Financial Authorities Acting Above The Law

Commodities / Market Manipulation Jun 30, 2008 - 11:31 AM GMTBy: Captain_Hook

Above the law – that's where financial authorities, politicos, and bureaucrats think they are – a farce justified on the premise extreme times justify extreme measures. Moreover, they routinely lie and cheat the public out their savings to protect their own positions, as opposed to living up to oath's of office and serving the public's interest. Some may say this has always been true, and perhaps this is the case, even within our modern era of globalization, technological advancement, and modern society. And if you so take a close look at it, things have been getting worse in this respect since Nixon dropped the Gold Standard in 1971, along with a loss of freedom and liberties.

Above the law – that's where financial authorities, politicos, and bureaucrats think they are – a farce justified on the premise extreme times justify extreme measures. Moreover, they routinely lie and cheat the public out their savings to protect their own positions, as opposed to living up to oath's of office and serving the public's interest. Some may say this has always been true, and perhaps this is the case, even within our modern era of globalization, technological advancement, and modern society. And if you so take a close look at it, things have been getting worse in this respect since Nixon dropped the Gold Standard in 1971, along with a loss of freedom and liberties.

You see the thinking is Western society has been completely corrupted on one level (officialdom), and is brain-dead on another (the public), evidenced in the government's ability to not pay its international debts with tangible (non-depreciable) money, along with the banking community's ability to steel your savings every day with this same depreciation. And to this day Western bankers continue attempting to push their self-serving agenda on unsuspecting populations under the guise of globalization, and are successful at it. So the question then arises – why not keep lying? Indeed – why not – as power corrupts – and they do.

The following is an excerpt from commentary that originally appeared at Treasure Chests for the benefit of subscribers on Tuesday, June 10 th , 2008.

While it's true these concepts might be too course for the average man, not that they would care if still fat, perhaps if put in different terms, and certainly once the economy begins to suffer on a broader level, people might once again begin to care more about protecting their civil liberties, wealth, and savings. This is why to continue this fraud, gold (and silver) must be contained, so that the biggest lie of all when it comes to the larger financial system, and the public's wealth, is not exposed. So, this is why the bureaucracy will bold face lie until they are blue, because to do the opposite would trigger a profound unraveling of the financial system on their watch, which would be political suicide on multiple levels.

This means that if gold and silver were to begin rising rapidly, as sleepy and confused as they may be on such issues, the public would sense something ‘big' is wrong, and may not only begin attempting to save wealth as opposed to speculate in it, with precious metals undoubtedly becoming a more important element within the portfolio by the day. You see, gold and silver are honest money – hard earned money – that must be mined out the ground as opposed to be created at the whim of a banker. This means you can't lie about the value of gold and silver forever, which is the case at present based on reliable relative measures that will be discussed further below.

You may be asking yourself why I am bringing all this up right now if it's been with us for so long, and nothing ever seems to get done about it. Why then? Besides the obvious in terms of the public needing to do more about protecting its own liberties, which is likely a lost cause given the amount of brain damage apparent, it is still possible for concerned individuals to protect themselves. And why we are here dear reader, to serve your best interests, so read on, as great opportunity exists in the precious metals market(s) at present. In fact, if Ted Butler is right, and much like the situation in crude oil at present, precious metals, and more specifically silver is next in line to be bubblized by a rolling speculative mania that grabs hold of commodities one by one and wrings out the bears in a short squeeze. That's how manic / bubble pricing episodes occur you should know.

Here, it's important to understand that essential commodities like crude are not in unsustainable bubbles when this occurs, it's just that to reach pricing consistent with fundamentals in this case (which wasn't the case with tech stocks by the way), often, in the end, the majority of price gains are put on as a result of a short squeeze. This is what is happening in the energies. And once traders are finished pricing half the planet out of the energy market in aligning prices to the fundamental backdrop, they roll back over to precious metals to continue this process over there as well. Already many could not afford to buy an ounce of gold if their lives depended on it, which is why ‘poor man's gold', silver, becomes increasing popular as prices continue to rise.

So, if Ted Butler is right then, which is likely the case, then we should finally be close to what might prove to be the greatest short squeeze in the history of financial markets, where precious metals prices soar, led by silver. Here, the thought process is with the majority of crude's price gains likely behind us already, combined with the fact monetary aggregate measures are reaccelerating higher, which includes the monetary base , rolling pools of hedge fund based ‘hot money' will be looking for new market's to bubblize. And even if it's not for the right reason (to protect wealth), if the hot money does begin to flow into the silver market, all hell could break loose with physical supplies in such short order as small investors pick away at it.

In this respect it should be recognized that at present there appears to be a growing shortage of physical supply on the market as evidenced in the US Mint having to drastically cut back on production / delivery to it's dealers. Of course one would think that with an apparent physical shortage higher prices should be a ‘no brainer' right? This is if the laws of supply and demand are working properly in the silver market. For those who understand the larger situation however, you know why this has not been the case, not with silver's attachment to gold, and the desire of the bureaucracy to suppress it such that the public remains asleep, and demand remains relatively subdued.

How is this done if there is more demand for the physical metal than supply? After all, we do live in a physical world in the end. Answer: By throwing a blizzard of naked short orders at the primary paper pricing mechanism on the COMEX market for one thing, along with having your agents lie through their teeth (lest we forget these jokers think they are above the law) about the true state of the market. As you would know from reading Ted Butler's regular review of silver market internals, this has been the situation for some time now. However, with the disparity between physical and paper pricing mechanisms becoming stretched to the extreme of late, this might finally be set to change.

