The Next Silver Bull Market May Have Already Started

Commodities / Gold and Silver 2015 Aug 07, 2015 - 08:41 PM GMTBy: Casey_Research

By Laurynas Vegys

By Laurynas Vegys

Silver is down 7.1% this year. Will this weakness persist? To find out, let’s look at the key factors in the silver market this year.

- Like gold, silver fell as the US dollar rose on the back of expectations that the Fed will hike rates.

- World demand for physical silver fell 4% in 2014, largely due to a record 19.5% drop in investment demand.

- Silver exchange-traded funds (ETFs) did not see big liquidations in 2014. ETF holdings grew by 1.4 million ounces and recorded their highest year-end level at 636 million ounces.

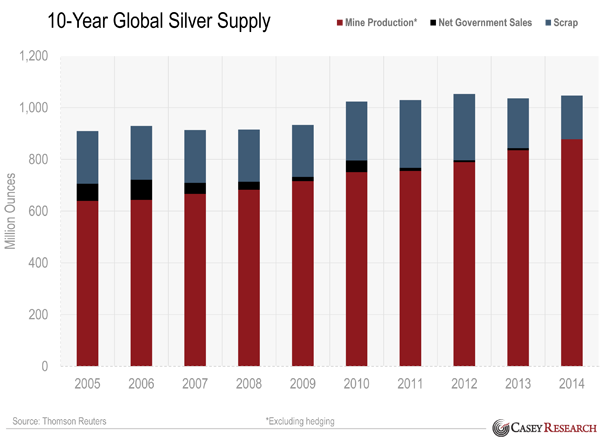

The first two factors helped push silver 19.9% lower last year. That’s more than gold or any other precious metal fell. Despite this, silver production rose 5% in 2014. That added to the pressure on prices.

Why did miners produce more silver when prices were falling? Because of:

- By-product metal. Around 75% of the silver mined is a by-product at gold or base metal mines. These producers will keep mining silver, almost regardless of price.

- Reduced cash costs. The primary silver producers have cut costs since they peaked in 2012. The main way miners do that is by boosting production to achieve economies of scale.

- Bull market hangover. Precious metals were in a major bull market from 2001 to 2011. Producers built a lot of mines in response. Nobody wants to pull the plug on a new mine that’s losing money if they think prices will go higher.

That’s the backdrop. Now let’s look at this year’s fundamentals.

Supply

Silver mine output has risen for 12 consecutive years (silver mine supply is a little different, due to hedging, but also trending upward). This year could break this trend. Industry experts at GFMS forecast up to a 4% decline in silver output in 2015.

Why? It’s not rocket science. There are now fewer major new mines under construction due to lower metals prices.

That leaves scrap supply. But scrap comes from jewelry, and sellers are price sensitive. People like to sell granny’s silver tea set when prices are up. We expect subdued scrap supply until silver heads much higher.

Demand

Investment demand - that’s us - is a big chunk of total silver demand: 18.4% as of the latest figures.

There was a big drop in investment demand last year: 19.5%. This tells us that most short-term investors and sellers have left the market. We don’t know any “silver bugs” who were selling. That means that today’s bullion is in stronger hands. And that means that any new buying will have a strong impact on prices.

But will there be buyers?

The Silver Institute expects more silver demand from investors this year. They say that the first half of 2015 sales of silver bars were the fifth highest on record.

Photovoltaics (PV) is another source of silver demand that many analysts expect to rise in 2015 and beyond. Global PV demand is set to increase by 30% in 2015, according to IHS analysts. China alone has plans to install 17 gigawatts of solar capacity by the end of the year.

The solar industry consumes a small amount of silver compared to jewelry and other electronics. Yet, if PV demand delivers in 2015, it will become the third-largest source of fabrication demand for silver.

Wildcard: Tesla plans to put batteries big enough to power a house in every home. What happens if that takes root is anyone’s guess… but it will be big. Really big. And the impact on demand for silver would be just as huge.

