Stock Market Critical Week Ahead

Stock-Markets / Stock Markets 2015 Aug 03, 2015 - 10:32 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

Intermediate trend – SPX may have started an intermediate correction

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

A CRITICAL WEEK AHEAD

Market Overview

We are quickly approaching the time frame when SPX must confirm that it is capable of making a new high. Friday’s inability to extend its current uptrend decisively was already a big negative. Next week, it will have a final chance to redeem itself with some positive action which can begin to erase the negativity displayed not only on Friday, but for the past few weeks…

NASDAQ and SPX are the only two major indices which are still behaving relatively well, and SPX is quickly losing it! Of the others, the DOW Composite was the first to establish a downtrend. The DJIA may have joined it last week, and the New York Composite Index is not far behind. In the face of this showing, SPX might find it easier to join the crowd than to go against it. Even the NASDAQ looks as if it just made a buying climax! OH, I forgot! IWM and MID are not looking so hot, either.

As you can see, it’s not just SPX that has work to do to turn positive, it’s the whole caboodle!

Indicators Survey

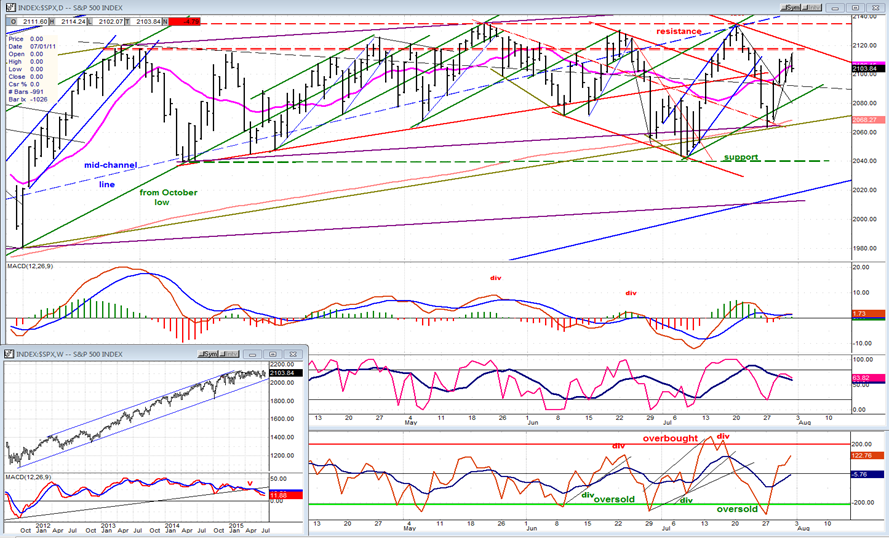

Since the Weekly SPX MACD broke its uptrend line from October 2011, it has been in a steady decline and it is getting closer and closer to going negative. When it does, it will be the final nail in the coffin to confirm that the index is in an intermediate downtrend. The DOW Comp’s already went negative several weeks ago, and DJIA’s is closer to the zero line than SPX.

The daily indicators all bounced with the rally but are beginning to roll over.

This is a quiz: can you find the current rally in the summation index (courtesy of MarketCharts.com)? Enough said!

“The 1X P&F filled a phase projection to 2078 on Friday, but the top distribution pattern has potential lower counts.” Until the 2132 top is surpassed, those lower counts are still in effect. The current pattern of distribution may be in the process of confirming the lower targets.

The 3X3 chart went from 2055 to 2130 without a single reversal. It also came back down to 2064 without a reversal. First time since I have been keeping this chart (about 4 years) that I have seen this kind of volatility!

Chart Analysis

- The Daily SPX (chart courtesy of QCharts.com as others below) is trying to establish a downtrend, but it has not quite succeeded yet. Next week should be its chance to prove that this is what it is doing. The lower lows are already in place (connected by a red trend line) and all we need is for the current rally to fail at or below the top red parallel, and for prices to head south again. This would set up another attempt at breaking through the 200-DMA. It has already been tested twice and you know what they say about the third time!

- The sideways move for the past several months has created a strong resistance zone at the top and support at the 2040 level. For a trend of larger duration to take hold, the index would have to penetrate one or the other and keep on going. My bet is that, for the foreseeable future, breaking support has much better odds than overcoming resistance.

- The insert of the weekly chart shows how, after a long period of deceleration and negative divergence, the MACD has declined steadily since it broke its uptrend line. It would take strong and sustained market positives to reverse that trend. The daily momentum indicators started to roll over after the price stalled just below the resistance level. The A/D indicator is still moving up, suggesting that a little more distribution might have to take place at this level before the start of a downtrend.

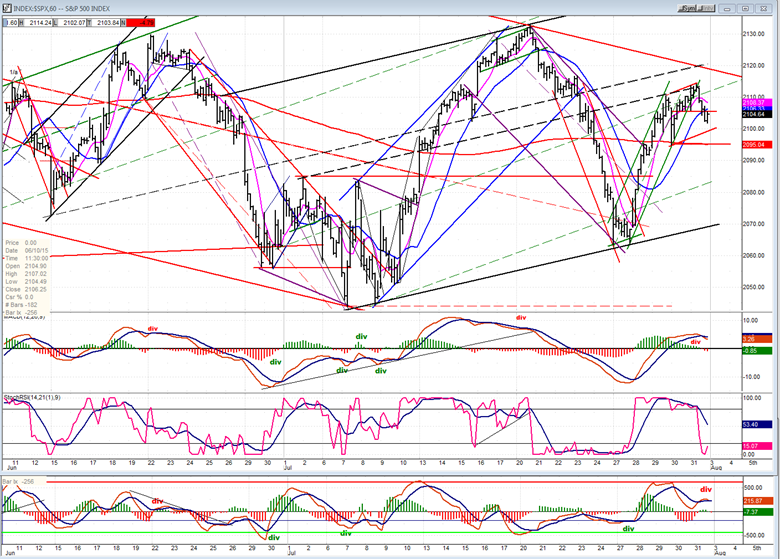

- The Hourly chart shows that the index, which has been in a low grade uptrend since early July, seems to be running into some resistance just above the mid-channel line. The red line above is a tentatively drawn channel line which is a parallel to the one connecting the last two lows (you can see this better the daily chart above). If SPX fails to rise above that line, it will have taken another step towards confirming that it is establishing a downtrend; and if it breaks below the recent low of 2064, it will be one more and final step.

