Why Buffett Bet A Billion On Solar Energy

Commodities / Solar Energy Jun 26, 2015 - 09:14 AM GMTBy: OilPrice_Com

Miles Per Acre Per Year

Miles Per Acre Per Year

During the late innings of the ICE-age (as in the Internal Combustion Engine age) it has become clear that feeding gasoline and diesel to the next billion new cars is not going to be easy, or cheap. In China alone, 500 million new vehicles can be expected to jam the roads between now and 2030.

That may sound far-fetched but considering annual sales have already made it to 25 million units per year (vs. around 17 million in the U.S. – China became the top market in 2009), it only requires a 4 percent growth rate to reach that target in fifteen years.

The cost to operate an EV, per mile, is already well below the cost to drive a standard ICE-age model, and the advantage is likely to widen. The average U.S. residential customer pays 12 cents per kilowatt-hour (kWh), which means the cost to drive one mile in an EV is somewhat less than 4 cents. By contrast, at 25 miles per $3 gallon of gasoline, those miles cost 12 cents each.

Coal still supplies more power in the U.S. than anything else, with natural gas next. However, building more coal and gas power plants to make miles for transport is counter-productive if the game plan is to reduce carbon output.

Fortunately, abundant renewable power, is getting cheaper, while gasoline from finite fossil fuels may get more expensive. (Even after the fall in U.S. crude, gasoline in California costs $4 on average. At that price, California miles are 16 cents each. If you drive an SUV in Southern California those miles cost over 30 cents each.)

Even though not all renewables are created equal, power purchase agreements (PPAs) for PV projects with utilities in the U.S. Southwest are now coming in under seven cents per kWh for a twenty year period. At that rate, the cost to operate an electric vehicle is 2 cents per mile. Hydropower in Seattle will push you around for the same price. The first ‘eye-opener’ for large scale solar was the Austin Energy PPA last year that was priced at 5 cents. What this country needed was a good 5-cent kWh, and now we have it.

It is generous to say that an acre of Iowa can provide 12,500 miles per year at a cost of 10 cents each. (Average fuel efficiency in the U.S. is 22 miles per gallon (mpg). New cars in 2015 get 25 mpg.) An acre of corn that provides 500 gallons of ethanol, at 22 mpg, gives you 11,000 miles, or would, if such gallons had the same energy content as a gallon of gasoline.

Unfortunately, they don’t. Ethanol packs about 70 percent of the punch of gasoline, so you actually need 1.4 gallons of ethanol to get you as far as a gallon of gas. (Instead of 11,000 miles per acre for the average 22 mpg model, the figure drops to 7,850 miles per acre per year.)

But suppose your new car is up to current Chinese standards (~35 mpg). In that case, Iowa’s acres provide 12,500 miles in a year (17,500/1.4). This is still roughly two orders of magnitude less output per acre than Warren Buffett’s Agua Caliente array in Arizona. No wonder Berkshire Hathaway has already bet a billion on PV arrays. One could say that Mr. Buffett has not only seen the light but invested heavily therein.

Sunrise in the Desert

An acre of desert in Arizona, Nevada and many other places on earth ‘sees’ on the order of 3,000 hours of direct sun per year. (This amounts to 34 percent of the total 8,765 hours available, half being dark.) PV arrays on a house are spaced closely together and it is reasonable to figure 250 kilowatts (kW) per acre of aggregated rooftops. However, it costs more to build an acre of rooftop PV. On the ground the figure is closer to 150 kW per acre.

The biggest difference between rooftop and most of the utility scale arrays yet to be built is that it makes sense, when possible, to track the sun. Since not everyone can afford to build houses that track the sun, let’s just assume that all residential rooftop arrays will be fixed. In the commercial sector, and in the case of community solar, there is more flexibility and tracking arrays may make sense, especially when mounted on the ground.

The arithmetic is pretty simple. You get about 20 percent more yield by tracking the sun. A rooftop array is pointed directly at the sun (known as direct normal irradiance) only for a short while each day, assuming the roof pitch is right, and most aren’t. If it costs 1o percent more to get that 20 percent extra yield, do it.

Critics will say that more structure and added tracking motors and mechanisms will add to the chance of system failure. This, however, is a fallacy. Consider the venerable oil drilling donkey, which cycles once every 7 or 8 seconds. At this rate (480 cycles per hour, and 11,520 cycles per day), these ancient and effective oil rigs cycle more in a day than a tracking PV array in its 30-year lifetime. (365.25 days x 30 years = 10,957 cycles.)

An acre of desert PV will easily yield 300,000 kWh (150 kW per acre x 2,000 hours of direct normal sun) and a million miles per year for an EV. Since 2,500 to 3,000 hours are available in many places, the figure jumps to between 375,000 and 450,000 kWh per year, yielding between 1.25 million and 1.5 million miles per acre per year.

In other words, the output from (more expensive) ethanol is little more than a rounding error compared to the output from PV. The choice is between a million miles per acre per year, costing 2 to 4 cents each from the sun, or 10,000 miles per year costing 12 to 20 cents from a cornfield that would be better served making food.

Even if the figures were more supportive of the ethanol case, biomass in general does not scale very well. Silicon based PV, on the other hand, is hugely scalable and relatively cheap. It really isn’t a fair fight.

