The 10 Best Stocks for Options Trading Plays in This Market

Companies / Options & Warrants Aug 28, 2015 - 01:45 PM GMTBy: ...

MoneyMorning.com  Tom Gentile writes: The biggest market drop in recorded history on Monday… a wild end-of-day plummet on Tuesday… a huge up day on Wednesday… and more bullish action today?

Tom Gentile writes: The biggest market drop in recorded history on Monday… a wild end-of-day plummet on Tuesday… a huge up day on Wednesday… and more bullish action today?

Talk about opportunity!

Right now, the only real barrier to trading profits is a stock that doesn't move.

So in times like this, I like to use a really great tool that identifies what I call my "Top Movers" – the stocks and ETFs that have had the biggest percent moves and best correlation to the market.

Then I can focus on finding the best stock with the best option trade and the best potential to double in value on the smallest move in the stock.

That's a lot of "bests."

This is a really simple tool, and I know you'll like it.

The Second-Biggest Obstacle to Options Profits

When trading options, time decay – the loss of value as expiration approaches – is the biggest obstacle to profits.

But the second-biggest obstacle is a stock that does not move.

You can do all your homework and make all the right moves, pick a solid stock with good fundamentals, even anticipate where the markets are going in the weeks ahead.

But if the underlying stock or ETF doesn't move, your options will simply waste away.

When the stock does not move, day after day, the time decay is even worse. You're not getting any stock price move that is either intrinsic to counter theta decay, or you're not getting any stock price move that gets your options close to "in the money" to get you that intrinsic value increase.

This is why I favor the "in the money" (ITM) options to begin with on my shorter-term directional long call or put option trades.

You can probably see where I'm going with this. The best way to avoid this is to trade calls and puts on stocks that move in price. You can see movement or volatility in price by looking at a chart. If a stock trades sideways in a range for three, six, or more months, that is not a stock to try and trade options on.

That's not to say you should avoid any stock that trades sideways. If that sideways range trades slightly up or down in trend but has a five-point range between support and resistance, then trading options on that stock becomes very lucrative indeed.

I am not a fan of going through all the "optionable" stocks one by one on a charting program. There are over 2,500 optionable stocks, and when you add in ETFs and indices, that number goes way up. Trying to go through them one by one will eventually drive you crazy.

Fortunately, I've developed a great method to whittle it down to the 10 best stocks at any given time.

How I Find My "Top Movers"

I run a scan that searches for what I call my "Top Movers." First, I look for only stocks with options that trade in penny increments, typically within a $0.05 bid/ask spread. That narrows it down to around 250 stocks in total.

You can find that list of stocks, called the "Penny Pilot" list, at the Chicago Board Options Exchange (CBOE) website:

Sifting through 250 stock charts looking for volatility is still a lot of work, so to cut that number down even further, I set my search parameters on that list in the following manner:

- Stocks over $100 per share

- Stocks that move an average of 1% a day between the high and low

- Stocks that correlate to the market, specifically the S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)

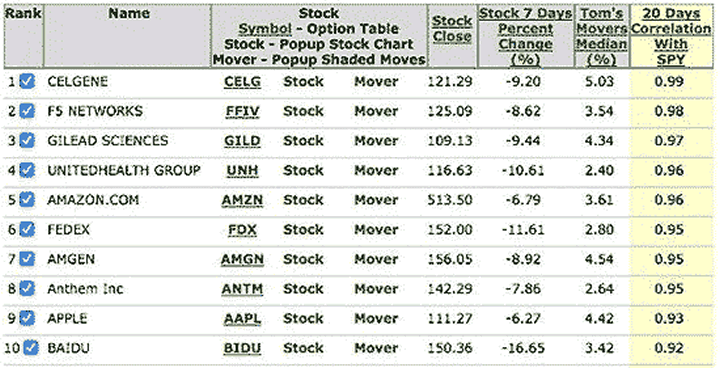

Here is a snapshot of the search results (taken Wednesday afternoon). These are stocks that meet the above criteria and have been on the move over the previous seven days.

Usually a few of the top spots will be ETFs, but here we have a solid collection of stocks, including…

- Celgene Corp. (Nasdaq: CELG),

- F5 Networks Inc. (Nasdaq: FFIV),

- Gilead Sciences Inc. (Nasdaq: GILD),

- UnitedHealth Group Inc. (NYSE: UNH),

- Amazon.com Inc. (Nasdaq: AMZN),

- FedEx Corp. (NYSE: FDX),

- Amgen Inc. (Nasdaq: AMGN),

- Anthem Inc. (NYSE: ANTM),

- Apple Inc. (Nasdaq: AAPL), and

- Baidu Inc. (Nasdaq ADR: BIDU).

The fifth column from the left shows the stocks' percentage move over the last seven days, and the seventh column shows how well the stock correlates to the SPDR S&P 500 ETF Trust, which is what I use to measure the markets over the last 20 days.

With those two numbers, you can figure out how well a stock moves, and if it's moving with or against the markets.

Once you have this list of stocks, you can run any number of screens and filters to assess which of these "Top Movers" would make the best option play.

For example, you can run a "percent to double" search on the stocks and see which one has an option that has the potential to double, then further analyze them to see which one requires the lowest percentage move in the stock price to double.

So from here, I can cross-reference this with my Money Calendar to find the best stock with the best option trade and the best potential to double in value on the smallest move in the stock!

Get Power Profit Trades Updates on These Plays and More

When you're using options, you've got to stay on top of the trade. So Tom is committed to regularly updating his Power Profit Trades readers on the latest high-profit opportunities each week. To get these updates and recommendations yourself, click here. You'll also get his latest investor briefing on how to double your money on Apple Inc.

Source http://moneymorning.com/2015/08/28/the-10-best-stocks-for-options-plays-in-this-market/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.