How the Fed Is Hurting U.S. Manufacturing

Interest-Rates / US Federal Reserve Bank Sep 13, 2015 - 02:25 PM GMTBy: Investment_U

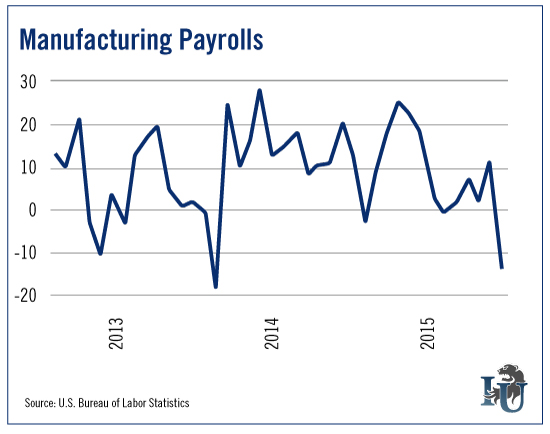

Sean Brodrick writes: Whether he deserves it or not, Obama is getting kudos on his handling of the economy, particularly the declining unemployment rate. In August, the official headline unemployment rate dropped to 5.1%. But that same jobs data out of the Bureau of Labor Statistics (BLS) contained some sobering news: Manufacturing payrolls are getting shredded.

Sean Brodrick writes: Whether he deserves it or not, Obama is getting kudos on his handling of the economy, particularly the declining unemployment rate. In August, the official headline unemployment rate dropped to 5.1%. But that same jobs data out of the Bureau of Labor Statistics (BLS) contained some sobering news: Manufacturing payrolls are getting shredded.

Yikes!

As you can see, 17,000 manufacturing jobs disappeared in one month. The only reason the unemployment rate is going down is more service jobs - everything from bartenders to home healthcare workers - are being created.

The BLS reported: “Job losses occurred in a number of component industries, including fabricated metal products and food manufacturing (-7,000 each). These losses more than offset gains in motor vehicles and parts (+6,000) and in miscellaneous durable goods manufacturing (+4,000).”

The source of good jobs for America’s workforce is being hollowed out and replaced with bartenders.

Should we blame Obama for this? After all, he’s getting the credit for low unemployment; he should also get the blame, right? Maybe.

But if you want to blame anyone, first in line should be the U.S. Federal Reserve.

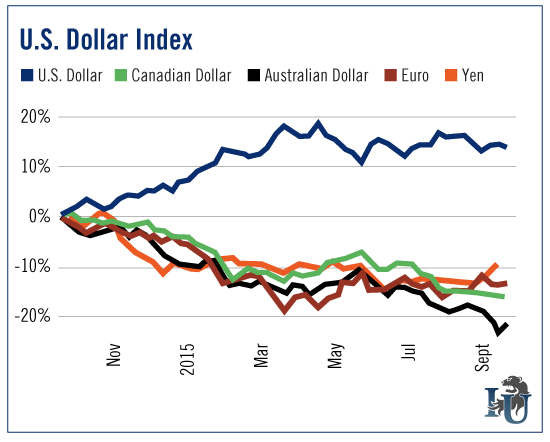

The Fed has been making a lot of noise about raising its benchmark interest for months. In an environment where other central banks around the world are cutting rates, this anticipation of higher rates pushes the U.S. dollar higher.

In the last year, the U.S. Dollar Index has increased nearly 15%. At the same time the Yen has lost more than 11% of its value, the euro nearly 14%, the Canadian dollar 16% and the sad-sack Australian dollar more than 20%.

Ouch!

As our currency rises, our manufactured goods become more expensive in foreign countries. The pain is doubled if the country’s currency is falling at the same time.

So why is the dollar so strong?

It is partly due to economic forces - both Canada and Australia are in recessions now thanks to falling prices in natural resources. But the Fed’s promise of a rate hike is a major factor.

Again, money from around the world is being parked in greenbacks in anticipation of that rate hike.

Am I saying the Fed shouldn’t raise rates next week?

Not necessarily. I can see the argument of those who say the Fed should sit tight.

- The market is on a roller coaster right now.

- While parts of the U.S. economy, including real estate, healthcare and consumer services, are shifting into higher gear, there are big layoffs in the energy sector.

- A lack of liquidity in the bond market has many analysts sounding the alarm.

On the other hand, I’d hate to think our economy is so frail that the Fed can’t raise its benchmark interest rate by a measly quarter point without triggering a financial earthquake.

A big part of the problem is that the Fed keeps delaying its rate hike. In fact, if and when the Fed finally hikes rates, I’d expect to see a “sell the news” reaction that could send the U.S. dollar lower.

My message to the Fed would be: “Poop or get off the pot.” Either raise rates as you’ve been hinting at for the last three meetings, or put them off the table for the rest of the year.

There are some things you as an investor and consumer should and shouldn’t do before the Fed hikes rates.

- If you’re going to buy a home, lock in that rate. The same goes for a car.

- Expect downward pressure on bonds. But also remember that yields on short-term money market instruments will remain low for another year at least. That means little competition for bonds of longer maturity or lower credit quality. So, there’s no need to panic out of any positions.

- Have a cash reserve ready. A fed rate hike may spark a short-term panic in stocks. They’re looking toppy anyway, and September is historically a month associated with market corrections. So, if bargains present themselves, consider jumping on them. The long-term trend in stocks is up.

Meanwhile, we’ll watch to see what kind of blame or credit goes to the folks in Washington. There is no doubt the Fed has misjudged the power of its decisions.

It’s created ripples across the economy.

Good investing,

Sean

Source: http://www.investmentu.com/article/detail/47501/interest-rates-fed-us-manufacturing#.VfVqhU3bK0k

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.