The 5th Convergence…An Economic & Financial Superstorm That Will Devastate America

Economics / Cycles Analysis Oct 07, 2015 - 02:12 PM GMTBy: Harry_Dent

This morning we had to face some hard truths. The economy’s beginning to show its true colors.

This morning we had to face some hard truths. The economy’s beginning to show its true colors.

Last month the economy added just 142,000 jobs. August was revised substantially lower to just 136,000 jobs. Analysts were expecting 200,000-plus jobs growth like it would go on forever.

Of course, I’m not the least bit surprised. You know I’ve seen this coming.

I’ve spent the last 30 years developing something no economist thought possible.

In fact, I’m not really an economist. I’m an entrepreneur in economics.

Entrepreneurs are almost like criminals. They attack society’s norms. Both are creative, and even many criminals become famous for what they do – like Jesse James, Butch Cassidy, the Sundance Kid, or even mob bosses like Al Capone.

The difference, of course, is that entrepreneurs attack society and business in a constructive manner.

My breakthrough research has shown that you and I can predict the key economic trends that will impact the rest of your lifetime today.

It took me 10 years to get my first major insights, and now 30 years to perfect a long-term model for our economy.

Most economists tell you that they may be able to predict the trends into the next election, and most of them can’t even do that. But no one, they say, can predict the future beyond that…

I beg to differ!

I got my first breakthrough indicator in 1988: a 46-year lag on the birth index for the peak in spending for new generations, like the massive baby boom.

How simple is that?

Knowing that – along with a 20-year lag for workforce entry that best forecast inflation trends and interest rates – I was able to predict the mega boom of the 1990s into 2007 with its falling interest rates.

After 2007, I saw deflation – and look what happened! I simultaneously predicted the collapse of Japan when everyone thought they would take over the world. Look what happened there!

Since those earlier predictions, I’ve greatly expanded my research.

When 9/11 hit, I knew demographics didn’t tell the whole story. Nothing’s been the same since. It’s been one negative geopolitical event after the next.

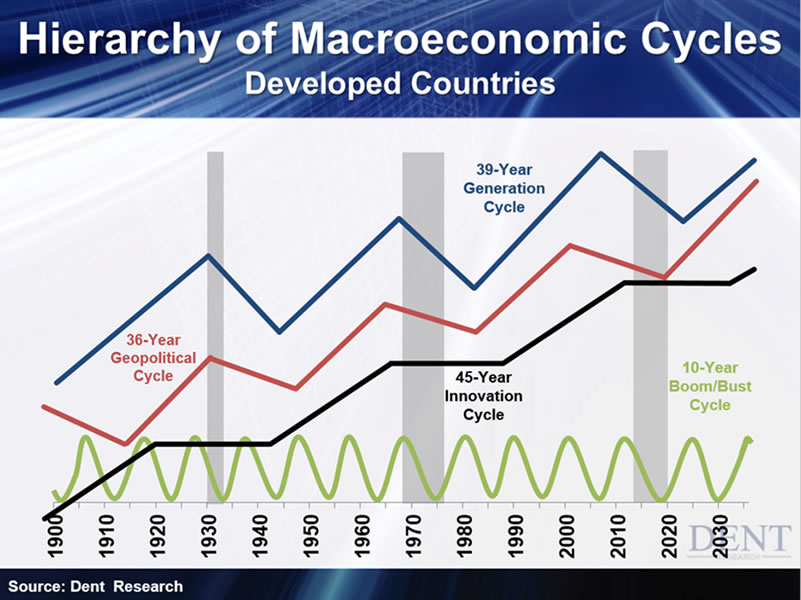

That led to the discovery of my second macroeconomic indicator: the geopolitical cycle.

It’s like clockwork: every 17 to 18 years, it changes. Its current phase points down to around early 2020, rounding out the geopolitical environment started by 9/11.

This is the cycle that most affects stock valuations, as the risk premium goes up in such adverse times.

The next was an innovation cycle that spans 45 years.

Every 45 years, powerful clusters of technologies finally move mainstream, revolutionizing how we work and live.

Steamships and canals peaked into 1875; then railroads and telegraphs into 1920; then automobiles, highways and electrical appliances like TVs into 1965; and most recently the Internet and handheld computing devices into around 2010.

Each one, 45 years after the other!

We tend to think progress moves in a straight line. It doesn’t. It won’t be until 2032 to 2055 before we see the next mainstream innovation cycle that transforms our lives and work. Until then, we have Facebook for entertainment!

But it’s my final indicator that best predicts the timing for major stocks crashes and financial crises: a decennial boom/bust cycle originally identified by Ned Davis.

Davis looked at stocks all the way back to 1900, and learned that the worst stock crashes and recessions tend to occur in the first two to three years of every decade. That’s especially been the case since the 1960s.

Of course, this didn’t play out in 2010 to 2012. That’s what made me dig deeper. It turned out, 10 years was too exact – the cycle actually manifested between 8 and 13 years.

This cycle is certainly more variable than I would have thought. 10 years sure would’ve been easier. But it’s tracked and measured by major scientists, as it affects everything – from agriculture, to satellites, to electronic infrastructures.

The last cycle was more extreme, peaking in early 2000 and bottoming in late 2009. And in it, we saw not just one, but two major crashes and recessions.

This next started in 2014 and doesn’t bottom out until around early 2020.

But the truly frightening part, is that all of these cycles are in their downward phases at the same time.

You’ll notice from the most recent periods where all four cycles spelled trouble, truly awful things happened. The Great Depression… the inflationary financial crisis of the 1970s… and now, this.

In fact, this "convergence" has only happened 5 times in the past 200 years... each with devastating results.

That’s why I believe the next financial crisis and depression is inevitable. I’ve been forecasting it for years.

And I believe, with the convergence of these four cycles, it’ll be much worse than the last crisis in 2008/2009.

That’s why, if we don’t have a major financial crisis and stock crash between late this year and early 2020, I will quit my profession and become a limo driver in Australia.

I doubt it’ll come to that, because based on what I see, it’s already starting to happen.

Economists, Wall Street analysts, and your stock broker, will not see this coming.

Protect yourself now and sell any financial assets you aren’t actively trading, like with one of our analysts who actually see this coming, before the greatest bubble in history continues to burst.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.