Gold Price Up Before Fed Interest Rate Decision - Myth Of All Powerful Central Banker Continues

Commodities / Gold and Silver 2015 Sep 17, 2015 - 01:30 PM GMTBy: GoldCore

Gold rose 1.3% yesterday ahead of the Federal Reserve interest rate announcement today. Markets remain divided and uncertain whether the Fed will increase rates by 25 basis points today (1900 GMT).

Gold rose 1.3% yesterday ahead of the Federal Reserve interest rate announcement today. Markets remain divided and uncertain whether the Fed will increase rates by 25 basis points today (1900 GMT).

The Fed last raised interest rates in June 2006, by 25 basis points to 5.25%, shortly after that America’s central bank found itself reducing rates and since December 2008 the Fed’s benchmark interest rate has been set between 0.0% and 0.25%. Gold prices rose in the months after the interest rise and were 23% higher in 2006.

Lower than expected U.S. inflation numbers yesterday eased fears the Fed will hike interest rates later this session. The dollar came under pressure today after the weak inflation data led traders to pare bets that the U.S. Federal Reserve will deliver an interest rate hike.

The ‘will they or won’t they’ speculation is rife and all consuming in markets. The Fed will hold rates near unprecedented historic lows at 0.25% and not have its first interest rate rise in nearly a decade, according to a little over half of economists in a Reuters poll who only last week narrowly predicted the Fed will increase rates by 0.25% today.

Since last week’s poll, five economists have changed their prediction for a hike and now expect the Fed to keep rates at 0.25%. None changed their view from a hold to a hike, suggesting that momentum is moving against a Fed move this week. The number of economists predicting no change in rates now outnumbers those betting on a hike by 45 to 35. Among primary dealers, 12 banks expect the Fed to hold and the remaining 10 expect a hike.

Markets do not like uncertainty and there is the possibility of volatility and sharp moves in markets during and after the decision.

With regard to gold, the perception and narrative is that a rise in rates, even by a very marginal 25 basis points will be negative for gold. This may be true in the short term as perception, even misguided perception, can drive markets in the short term. As can hedge funds and banks who are short the market or desire lower gold prices – for whatever reason.

However, economic reality determines prices in the long term. Ultimately, gold’s fundamentals remain sound as long as interest rates remain near zero in major western markets and as importantly as long as we have negative real interest rates.

Rising interest rates are not bearish for gold per se as was seen in 2006 and again in the 1970s. What is bearish for gold is positive real rates of return whereby depositors and savers are again rewarded with a positive real rate of return. This will likely only happen towards the end of an interest rate tightening cycle as was seen in 1980.

It is important to remember that gold rose in tandem with interest rates in the 1970s.

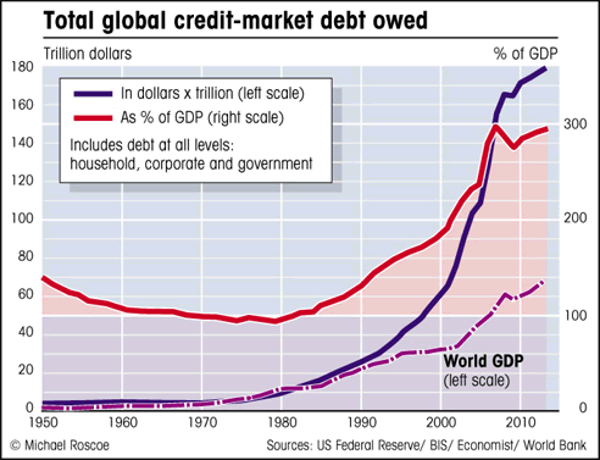

The simple fact that the Fed is struggling to increase interest rates from near 0% after seven long years should give pause for concern. It underlines the vulnerability of the U.S. economy and means that another recession is very likely. Indeed, the huge levels of debt at all levels of U.S. society and the significant increase in global debt levels during the last seven years mean that another recession is almost certain.

When it comes, the Fed has little monetary ammunition left besides negative base rates and further QE. Indeed, there balance sheet shows that they are in effect insolvent as is the U.S. itself with its $18.3 trillion national debt and over $100 trillion in unfunded liabilities.

The Fed knows this and hence their inability to increase interest rates in any meaningful way. The increasingly negative global economic backdrop is bullish for gold.

We believe that ultra loose monetary policy will continue. Indeed further QE and money printing remains very likely given the poor structural state of the U.S. and indeed the global economy.

We advise investors to fade out the short term noise emanating from the Fed today and from Janet Yellen and focus on the reality that ultra loose monetary policies will continue for the foreseeable future. In this environment, currencies remain vulnerable to competitive currency devaluations.

It is important to remember that central bank’s ultra loose monetary policies was primary factor in the first global debt crisis. Low interest rates by central bankers and Alan Greenspan in particular led to rampant speculation and risk taking on Wall Street, the subprime crisis and the stock and property bubbles.

Will a continuation of the same monetary policies that got us into the financial crisis get us out? Conventional wisdom is that yes it will. We do not think it will and indeed believe that will make the next crisis much worse.

The myth of the all powerful central banker continues for now…

DAILY PRICES

Today’s Gold Prices: USD 1118.15, EUR 987.46 and GBP 720.64 per ounce.

Yesterday’s Gold Prices: USD 1109.75, EUR 987.54 and GBP 719.82 per ounce.

(LBMA AM)

Gold rose 1.3% or $14.20 to $1,124.22 while silver gained 3.5% or 48 cent to $14.91 an ounce on the COMEX yesterday ahead of the Federal Reserve interest rate announcement today.

Gold in GBP – 1 Year

Gold in Singapore was essentially flat and remained tethered to the $1,020 per ounce in European trading.

Silver bullion has ticked higher to $15.04, following the 3.5 percent jump in the previous session, its biggest one-day jump since May. Platinum and palladium are slightly lower today.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.