FOMC Word Play Kicks Off a Correction That Was Coming Anyway in Gold, May Soon Come in Stocks

Commodities / Gold and Silver Stocks 2015 Oct 29, 2015 - 01:49 PM GMTBy: Gary_Tanashian

What They Said

What They Said

“In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

What They Did

What did the Fed do yesterday? Why, they rolled over once again and held ZIRP. They also got mighty specific with some wording that freaked out precious metals players and put in a reversal, not only in the metals, but importantly, in their ratio. See yesterday’s post on the Silver-Gold ratio’s status… What Thing Looks Like the Other. A reversal in silver vs. gold would put the sector on a correction and also issue a warning to other global markets.

So the Fed still has a few tricks up its sleeve. They are backed into a corner in which they are expected to normalize monetary policy because well, they are they Fed, they have perceived credibility (i.e. the confidence of the markets in what is largely a confidence game) and legions of conventional investors to whom they must appear reasonably normal.

What They Are Facing

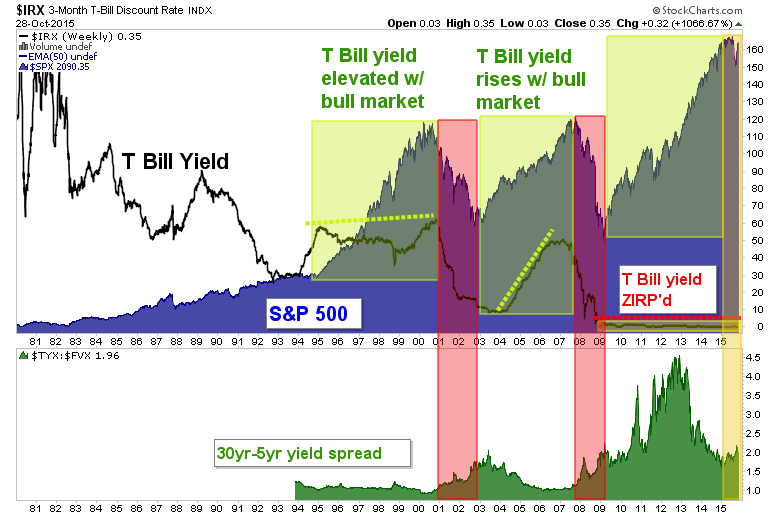

Here is what they actually have, an abnormal distortion of their own creation in the markets; and if you ask me, an out and out disgrace on their hands. The horizontal red dotted line is post-2008 monetary policy. This while the S&P 500 grew a third hump of epic proportions.

Looking at yields in the 30yr-5yr year range (lower panel above), we see that the Treasury bond market is trying to turn that curve up (orange shaded area). The early stages of such upturns have broken the stock market on the last two cycles (red). Is this a picture of the ‘Bond Vigilantes’ taking over the show out on the curve, far enough away from the Fed influenced short end?

Shorter-term Spreads Still Under Control

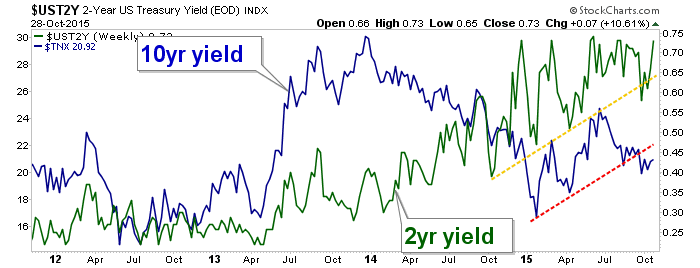

The 10yr-2yr still looks completely under control and in the grips of unbending confidence in the Federal Reserve. Here are the nominal 10’s and 2’s, showing the shorter duration popping big with the dreaded wording in the FOMC release. The Fed really really means it this time!… maybe. The alignment in bonds nearer the Fed-controlled Funds Rate continues to show that all is well, normal, in control and by the way, antagonistic to gold, which most definitely does not want to see short rates rising vs. long rates.

A Peek Behind the Scenes

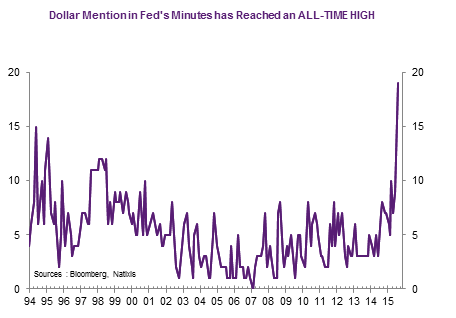

Complicating matters is an appreciating currency, which Fed members are actually fairly neurotic about. Here, courtesy of Bloomberg, is the graphical view of Fed members’ mentions of the US dollar at recent meetings. The chart broke out even before yesterday’s meeting. Meanwhile, Mario Draghi thinks… ‘Bravo miei amici , bravo! Lavoro ben fatto.’

