The US Dollar Rally Could Trigger a $9 Trillion Debt Implosion

Currencies / US Dollar Nov 11, 2015 - 06:07 PM GMTBy: Graham_Summers

The US Dollar rally, combined with the ECB’s policies and the Fed’s hint at raising rates in December, is at risk of blowing up a $9 trillion carry trade.

The US Dollar rally, combined with the ECB’s policies and the Fed’s hint at raising rates in December, is at risk of blowing up a $9 trillion carry trade.

When the Fed cut interest rates to zero in 2008, it flooded the system with US Dollars. The US Dollar is the reserve currency of the world. NO matter what country you’re in (with few exceptions) you can borrow in US Dollars.

And if you can borrow in US Dollars at 0.25%… and put that money into anything yielding more… you could make a killing.

A hedge fund in Hong Kong could borrow $100 million, pay just $250,000 in interest and plow that money into Brazilian Reals which yielded 11%… locking in a $9.75 million return.

This was the strictly financial side of things. On the economics side, Governments both sovereign and local borrowed in US Dollars around the globe to fund various infrastructure and municipal projects.

Simply put, the US Government was practically giving money away and the world took notice, borrowing Dollars at a record pace. Today, the global carry trade (meaning money borrowed in US Dollars and invested in other assets) stands at over $9 TRILLION (larger than the economy of France and Brazil combined).

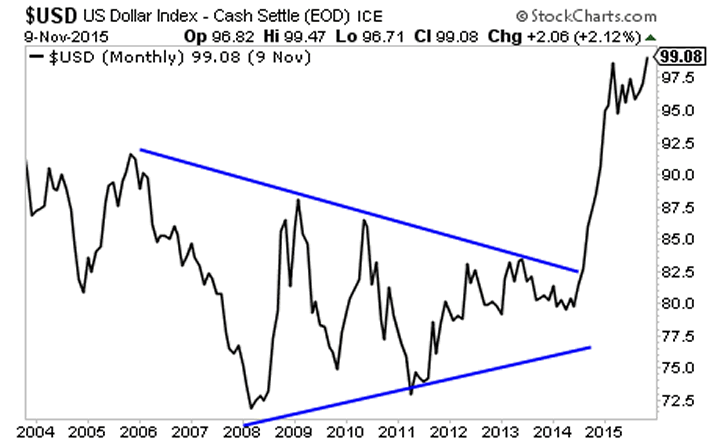

This worked while the US Dollar was holding steady. But in the summer of last year (2014), the US Dollar began to breakout of a multi-year wedge pattern:

Why does this matter?

Because the minute the US Dollar began to rally aggressively, the global US Dollar carry trade began to blow up. It is not coincidental that oil commodities, and emerging market stocks took a dive almost immediately after this process began.

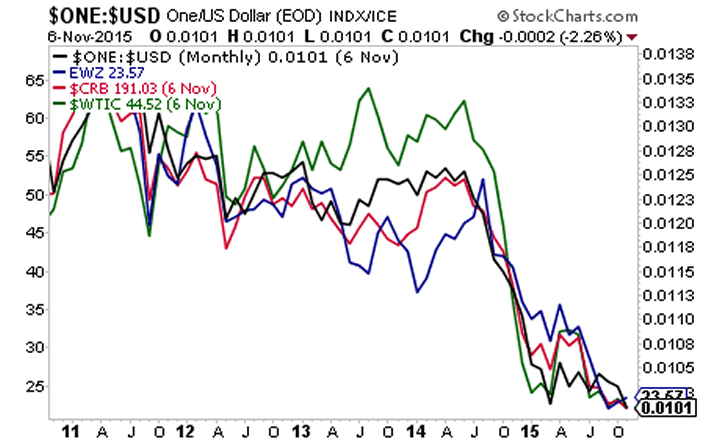

The below chart shows an inverted US Dollar chart (so when the US Dollar rallies, the chart falls), Brazil’s stock market (blue line), Commodities in general (red line) and Oil (green line). As you can see, as soon as the US Dollar began to rally, it triggered an implosion in “risk on” assets.

This process is not over, not by a long shot. As anyone who invested during the Peso crisis or Asian crisis can tell you, when carry trades blow up, the volatility can be EXTREME.

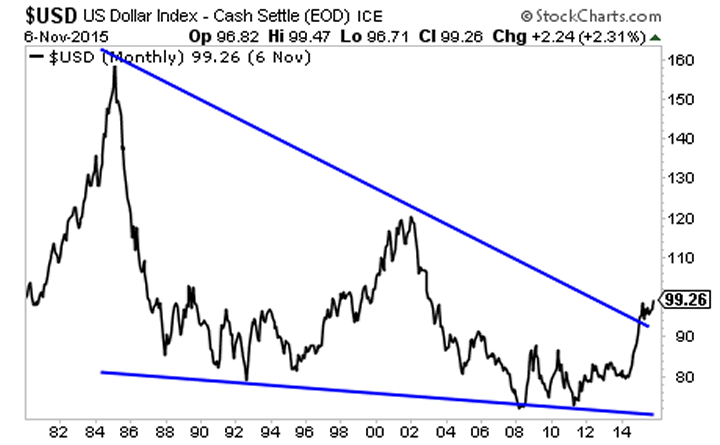

Indeed, the US Dollar as broken out of a MASSIVE falling wedge pattern that predicts a multi-year bull market.

The market drop in August triggered by China devaluing the Yuan (another victim of the US Dollar bull market) was just the start. Once the US Dollar rally really begins picking up steam, we could very well see a crash.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets.

Indeed, while other investors are getting whipsawed by the markets…we’ve just locked in two more winners, bringing our winning streak to 35 straight winning trades!

All told 40 of our last 41 trades MADE MONEY.

However, I cannot maintain this track record with thousands upon thousands of investors following these recommendations.

So tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

To lock in one of the remaining $0.98 slots…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.