The Deficit

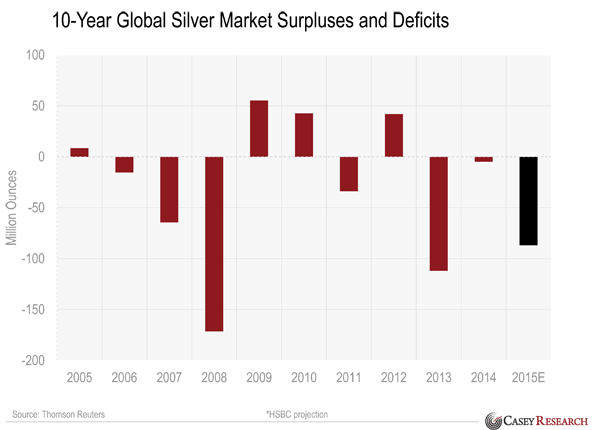

Silver supply went into deficit during much of the big run-up from 2001 to 2011. That may happen again. Silver Institute expects the silver supply deficit to grow to 57.7 million ounces in 2015. (Note that even if physical mine supply is up, net supply can be down if a lot of the mine supply was forward sold as hedges.) If the institute is right, it’ll be bullish for silver prices.

The Dollar and the Fed

We believe the dollar is grossly overvalued, and we are not alone. HSBC thinks the greenback’s rise since 2014 could be in its final stage. For the three months between April and June, the US dollar fell against every developed-market currency (save for the yen and the New Zealand dollar).

Many investors seem convinced that the Fed will raise interest as soon as September. We view this as unlikely at this stage. Yes, tightening US monetary policy would propel the dollar to new highs. But an even stronger dollar would mean slicing billions off the US GDP; not exactly a desirable situation from the standpoint of the Fed given the sluggish growth of the economy. We think the Fed could delay raising rates until 2016. It might even stop talking about rate hikes indefinitely. Each delay, the dollar will get whacked, and that’s good for precious metals.

On the other hand, if the Fed does nudge rates higher this year, it would likely dampen the stock market. That would increase demand for silver and gold. This could push silver prices much higher, given the small size of the market.

The Gold-Silver Ratio

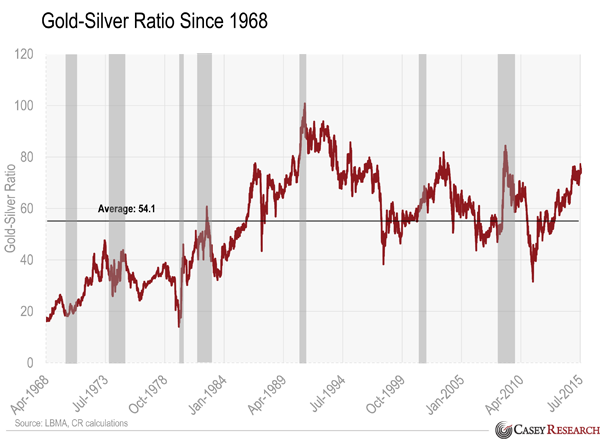

The gold-silver ratio (GSR) tells you how many ounces of silver you need to buy one ounce of gold. The record shows that the GSR often surges during a recession. (See the shaded areas on the chart below.)

Silver is about 17 times more abundant than gold in the earth’s crust. Silver and gold prices were close to this ratio for most of history. These facts make many investors think that the GSR should be 17-to-1 and that eventually it will be.

They may be right, but we’ve never found the GSR to be a strong predictor of gold or silver prices. To us, the GSR “suggests a lot but proves nothing.”

Conclusion

The fundamentals are positive for silver in 2015: less mine supply, and the healthy demand we already see is bullish. The greater demand that’s possible could create a real supply crunch. As a result, we expect silver to hold on throughout 2015 and perhaps even increase faster than gold, if the whole precious metals sector turns positive this year.

As for guessing the future, we have no crystal ball. We can say that Louis’ case for 2015 as a win-win year for silver is backed by the numbers.

P.S. If silver moves off its current level of $15 and into the $20 or $30 areas, silver investors could make large gains. But owners of a unique silver-related security could make gains that are five... 10... even 100 times greater. And right now is a once-in-a-decade chance to buy them very, very cheap.

Our friends at Casey Research are the world’s leading experts in this sector. And they’re EXTREMELY bullish on this rare opportunity. Read on here for details

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.