- In order to suggest that it has started another challenge of the highs, strong buying must start right away or after a minor pull-back. Since the SRSI has already given a sell signal and the other two oscillators have already started to turn, these are signs that the upside momentum has already been arrested.

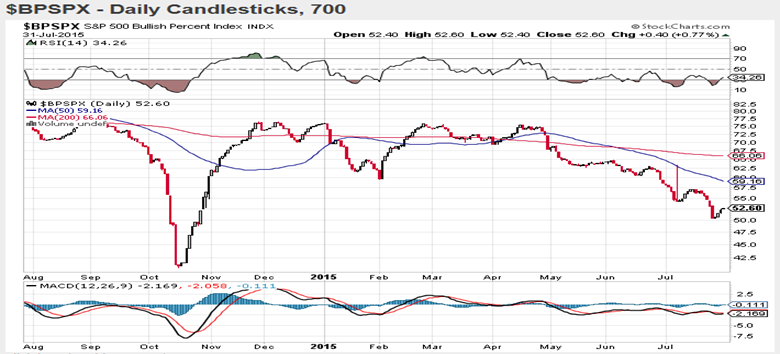

The following two charts are very revealing when compared with their respective index charts. To begin with, they are both relatively much weaker. Also, BPNDX has shown more weakness than BPSPX since May, even though the NDX has been the strongest index among all those which make up the entire stock market. What is made obvious is that these two indices are distorted by the performance of a few high price stocks while a good percentage of their stocks are already correcting.

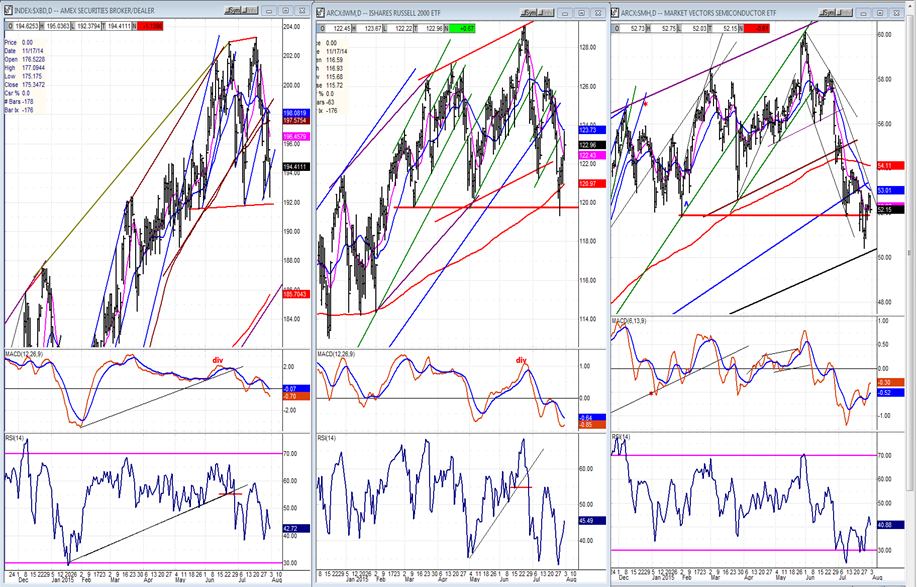

XBD -- IWM – SMH

As I have mentioned several times, these three indices are supposed to be market leaders and it looks as if they are just beginning to lead the market on the downside – at least IWM and SMH are. All three are showing recent negative relative strength to SPX in increasing order of weakness from left to right.

UUP (dollar ETF)

On Friday, UUP looked as if it were desperately trying to avoid another down leg in its consolidation pattern. If it cannot follow through on the upside early next week, it may have to continue the corrective pattern which started after the March top. If so, this could have some implications for the next two indices. Both tend to run contrary to the dollar.

GLD (Gold trust)

The start of a correction in UUP could be especially beneficial to GLD which has arrived at a cycle low and looks ready to bounce up. Notice the similarity between the current price pattern and the condition of the oscillators, and that of the two former short-term lows.

A short phase count on the P&F chart 104 (which GLD has now touched twice) seems to have halted the current decline of GLD. The total count is 100-101, but that may not prevent an oversold GLD to have a bounce to 107-108 before reaching that lower target. It would be even better if it retraced one more time to 104; but considering the position of the indicators which have already turned, the price could follow at any time.

USO (US Oil Fund)

USO is also in a position to benefit from a retracement in the dollar to halt its decline in the vicinity of its former low. It’s less than a point away from a phase projection of 15.

Summary

My last newsletter was entitled “BULLS BEWARE”! In the above analysis, I have attempted to show that in spite of last week’s rally, nothing has really changed and time is running out for the bulls to show that they have the wherewithal to take the SPX to a new high. If they can’t, it is likely that the bears will have won the tug-o-war that has been on-going for the past 5 months!

AndreFREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.