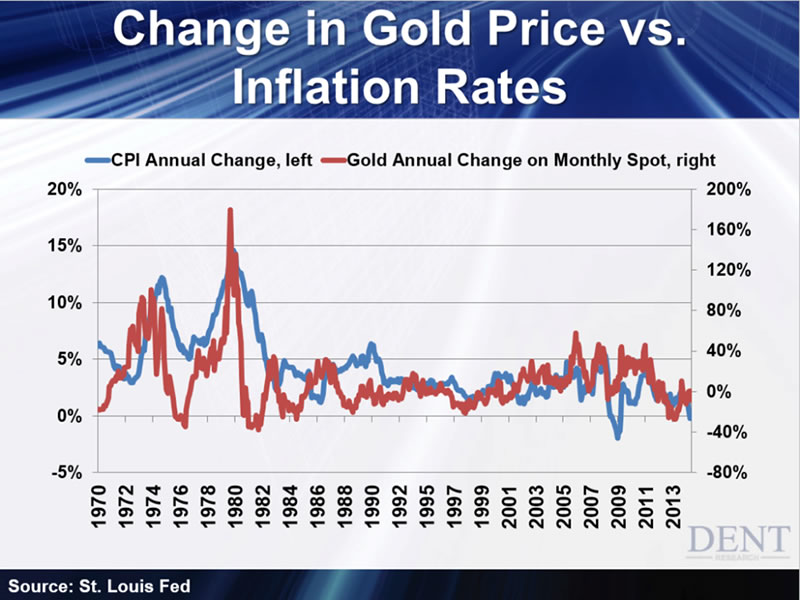

Look at this chart…

As you can see, gold correlates more than anything else with inflation. It was one of the very best investment during the inflationary crisis of the 1970s, when gold exploded nearly 10 times in value.

And gold bugs think we’re heading for more inflation.

That’s where we differ. I don’t see inflation on the horizon – I see more deflation, where we’ll see the deleveraging of massive debt and financial bubbles. This follows every debt bubble in history.

Their gold forecasts are based on the assumption that, after unprecedented money creation to stimulate the economy, we would see massive inflation… or even hyperinflation.

In such a world, gold would take off again.

Maybe I’m senile, but it’s been seven years and counting, and inflation is nowhere in sight.

There’s a couple reasons why.

For one, our economy had already over-expanded, with debt growing 2.6 times GDP for 26 years in the great boom. Consumers and businesses both over-expanded and over-borrowed... and our government ran unprecedented deficits in a boom period.

Secondly, all this new money the Fed threw at us didn’t go much into lending and expanding the money supply – which would have caused inflation.

Instead, it went into financial speculation in asset bubbles at zero short-term and long-term interest rates (adjusted for inflation).

In short, inflation is not the threat. Deflation is. With the largest, global financial asset and debt bubble in recorded history, when this goes belly up, trillions of dollars are going to disappear overnight, like magic… now you see it, now you don’t! That’s not only going to strengthen the dollar, it’s going to create a massive wave of deflation and the destruction of gold.

Still, the bugs cling to their gold: “But Harry, look at all the crises through history. Gold has soared during each one!”

True, but one little detail they’re conveniently ignoring is that almost all the crises we’ve witnessed over the last century have been inflationary. World War I. World War II. Vietnam. The Cold War. The OPEC embargoes and inflation crisis of the 1970s.

Only the 1930s were deflationary – and back then, gold was fixed in price and confiscated!

So we can’t judge its real performance during that time. But we can judge its real performance during the first short deflationary crisis in late 2008, when the banking and financial system melted down.

And what did gold do? It went running to mommy! Between June and November 2008, the greatest deflationary financial crisis we have seen in a long time, gold went down 33% and silver 50%!

And the dollar that was supposed to collapse? It went up 27% in that crisis.

We’re in for more of the same ahead, only worse.

Earlier, I mentioned there were two myths gold bugs relied on. I’ve debunked the first today, and I debunk the second in my newest book How to Survive (& Thrive) in the Great Gold Bust Ahead. I also delve into the numerous other myths gold bugs rely on to trap you like a moth to the flame.

That book is due for release on December 1. We’ve reserved a handful of copies to give to subscribers for free. Get your name on the waiting list now.

Sure, gold may well get as high as $5,000 one day – in the next great 30-year commodity cycle. But you may be dead before that day comes.

Don’t let gold be the anchor that drowns your retirement.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.