Top 6 Myths Driving Oil Prices Down

Commodities / Crude Oil Aug 04, 2015 - 12:06 PM GMTBy: OilPrice_Com

"Whoever would overthrow the liberty of a nation must begin by subduing the freeness of speech." ~ Benjamin Franklin, Silence Dogood, The Busy-Body, and Early Writings

I start with that quote because once the media, as well as politicians for that matter, have no accountability for actions or words then liberty will dissolve. Over the last few weeks I have witnessed another litany of lies that the media insists on putting forth. They come in the form of statements presented as facts to sway opinion while others are opinions quoted by others. Either way, the bias in talking down oil prices, reinforcing the "glut" that is fueled in part by misleading EIA and IEA data, is readily apparent.

Earlier in the year I documented half a dozen media reports which turned out to be 100 percent false. Now I expose another half dozen in just the past few weeks. Prices remain unchanged as a result of the largest drop in production in a year, as well as a large inventory draw this week via the EIA. The very fact that prices haven't responded demonstrates my points. This comes despite the dollar index (UUP) over the last month remaining essentially flat while USO has fallen over 15 percent (so much for that relationship, except when the dollar rises right?)...

Even at the time of this article the dollar index is down 1 percent yet oil is down as well.

Here is a list of the latest lies:

1. Iran Agreement to flood market. FALSE. OPEC has even stated that the natural 1.0 to 1.5 million barrels per day (MB/D) rise in demand in 2016 will more than offset any production rises in Iran which, contrary to earlier reports, won't come on line until early 2016. In addition, China will open up refining to third party, non-state-owned refineries which will reportedly add another 600,000 B/D in demand in 2016.

2. Iran floating storage will flood market. FALSE. As initially reported in the media, it was Iranian oil floating in storage but it now turns out to be low grade condensate as stated by PIRA on Bloomberg a few weeks back and then supported by tankers attempting to move inventory to Asia. Later media reports corrected earlier ones that the storage is in fact condensate while failing to report on its grade.

3. U.S. production resilient. FALSE. The latest EIA data refutes this as does data via EPS calls at Whiting Petroleum (WLL) & Hess Corporation (HES). Yes, some are increasing production such as Concho resources (CXO), but in the Bakken both companies confirm that 2H15 production will decline due to lower rigs and depletion. HES raised production for the year as a result of 1H15 production being higher than expected by some 5 percent. All in all, next week should see further production drops.

4. U.S. Inventory resilient. FALSE. EIA data would have fallen last week by some 4MB as it did this week ex import surges and continues to be overstated by "adjustments" made to production that amount to millions of barrels in daily production.

5. Cushing inventory fears revived. FALSE...see above.

6. OPEC supply will continue. The Saudis, as OPEC's largest producer and largest contributor to growth in 2015, have already stated that they will reduce output by 200,000-300,000 by summers end. Yes true, OPEC as an entity won't formally announce a cut but isn't it misleading to report this?

I should note that WLL also refuted Goldman Sachs' call that, at $60, U.S. production and rig count increases would resume. Before the most recent fall in oil, that call admittedly looked true as rigs did rise and Pioneer Natural Resources (PXD) was reportedly going to add 2 rigs a month until early 2016.

WLL, however, finally drew a line in the sand as they stated on their EPS call that they would not add a rig until 4-6 months after oil remained at $60 or better. PXD, if they are smart, will follow suit and, I suspect, the oil industry has finally come to realize that the "Trillion Dollar Swindle" in oil is very real and normal supply and demand dynamics no longer apply. The law of diminishing returns in more supply is real thanks to media hype.

Lastly, I wish to emphasize that freedom of speech not only comes as the freedom to express yourself, as I am doing here now, as others have done freely in the media, presenting both bullish and bearish cases. However, the number of statements that have been proven false and not retracted, as well as the obvious bias should raise serious questions about the role of media in the current oil bust. Which industry will be under attack next?

Meanwhile, an industry which by simple math cannot generate free cash flow (FCF) on $100 oil is disintegrating before our eyes, with millions affected by the fallout. Targeting individuals has become a regular theme in the media but now it appears to have moved to certain industries.

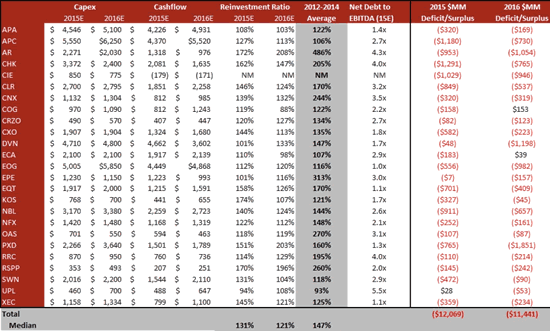

Below demonstrates that even on $100 oil shale isn't self-sustainable on a FCF basis, never mind $50 oil.

Below is the estimated CF deficits for 2016 according to Jefferies with hedges:

How one on the sell side or media can argue for even lower oil to balance the market demonstrates the lack of detailed research and understanding of shale economics.

Source: http://oilprice.com/Energy/Oil-Prices/Top-6-Myths-Driving-Oil-Prices-Down.html

By Leonard Brecken of Oilprice.com

© 2015 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.