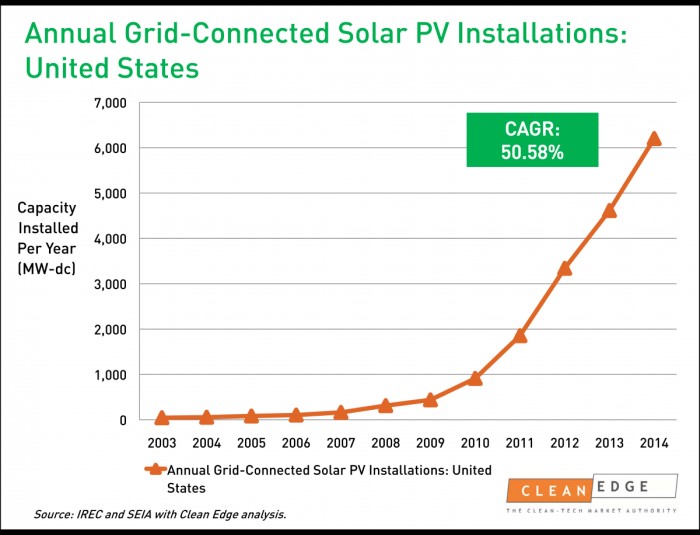

Image URL: http://cdn.oilprice.com/images/tinymce/HHelecgen1%20-%20copia.jpg

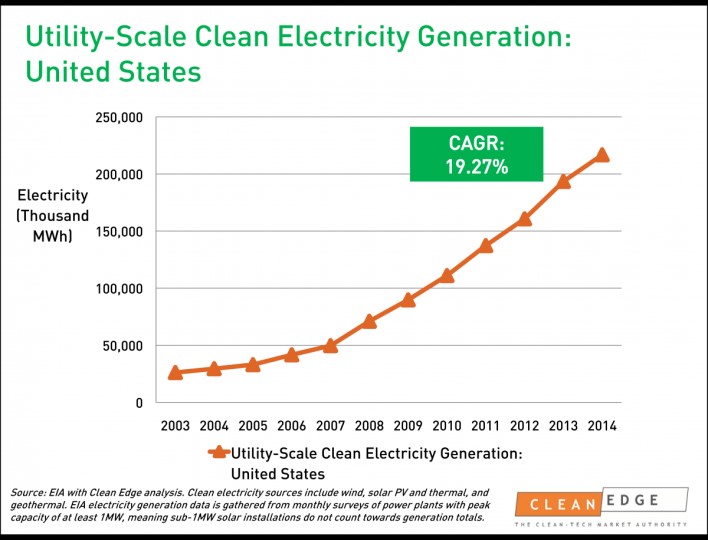

Image URL: http://cdn.oilprice.com/images/tinymce/hhelecgen2%20-%20copia.jpg

The calculation for rooftop solar is not quite as straightforward as multiplying the number of kilowatts by the number of hours of sun in a year. NREL has done the math on how many kWh you get from a fixed (non-tracking) array per day from a square meter depending upon location. It is roughly the measure of how many hours per day the panels will produce peak power. The US average is around four hours which means that,

For an individual homeowner, a 3-kW PV system in a less than arid region will still yield 4,000 kWh (3 kW x 4 hours x 365 days) and enough EV miles to cover the average annual 12,000 – 15,000 miles of commuting. Even at 15 cents per solar kWh (and, as mentioned, many PPAs are coming in at half that figure or less), you will save about 10 cents per mile over the gasoline price. The 5-year fuel savings will pay for a 3-kW system.

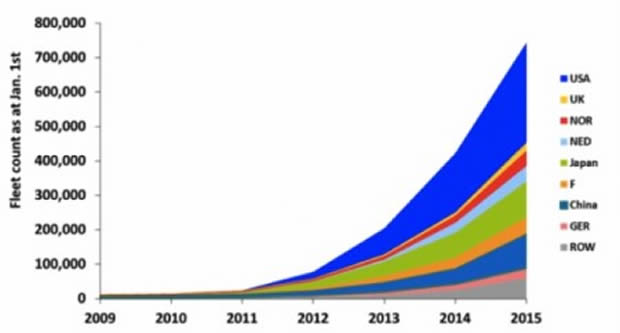

Chevron, ExxonMobil and Shell cannot stop this; they will begin to bleed trillions of miles per year. They had better think seriously about financing solar and wind arrays. The estimated one million EVs on world roads by the end of this year will cover roughly 10 billion miles per year, and over 100 million miles over their lifetime. What will ExxonMobil’s share price be when cumulative EV sales reach 100 million units?

EV Sales Worldwide (740,000 units)

Image URL: http://cdn.oilprice.com/images/tinymce/hhelecgen3.jpg

By 2030, millions of people will have transport fuel that is ‘on the house.’ During the midday hours, many grids will experience negative pricing as solar PV floods the market to the extent that the power cannot be stored. As millions of EVs hit the road, four percent of the time, on average (the rest of the time they are in a garage or parked on the street), they will likely become the default destination for stored electricity.

When there are 100 million EVs, figuring 60 kWh batteries, the fleet will provide 6 terawatt-hours of storage, enough to run the U.S. (with 1,000 GW, or 1 Terawatt, of power capacity) at peak power for six hours, or the world (with 5 Terawatts of capacity ) for over an hour. If all the cars sold in the U.S. this year were electric, their battery capacity would be sufficient to power the country for an hour (17 million vehicles x 60 kWh). How many gigafactories will Mr. Musk have to build?

Source: http://oilprice.com/Energy/Energy-General/Why-Buffett-Bet-A-Billion-On-Solar.html

By Henry Hewitt for Oilprice.com

© 2015 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.