The Most Pressing Reason Yet You Want to Avoid Investing in Retail Stocks

Companies / Retail Sector Jul 04, 2015 - 01:24 PM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes:President Obama announced last week that he’s directing the Department of Labor to mandate higher overtime pay for anybody making $50,400 or less per year. Coupled with rising minimum wage standards, that’s given many people reason to cheer.

Keith Fitz-Gerald writes:President Obama announced last week that he’s directing the Department of Labor to mandate higher overtime pay for anybody making $50,400 or less per year. Coupled with rising minimum wage standards, that’s given many people reason to cheer.

Yet, this is absolutely the last thing you want to see as an investor.

To be clear, I think anybody who wants a job should have one and that it should pay well. So let’s get that off the table right away.

What matters here is that the President’s actions just doomed millions of hardworking Americans to the unemployment line and, at the same time, just made it harder for every retailer – large and small – to turn a profit.

It’s the latest in a long line of reasons why every investor should think twice about holding retail stocks.

The Government’s Latest Rule by Fiat Targets Five Million Workers

Last Monday President Obama announced via the Huffington Post that he’s directing the Department of Labor to raise the standard for overtime pay to anyone making $50,400 or less per year.

What that means is that every salaried individual in that wage range will now receive 50% more pay each hour for every hour beyond 40 they work each week.

Currently, the bar for overtime pay for salaried workers is set at $23,600, targeting mainly workers who are receiving minimum wage or close to it.

Under the old rules, for example, someone making $15/hour on a 40-hour week would earn $30,000 a year, making them exempt from overtime pay. But if they work 55 hours a week like many store and restaurant managers, they’ll now be entitled to an additional $337.5/week, or a 56% pay raise.

It’s been estimated that five million workers will receive a bigger paycheck as a result.

As always, though, there’s a fly in the ointment.

When You Tax Employment, You Get Less of It

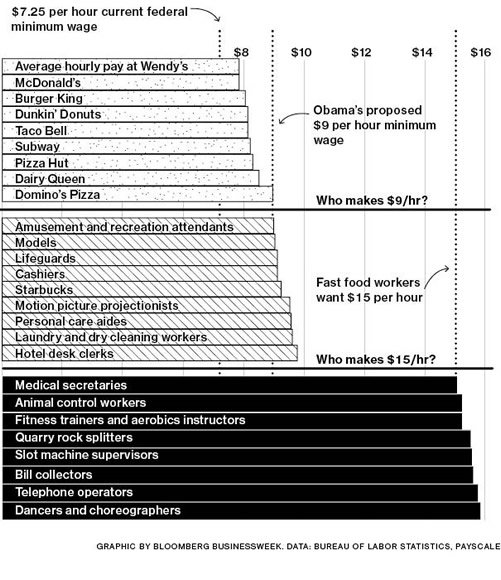

President Obama believes that a nation-wide minimum wage hike in this country is long overdue. Unable to get Congress to take legislative action on his call to raise the minimum wage from $7.25/hr to $10.10/hr, he’s turned to executive action. That’s because massively expanding overtime pay is the closest President Obama can come to making his minimum wage hike happen without Congress.

But, he might want to listen to what Congress has to say on this matter.

The Congressional Budget Office analyzed the effects of the minimum wage hike the President proposed, and found that 24.5 million workers would get a wage increase. At the same time, 500,000 workers would see their jobs vaporize once their labor became too expensive for their employers to afford.

Put bluntly, this means that for every 49 workers who see their pay go up, one American worker will see his or her paycheck go to zero.

You could argue like many proponents do that this is an acceptable situation, but it’s actually only the tip of the proverbial iceberg.

No Government Mandate Can Keep Down the Overtime Regulation’s Inflationary Impact

In 2013, economist Arindrajat Dube, Assistant Professor of Economics at the University of Massachusetts, testified before Congress in favor of a minimum wage hike. He argued it was overdue thanks to increases in worker productivity.

He also acknowledged that a 10% increase in minimum wage could be linked to a 0.7% increase in prices. On the surface, that sounds great. Who wouldn’t like wages to grow 10x faster than prices?

Unfortunately, you cannot outrun the math.

What the President and proponents of the hike are missing is that companies will only stand for a 50% increase in labor costs only so long. They’ll shift the burden to consumers – including the very workers that these wage hikes are supposed to benefit.

Here’s an example that may help put this in perspective, albeit a very simple one.

Let’s say ABC makes a widget they sell for $15. Approximately $5 is labor and $5 is materials. That means they’re bringing $5 to the bottom line.

If you bump wages up to $8 an hour and keep materials the same that means the company’s profit just dropped to $2.

