Gold: Bullish in Real Terms, Bearish in Nominal Terms

Commodities / Gold and Silver 2015 Aug 28, 2015 - 12:29 PM GMTBy: Jordan_Roy_Byrne

Last week when we covered rebound targets in the precious metals sector we also discussed the importance of Gold’s performance in real terms. It can be a leading indicator for the sector at key turning points. Since then precious metals sold off in aggressive fashion alongside global equity markets. However, Gold against equities gained materially. This is something to keep an eye on as it hints that a trend change is boiling under the surface.

Last week when we covered rebound targets in the precious metals sector we also discussed the importance of Gold’s performance in real terms. It can be a leading indicator for the sector at key turning points. Since then precious metals sold off in aggressive fashion alongside global equity markets. However, Gold against equities gained materially. This is something to keep an eye on as it hints that a trend change is boiling under the surface.

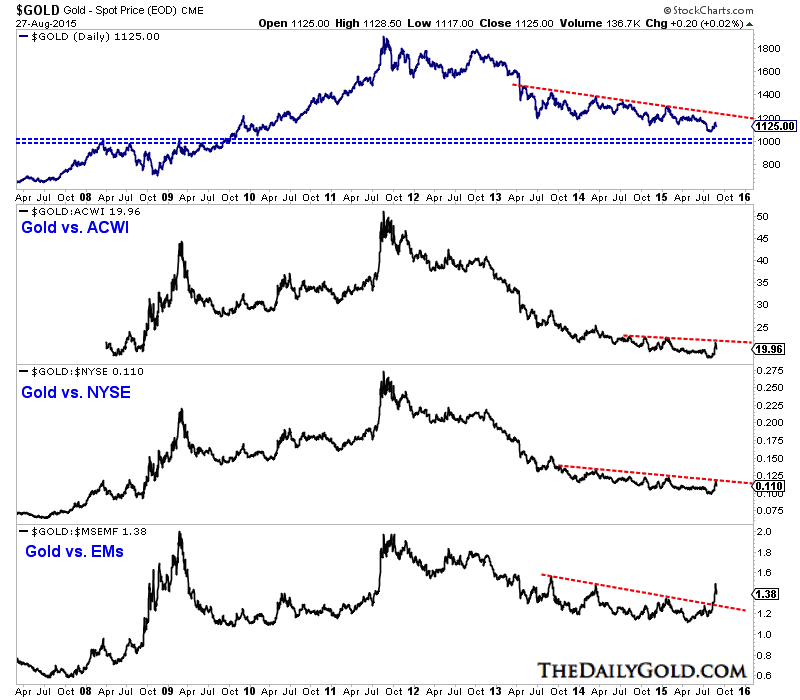

In the first chart we look at Gold in nominal terms and against various equity markets.

Gold has pulled back after its rebound from $1080/oz to $1160/oz. It has resistance at $1160 and $1180 and support at $1080 and around $1000. We continue to believe Gold’s most likely path is down to $1000/oz before the bear market ends.

Although Gold’s rebound from $1080 could be over, its outperformance of stocks could be starting. We plot Gold against the all-country index (ACWI), the NYSE and emerging markets. Gold relative to each market gained roughly 20% from the start of the month through Monday. Gold relative to emerging markets already broke out to a new high while relative to the others Gold tested important resistance.

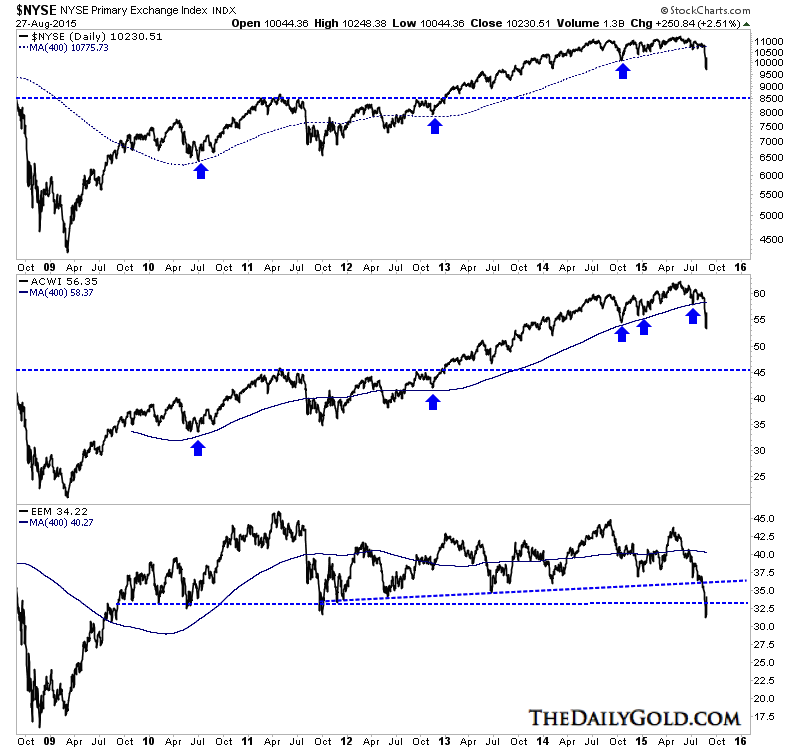

Gold Nominal & Real Terms

The equity markets have rebounded strongly this week but it is not much of a surprise given the previous sharp decline. We posted a chart a few days ago that argued for a bounce. The strong bounce over the past few days has not changed the broader technical condition which is negative.Below we plot the NYSE, ACWI and EEM with their 400-day moving averages. The first two lost the 400-dma only a few weeks ago. Each has rebounded but traders and investors should be advised that as the market nears previous resistance it becomes susceptible to another leg down. If new lows are on the horizon then we would turn our attention to NYSE 8500 and ACWI $46 which mark a confluence of strong support. Emerging markets have led this move lower and have more downside potential. If the US market has new lows ahead of it then EEM has downside risk to the low to mid $20s.

Gold breaking its downtrend against equities could be the last thing that needs to happen for its bear to turn to bull. Another move lower in equities could trigger that break. We’ve written about how Gold has already bottomed against foreign currencies and how it’s nearing an all time high against commodity prices. However, Gold relative to the equity market continued to decline and make new lows right alongside Gold in nominal terms. There has been a strong negative correlation for four years. The relationship as of a few weeks ago may have begun to shift in Gold’s favor. If that continues in the weeks and months ahead it certainly would have positive implications for precious metals and precious metals companies.

As we navigate the end of this bear market consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.