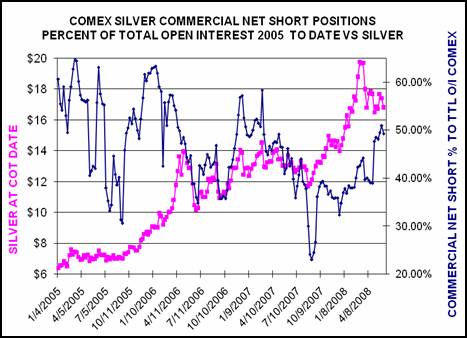

Here is a chart borrowed from Gene Arensberg's column this week showing that the net concentrated commercial (banks) short position has never been greater than at present. It's too bad we don't have access to well delineated and more frequent over-the-counter (OTC) data because a very large net short position exists here too. For the final six-months of last year however, we do know courtesy of the most recent BIS OTC derivatives market activity report that concentrations of this paper is growing a 40-percent annualized clip in the gold market, which far outstrips anything happening on COMEX. (See Figure 1)

Figure 1

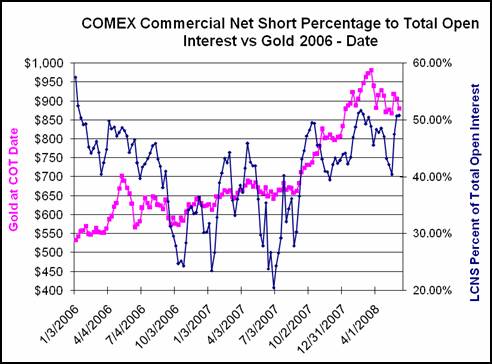

And as alluded to above, here is a look at gold's less concentrated, but still compelling Commitment Of Traders (COT) profile. (See Figure 2)

Figure 2

How can this be then, especially for an extended period of time? Well, for one thing, and again, as alluded to above, one must understand that gold, and its lesser monetary sister surrogate, silver, are political metals more than anything else. So, knowing this, and with the silver market being small and easily controlled, at least up until now, the bureaucracy's price management agents (bullion banks acting for the Fed) have taken it upon themselves to concentrate on this market in order to keep both brother and sister contained, where if the same exercise (concentration) were attempted in the larger gold market solely, failure might have come long ago. Be that as it may however, and as suggested earlier, we may finally be at the moment of truth for silver, and correspondingly gold, because the combination of mushrooming and uncontrollable problems in the larger derivatives market , and the lack of physical supplies may finally be enough to get some of the shorts to start covering their positions.

And this might be especially true if related derivatives positions in the FX (currencies) market(s) begin to suffer from counter party risk. Just try and imagine what would happen if at the same moment, due to the highly integrated nature of counter-party risk, we have enough bids to take out all existing physical supplies of both gold and silver in ten-minutes. This is possible you should know, because there is hundreds of trillions worth of whatever fiat currency you wish to talk about in the world that will all be looking for a home at the same time at some point in the not too distant future. Under such conditions silver could gap higher by $10 in a New York minute.

So, if history is a good guide then, where we have a very good example at present in the energies market, both the bankers in New York and politicos in Washington are going to find out they are not above the law. And this includes not only manmade laws, but those in nature as well. Because once we humans begin to panic, crazy things begin to happen, like seeing crude oil making a b-line for $150, or gold shooting past $1,000 as if the four-figure barrier didn't even exist, if we may talk about the metal of kings for just a moment. That's the big number in case you have forgotten – $1,000 smackeroos. Once gold gets past this pricing hurdle, which should be no problem ounce a panic sets into the market(s), you will know the big squeeze is on, with a great deal of blue-sky potential here to say the least.

All we need for this to happen is for the alternatives to continue drying up, where in case you didn't notice this may finally be the situation as it pertains to the debt markets. Certainly investors are not going near consumer debt, not with every measure of consumer credit crashing. And if consumers are crashing, corporations cannot be far behind , where finally, with put / call ratios on US indexes trending lower (meaning the short squeeze is over), prices should begin to reflect a closer approximation of reality soon here too. This only leaves sovereign debt in case you have not been keeping track, which of course has also been acting up of late with core inflation measures (contrived as they may be), stoking inflation fears. One should note price managers continue attempting to keep the public calm with more lies in this respect, but the lies are running thin these days with pocket books increasingly tight due to the reality of the situation.

And that's what we are talking about here in the end after all – the reality of the situation. Along these lines then, since this is what we are interested in measuring, let's take a look at the charts to see where we are now that we know that based on the above, fundamentals are positively aligned for gold and silver. Here, in maintaining our focus, we are returning to the silver market because as you will see below, after one more minor degree corrective sequence it will be set to rock and roll, leading the entire precious metals complex higher in effect.

What's more, this will surprise the heck out of a great many investors / speculators / price managers, which is an important necessary ingredient in any short squeeze. The element of surprise must be there in order to get the shorts to act. Previously if stocks were declining it was easy to hold silver back because has been viewed by banker influenced ‘orthodox' traders as an industrial metal. If this relationship were to be broken however, then the perspective of a trapped short seller would become – gee – I better cover my position because this stuff goes up now no matter what the stock market is doing.

Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our newly improved web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. For your information, our newly reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts , to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented ‘key' information concerning the markets we cover.

On top of this, and in relation to identifying value based opportunities in the energy, base metals, and precious metals sectors, all of which should benefit handsomely as increasing numbers of investors recognize their present investments are not keeping pace with actual inflation, we are currently covering 70 stocks (and growing) within our portfolios . This is yet another good reason to drop by and check us out.

As a side-note, some of you might be interested to know you can now subscribe to our service directly through Visa and Mastercard by clicking here .

And if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these matters.

Good investing all.

By Captain Hook

http://www.treasurechestsinfo.com/

Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2008 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

Captain Hook Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.