But is it Sustainable?

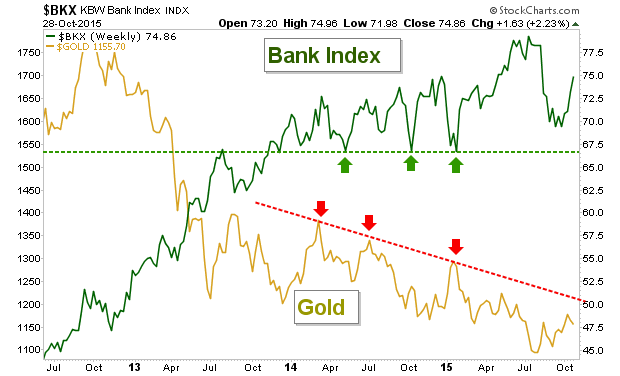

Of course, the implications of higher interest rates favor the banking sector as they disfavor gold. Gold after all is the ‘no one’s liability’ asset in a financial world stuffed to the gills with liabilities, including on Central Bank balance sheets and government coffers. Why on earth would it go up when everything is under control?

Confidence is the Final Obstacle for Gold

So it is very key for investors to decide whether or not the Fed has credibility. Given Draghi’s QE jawbone and monetary easing in China, the Fed sure is putting up a good front. Could the final brush stroke in the work of art created by Ben Bernanke with Operation Twist (which engineered and set in motion current bond market trends) and QE 3 (3rd time’s a charm?) be that this Fed can normalize policy with an orderly and extended rate hike regimen against a backdrop of easing global competitors and a rising domestic currency?

We can say ‘who needs the industrial sectors?’ if we want to be bubble headed dreamers, circa 2000. But even tech captains Apple and Alphabet (Google), in their earnings beats, noted one real negative and that was the impact of currency exchange rates on overall results. How do you think Parker Hannifin, Rockwell International or General Electric are going to take a perpetually strong US dollar? So again, is the Fed posturing or going all in on the confidence game?

Back on the Nuts & Bolts of the Gold Sector

Focusing on gold, the Commitments of Traders data (courtesy of COTbase.com) were bearish (silver’s CoT was even more bearish). This was the warning that something was amiss (from a gold bug’s perspective) heading into the FOMC meeting. Large spec’s were near ‘full bull’, with Commercials going the other way. Odds are, that these conditions (cut off date 10/20) intensified into the FOMC release. Look at the little guy; he was feeling quite peppy and ripe for getting corrected.

