Negative Jobs Report Sents SPX, TNX Lower

Stock-Markets / Stock Markets 2015 Oct 02, 2015 - 04:22 PM GMT Good Morning!

Good Morning!

The best proxy for the Monthly Jobs Report is TNX, because bonds start trading around 8:15. As you can see, it had a horrible miss, only 142,000 new jobs reported in August. The consensus expectation was 215,000.

The CES Birth/Death Model report has just been updated, showing a loss of 34,000 fictitious jobs in September. This statistic is made up out of thin air. But the August payroll number has also been revised downward. It is possible that the US has seen negative job growth for the first time in memory.

ZeroHedge writes, “And so the "most important payrolls number" at least until the October FOMC meeting when the Fed will once again do nothing, is in the history books, and at 142K it was a total disaster, 60K below the consensus and below the lowest estimate. Just as bad, the August print was also revised lower from 173K to 136K. The unemployment rate came in at 5.1% as expected but everyone will be focusing on the disaster headline print. And worst of all, average hourly wages stayed flat at 0.0%, also below the expected 0.2%.”

TNX has bounced just above the Head & Shoulders neckline. Should it be broken, Treasury yields will plummet even more. TNX may not reach a Master Cycle low until October 15.

SPX futures dove 20 points immediately at that news and continues its decline as I write. The Premarket, which is delayed, is having trouble catching up. The support at 1900.00 appears to be already gone. A decline through 1867.01 is likely to set off a flash crash of epic proportions.

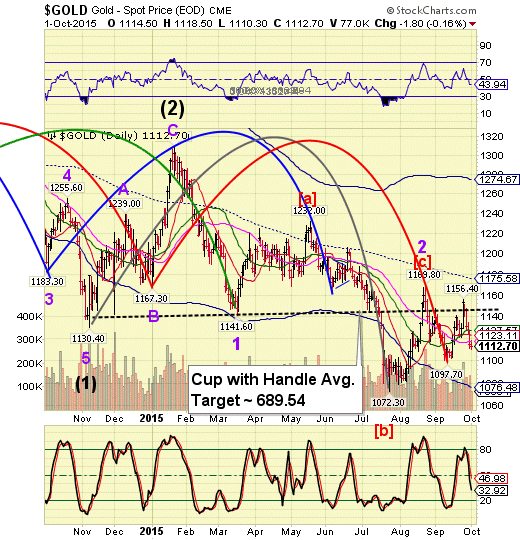

Earlier this morning, gold had settled down near 1104.00, but the payroll announcement flashed gold back up to 1136.40, just beneath the 50-day Moving Average instantly. That is a 61.5% retracement and may be a good position to sell or go short.

Crude appears to be breaking down, but not as dramatically as gold rallied.

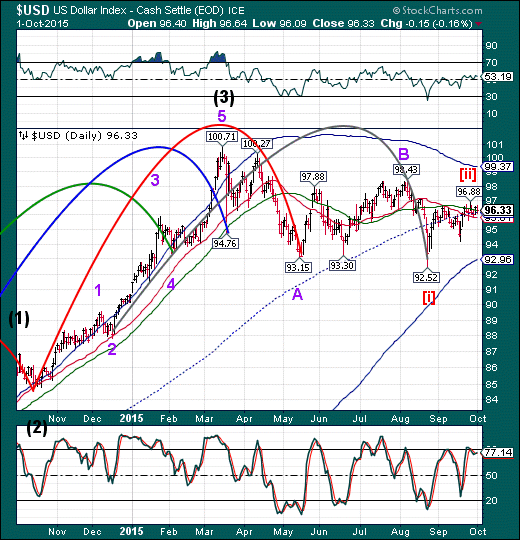

USD futures fell out of support to 95.31 this morning. The Cycles Model suggests that it may continue its decline to October 19. If so, this may also be the same schedule as the SPX low.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.