Euro Bourses and Euro Currency's Inverse Relation Still In Play

Currencies / Euro Jun 23, 2015 - 04:25 PM GMTBy: Ashraf_Laidi

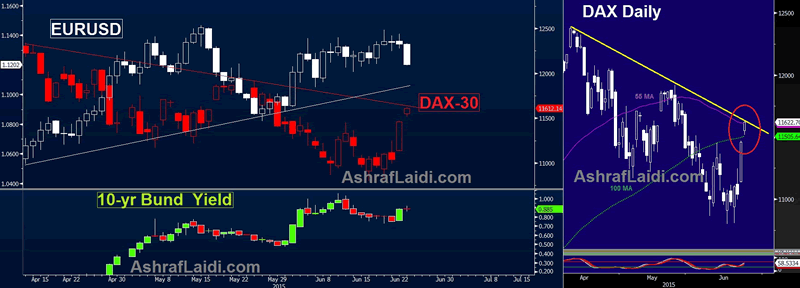

The euro-Dax-bunds relationship continues in full swing, led by a rallying Dax (and rest of Eurozone bourses) resulting from the most notable steps taken by Greece towards reaching a deal with creditors in four months.

The euro's initial rally to $1.1410 following yesterday's comments from EU's JC Juncker indicating Athens' proposal was an important step forward, but later gave up gains as other EU officials as well as IMF's Lagarde indicated that much progress remained and no agreement could be finalised ironed out by Wednesday's summit. Bourses continued to rally but the euro ignored strong June flash Eurozone PMIs and weaker than expected US May durable goods orders due two possible reasons:

-

Further diminishing of Greece Risk supports European stocks, while returns the euro to its previous role as a funding currency for higher yielding bets (equities, corporate bonds and currencies).

-

Continued ECB purchases of Eurozone bonds keep euro under pressure to the benefit of already bolstered German equities/economy as fund managers return to hedging euro exposure by selling euro forward contracts.

10-year bund yields are modestly lower, but this is unlikely to last if Eurozone indicators remains on the rise and if optimism in Eurozone stocks and macro data translates into a more rapid normalisation of Eurozone inflation especially as the ECB keeps EUR60 bn monthly purchases on autopilot.

Yet, the more pressing relation remains between stocks and the euro. As the DAX-30 and Eurostoxx break out of their April trendline resistance, coinciding with a double breakout above their 55 and 100 day moving averages, then the potential for further gains could weigh on the single currency towards key support of 1.1080s. One exception to this assessment would be renewed gains in bund yields relative to their US counterpart.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.