U.S. Economy On the Precipice of Deflation

Economics / Deflation Oct 28, 2015 - 10:43 AM GMTBy: EWI

Weakest economic recovery in seven decades gets weaker

Weakest economic recovery in seven decades gets weaker

Most people extrapolate present trends into the future. But yesterday's trend can look like day vs. night when tomorrow arrives.

Almost no one expected deflation when the December 2007 Elliott Wave Theorist said:

Inflation has raged, but deflation is next.

What followed was the worst financial crisis since the Great Depression and the weakest economic recovery since World War II.

The American economy remains weak. Growth is at the lowest level in more than three decades. ... Wages have been rising at the slowest pace since the 1980s. ... This is the weakest recovery since World War II ... . (U.S. News & World Report, August 23)

A co-founder of AOL and the chairman of Quicken Loans just graded the U.S. economy: They scored its performance near the bottom of the class.

Grading the U.S. economy, the rosiest scores from two billionaires on [October 23] would average about 68, equal to a D+ on a report card. (CNBC, October 23)

Deflationary pressures are increasingly evident.

U.S. consumer prices fell 0.1% in August. Producer prices have been even weaker. The nation's PPI fell 2.9% in August, and it's declined every month since December 2014.

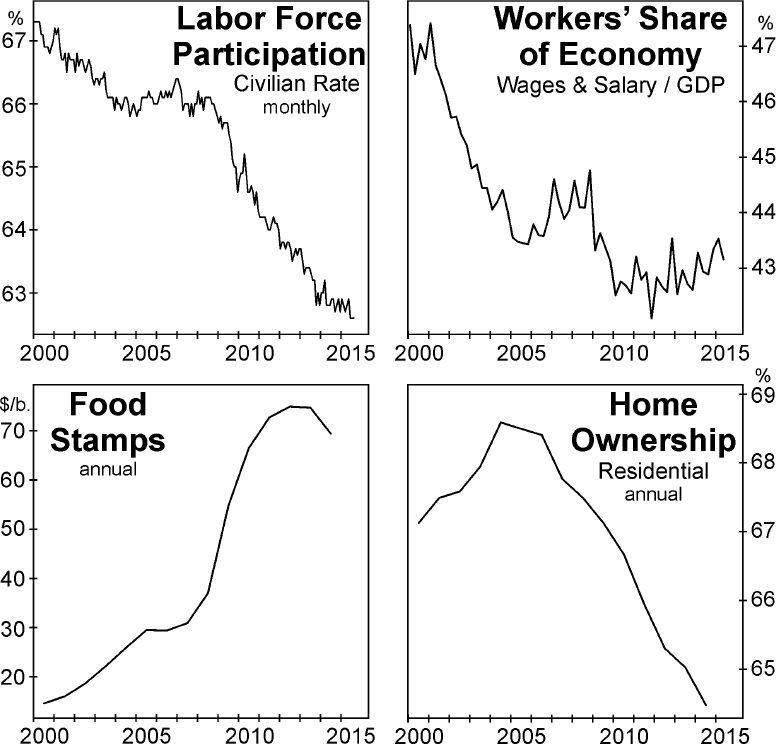

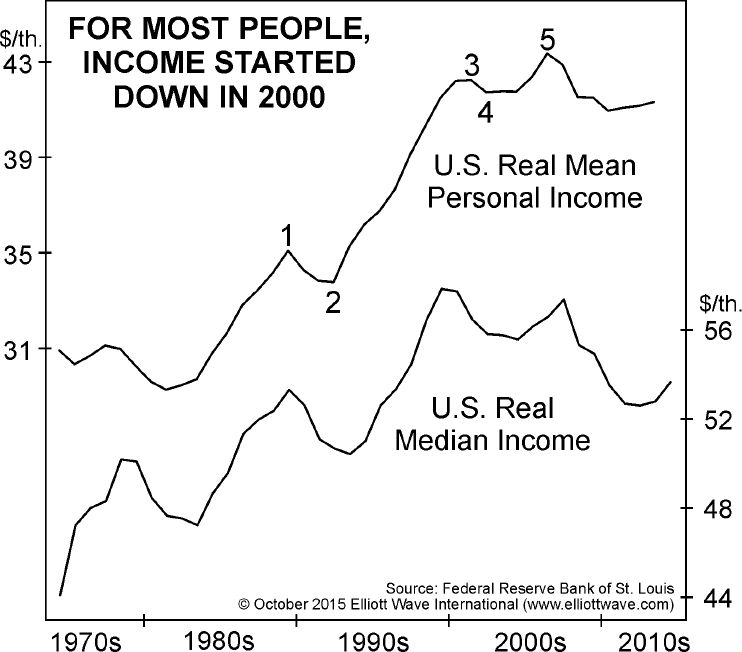

These charts are from our new report, Deflation and the Devaluation Derby:

The graphs show several key economic measures that reflect years of broad-based distress, despite historic monetary and fiscal stimulus.

The chart above of real mean and median U.S. personal income shows another long-term reversal that is hitting most Americans in their pocketbook. While the mean measure shows, on average, that personal income peaked with the real estate boom in 2006, the median measure shows that half of all U.S. citizens are earning less money in real terms than they were in 2000. The five-wave form of the rise in mean income is further Elliott wave evidence that the decline is about to accelerate.

Our July Elliott Wave Financial Forecast said, "Deflation is just getting started." The October Financial Forecast provided a reminder of that warning and added that deflation "is already deeply entrenched in many flagship quarters of the global economy."

Get the full picture of what we see as a worldwide deflationary trend in our new report, Deflation and the Devaluation Derby.

Here's what you will learn:

- Currency devaluation's role in the developing global crisis

- How the self-reinforcing aspect of deflation is already apparent in commodities trading

- Why the top 1% of earners are in for a rude awakening

- How Europe's biggest economies are screeching to a halt

- The hair-raising future for U.S. stocks

Just recall how swiftly the 2007-2009 financial crisis unfolded. We anticipate that the next global financial crisis could be even more sudden and severe.

Prepare now with our new report, Deflation and the Devaluation Derby. CLICK TO CONTINUE READING >>

This article was syndicated by Elliott Wave International and was originally published under the headline Dispatch: U.S. On the Precipice of Deflation. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.