Global Stocks Bull Market Breadth

Stock-Markets / Stock Markets 2015 Nov 12, 2015 - 09:24 AM GMTBy: Donald_W_Dony

Strong bull markets normally have a broad participation or breadth base. When that breadth starts to narrow, the short-term outlook for a continuation of the upward trend comes into question.

Strong bull markets normally have a broad participation or breadth base. When that breadth starts to narrow, the short-term outlook for a continuation of the upward trend comes into question.

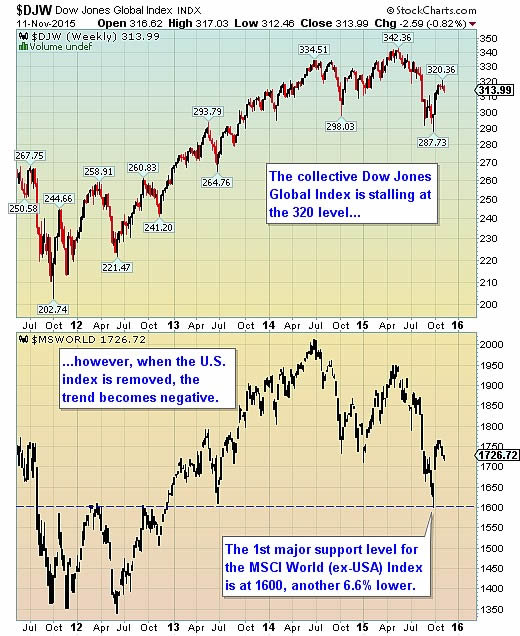

The upper graph in chart 1 is the Dow Jones Global Index (DJW). It presently shows a slight weakness in the global trend.

The August/September trough printed a fresh low for the DJW and suggested that the bull market for world indexes was changing course.

However, when the U.S. index was removed from the mix (lower graph in chart 1), the picture looks considerably weaker, indicating that only the U.S. index was supporting the global bull market.

The participation since late 2014 had greatly narrowed.

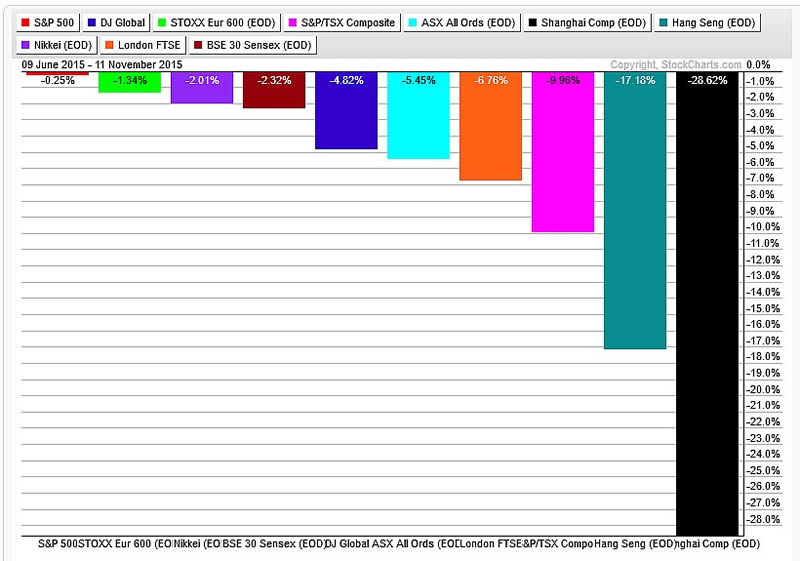

Chart 2 shows the performance of the major world indexes from June 9th to November 11th.

All of the indexes posted a negative return. The S&P 500 saw only a 0.25% decline whereas China's Shanghai lost 28.62% over the past 90 days.

Of note, Canada's TSX fell almost 10.0% during that time.

Bottom line: The global bull market has greatly narrowed in its breadth over the past year.

Healthy bull markets require a broad participation base. That does not appear to be the case at present.

Currently, only the U.S. market is participating in the bull market.

We anticipate that this very limited breadth will continue to year-end.

The target for the Dow Jones Global Index is 305 by late December.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2015 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.