Many people don’t believe there’s anything wrong with this. Those corporations already make too much money, goes the reasoning.

In reality, they don’t make that much money.

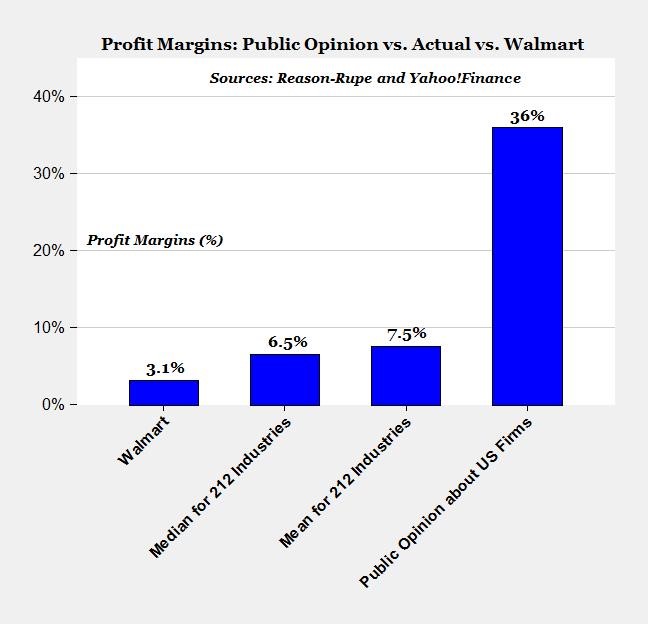

Most Americans believe that corporate profit margins are around 36%, when in reality the real numbers are between 6.5% and 7.5%, according to YahooFinance.com and Professor Mark J. Perry, Professor of Economics at University of Michigan.

That means thousands of companies employing millions of Americans are at risk with restaurants and retailers at the top of the list because labor in those businesses can account for nearly 50% of operating costs.

Here’s what you need to know:

- Companies will only absorb higher costs for so long. They are in business to profit and will raise prices to compensate, which means that the cost of anything requiring minimum wage production and/or overtime goes up.

- Growing revenues drive earnings which, in turn, ultimately translate into higher stock prices. Anything that interferes with that equation (like mandated higher wages) puts your retirement at risk.

- Periods of falling margins coincide with falling markets. For example, profit margins fell from an average of 7.1% to 4.6% from 1965 to 1970 and the S&P 500 went nowhere during that time frame according to Barrons. Margins crested at 10.1% in 2006 only to fall by half in 2008 even as the stock markets lost nearly 50% of their value and trillions of dollars in hard earned savings vanished.

Put simply, higher wages are not the “wash” that many people think.

Instead, they’re an unmitigated loss because the higher wages everybody thinks are so great are really an instant and hard-hitting tax workers and consumers alike will feel every day. Instead of helping, it will in fact rob them of purchasing power and diminish their savings by making everything more expensive over time.

Retail is Especially Vulnerable to Unforeseen Consequences

That’s why the National Restaurant Association came out strongly against the proposed overtime rules last fall.

This makes sense if you think about it. Wendy’s, for example, has a profit margin of just 5.12% and any hike in wages will result in a corresponding offset to consumers and a bottom line hit to earnings.

Restaurant chains that already have low profit margins like Wendy’s could be especially hard hit.

McDonald’s won’t fare much better. Bloomberg Business suggests that the price of a Big Mac will rise by $1 or about 25% to compensate. That’s going to send price-conscious consumers somewhere else at a time when the chain is desperately trying to reclaim its place in the fast-food arena. Anybody who owns Mickey D’s stock is at risk of losing big time.

Wal-Mart is in much the same boat.

The company proactively raised its minimum wage to $9 in an attempt to get ahead of the legislative 8-ball and curry goodwill. Now, they’re going to be stuck paying time and a half on wages they’ve already increased 19%!

Literally thousands of companies are going to suffer and if you’re investing in them, you’re going to get caught, too.

Fortunately, there is a way around all this.

By investing in high margin companies like Apple Inc. (NasdaqGS:AAPL) and Google Inc. (NasdaqGS:GOOG) or any of the other companies we talk about frequently, you are immediately gaining the protection that comes with higher margins that are less susceptible to this kind of government mandate. Further, and perhaps most importantly, you are pursuing the growth that comes with each of our Unstoppable Trends, every one of which is backed by trillions of dollars in spending the world can’t live without.

In closing, let me re-emphasize that I’m not against higher wages when they happen for the right reasons.

I say that because higher wages are the inevitable outcome of a brightening economy, companies that compete for talent, and a vibrant consumer motivated to spend money because his or her quality of life is getting better.

Not government policy.

Until next time,

Keith

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.