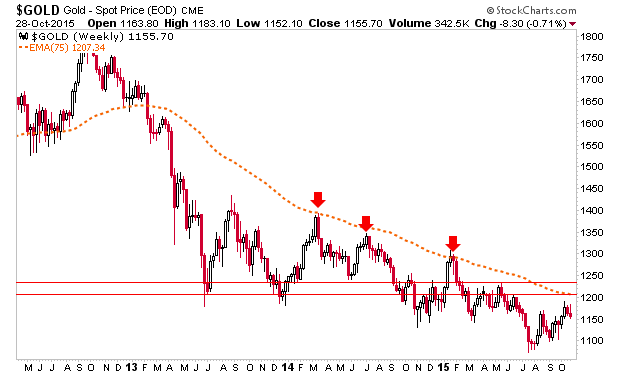

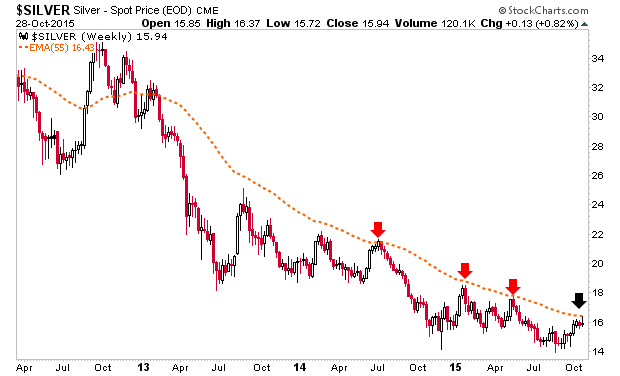

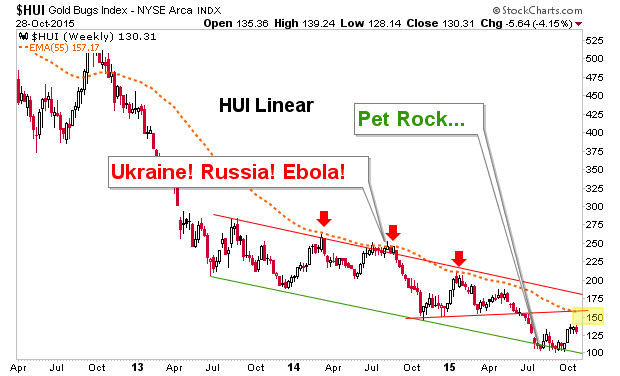

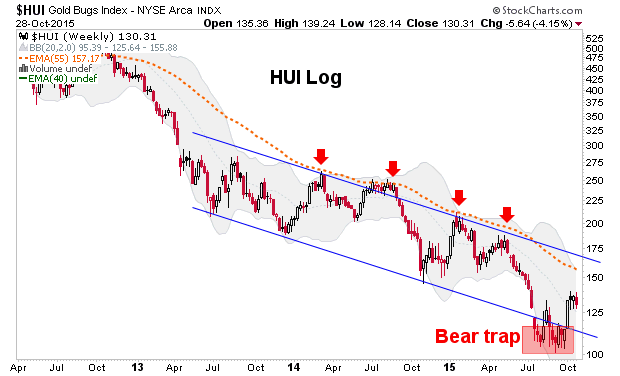

Meanwhile here are the cold hard facts of some simple weekly charts.

Gold has been bouncing in a bear market.

Silver has been bouncing in a bear market.

HUI for that matter, has been bouncing in a bear market after it ground around at the lower trend line amid the WSJ ‘pet rock’ contrary indicator in gold. It’s target is in the 150’s, preferably pending correction (mini or maxi) as the gold and silver CoT and attendant over-speculation get cleared.

Want to talk about a mean spirited market? Bears that thought they saw a trend line breakdown (and oncoming final plunge) in using a ‘log’ scale chart (which scaled HUI to their view of a gold bug Armageddon) shorted HUI right into the bounce from 100 to 140. Yesterday’s pre-FOMC upside hysterics probably got many of them to cover, right before post-FOMC reversal.

Policy & Markets, as One

That this the thing about modern day policy making; everybody is trying to out think an entity (or speaking globally, entities) that has aggressively painted the macro. The MSM headlines rationalized yesterday’s reversal in gold as speculative interests unwound trades in gold in light of the Fed’s stance (as implied by the wording). Regardless of the reasons that can be conjured now, the sector was in need of correction, whether it was to make its rally targets first or after said correction. My preference is ‘after’ for longer-term prospects of establishing a sound bottom for the sector.

If yesterday’s reversal means what it typically has in the past, then upside will be delayed and by the time of the next highly anticipated (yes, I am being sarcastic) FOMC meeting in December, all the unhealthy inputs should be cleared out of the precious metals. The question of ‘will they or won’t they hike by a measly 1/4 or 1/2%?’ is I guess psychologically terrifying to market participants, but it is not functionally so when so many other ‘tools’ exist in policy toolboxes both in the US and globally. These tools (i.e. the various aspects of QE and quasi QE) are employed to promote inflation even as they enthrall conventional market participants under the spell of confidence that policy is sound and in control.

We now routinely expect policy, policy jawboning and media amplifying it all to be intimately intertwined with the markets. Nowhere is intact confidence in this regime so important than in the gold sector. If yesterday’s signal in the silver-gold ratio is a good one, the precious metals are a ‘first mover’ to some ugly things coming in the broad stock market as well.

I am not saying that because ‘ooh, they are going to raise rates!!’ (history shows markets usually rise with a rate hike regime before ultimately crashing later on). I am saying that because of the T-Bill/Stock Market distortion and the message of the 30yr-5yr on the first chart in this post. I am also saying it because I know a rat when I smell one.

But the bottom line is that these are the markets we have, worked over by overly aggressive policy or not. So it is the lowly player’s job to understand what is at work here, have patience and make it work for you. It takes a lot of burned brain cells, but the macro is making sense. People who prepare for the eventual loss of confidence will be ready with both capital and sanity intact.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.