Fed Interest Rate Cuts Have Fed Food and Fuel Inflation

Interest-Rates / Money Supply Jun 23, 2008 - 01:10 AM GMTBy: Andy_Sutton

“Between a rock and a hard place” - Over the past few months, the US Federal Reserve, amid much fanfare, has lowered the benchmark interest rate from 5.25% to 2%. This loose policy was lauded by those in the financial media as being the right thing to do to prop up the economy, and banks in particular. Bernanke went from being the goat to the hero almost overnight. Rest easy folks, our Fed Chairman is on board; finally having gotten with the program.

“Between a rock and a hard place” - Over the past few months, the US Federal Reserve, amid much fanfare, has lowered the benchmark interest rate from 5.25% to 2%. This loose policy was lauded by those in the financial media as being the right thing to do to prop up the economy, and banks in particular. Bernanke went from being the goat to the hero almost overnight. Rest easy folks, our Fed Chairman is on board; finally having gotten with the program.

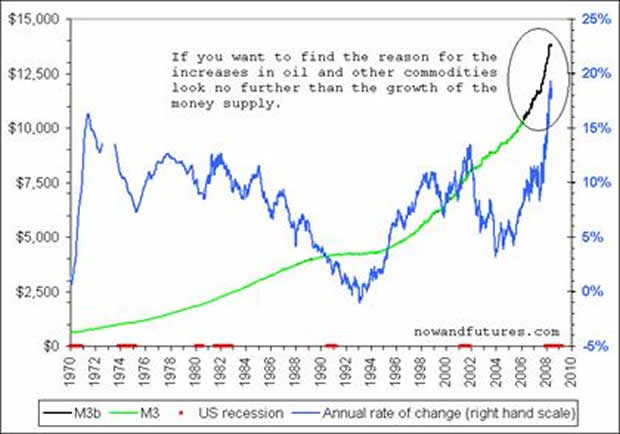

At the time, we discussed the obvious and perhaps unintended consequences of Bernanke's actions. On one hand, the Fed had to increase the money supply by leaps and bounds to drive their target rates lower; especially given the fact that banks were particularly loathe to lend, even to each other. This boost in the money supply has provided the fuel for the recent run up in food and fuel prices at the commodity level, and will begin to work its way through to producers and finally, consumers in the coming months. In the time since the official M3 numbers were discontinued in 2006, we have seen the total money supply grow by nearly 40%:

Much of this money has been created in the form of credit to either grease the wheels of our ‘borrow and spend' economy or provide vehicles to allow banks to offload worthless assets onto the Federal Reserve to prevent insolvency. That money has consequently been put to work in the real economy, translating into higher prices across the full spectrum of goods.

On the other hand, we have also talked about the moral hazards involved in bailing out bad behavior. Banks, mortgage brokers, and consumers alike have behaved in a fiscally irresponsible manner over the past 8 years, and bailing them out of their poor investments only guarantees more of the same behavior in the future.

However, a less understood and certainly less publicized consequence of these reckless policies is the impact that they have had on those inclined towards fiscal responsibility as well as those most susceptible to inflation; our nation's retirees. America 's savers and retirees have undergone a relentless onslaught over this past year.

Let's look for a minute at the timeline of since the explosion of the credit crisis from a couple of perspectives. As of last August, the typical 6-month CD was pulling 5.4%.

Over the next 7 months, that rate would be cut in half. This is important, because someone who bought such a CD in August of 2007 would have had it mature in this area of significantly lower rates and their rollover rate would have been significantly lower. It could not be avoided. During the same time, headline CPI surged at an annualized rate of 4.62%, making the real return on these investments negative. For example, a 6 month CD in March 2008 would yield 2.7% annually with an after-tax yield of 1.944% assuming a marginal tax rate of 28%. Discount the 1.944% by 4.62% for the increase in consumer prices (loss of purchasing power) and the real yield on that CD is negative 2.67%. Given what we know about the CPI, this real yield is in all likelihood much further in the negative.

A second popular area of investing for savers and fixed income individuals is bonds, particularly bonds issues of the US government as they are perceived to be ‘risk free'. Since August of last year, it has been a tale of two cities with regard to US Government bonds as is told by the 30-year US Treasury Bond Price chart:

And the corresponding yields on the 30-Year Bond:

The 30-Year Bond was chosen for this illustration because it typically provides the highest interest rate among the various maturities. Worth highlighting here is that while bond trading could have brought home some reasonable gains, this is not how the typical retiree or fixed-income investor operates. Depending how they have their funds organized, there are even restrictions that prevent them from taking advantage of certain types of market action. As a group, these folks generally buy bonds, bond funds, or CD's then collect the periodic disbursements using them to supplement Social Security, or pension income.

While those purchasing bonds now are seeing slightly higher yields, they still don't come close to covering the continued rise of consumer prices. These people have seen the purchasing power of their cash flows diminish before their very eyes as gas pump and grocery store prices have skyrocketed. In addition, healthcare costs; which are perhaps the retiree's biggest line item have soared as well. A double whammy is that their largest asset - their home - has seen its value decline over the past 18 months, restricting their ability to borrow against it or sell it to create a more favorable situation.

As real yields on historically safe investments have gone negative, savers and retirees alike have found themselves forced into the more volatile and risky world of the equity markets as they attempt to maintain pace with increasing prices. It is horribly ironic then to see the rude greeting they have received from the equity markets since the record highs of October 2007 as evidenced by the Wilshire 5000 US Stock Index:

So where do savers and retirees hide? The CD and Bond markets provide cash flows that aren't keeping up with inflation and the equity markets, at least for the short term are an unsettling proposition at best. A strategy we have embraced and executed for our clients at Sutton & Associates is first figuring out their personal CPI. Using this as a ‘target', we can then determine what investment classes are most likely to provide the returns necessary to maintain and grow purchasing power. Granted, there is no magic bullet for these new economic realities, but executing a carefully crafted strategy is much better than maintaining the status quo.

An age old economic axiom states that you always get more of what you subsidize and less of what you tax. Essentially, American savers and retirees are being taxed to pay for the excesses of both their neighbors and those on Wall Street. Unfortunately, because of their now minority status on the political/economic landscape, savers have little voice and their pockets are constantly picked to curry favor and buy votes. Savers are already on the endangered species list. Only through proactive strategies, further fiscal discipline, and ingenuity will they prevent extinction.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.