Did USD Just Bottom? Did EUR Just Top?

Currencies / US Dollar Oct 21, 2015 - 02:25 PM GMTBy: EWI

Find out free -- now, during Forex FreeWeek at elliottwave.com!

Find out free -- now, during Forex FreeWeek at elliottwave.com!

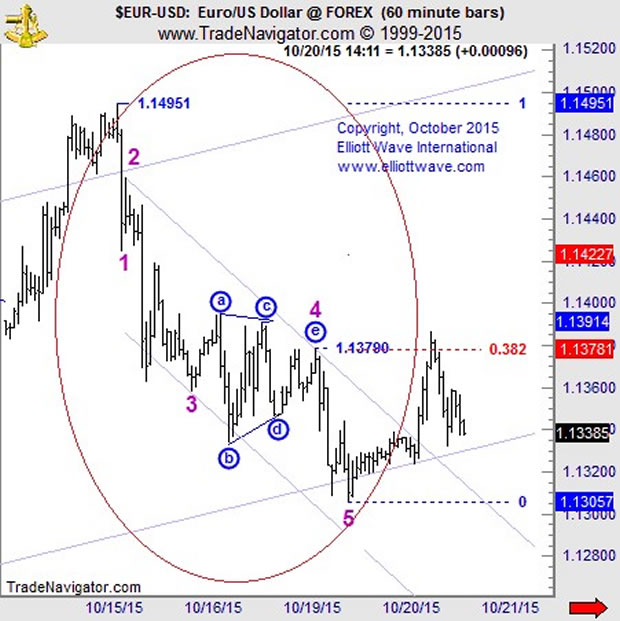

Late last week -- and then again on Monday -- EURUSD, the world's most traded forex pair, fell sharply. In fact, the euro lost almost 200 pips, or two cents, against the buck.

Here's a chart of that decline, copied from our Currency Pro Service (partial Elliott wave labels shown):

Our Currency Pro Service editor, Jim Martens, just posted a new video for FreeWeek participants where he explained why he's bullish on the USD. So this reversal certainly fits the "big picture."

However, forex markets rarely move in a straight line. Even if the euro top is in, temporary rallies are inevitable.

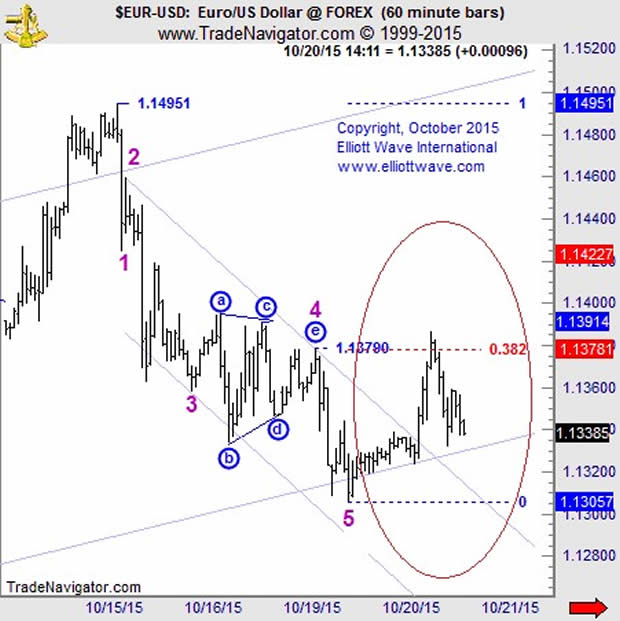

Indeed, on Tuesday morning, EURUSD rebounded -- but the recovery stalled after retracing a Fibonacci 38.2% of the prior decline and within the area of the fourth wave of one lesser degree. Again, this Currency Pro Service chart illustrates this attampted rally for you:

The fourth wave of lesser degree often acts as resistance -- and appears to have done so in this instance.

Did the euro just peak? Did the dollar just bottom?

Well, wonder no more. The good news is, you can get our most up-to-date forecasts for EURUSD (plus, the Japanese yen, British pound and more) now, completely free, during the ongoing Forex FreeWeek!

FreeWeek (Oct. 19-23) is 100% free to Club EWI members and EWI subscribers. Simply put, you get full access to our premier Currency Pro Service: new forex forecasts for 11 forex pairs, 24 hours a day. There is no catch, and we won't ask for your credit card number.

Ready? Register for Forex FreeWeek now to see our new FX forecasts now, free.

(Forex FreeWeek ends Oct. 23, so you may want to hurry.)

This article was syndicated by Elliott Wave International and was originally published under the headline Did USD Just Bottom? Did EUR Just Top?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.