Public Pensions: Live and Let Die

Politics / Pensions & Retirement Jun 22, 2015 - 08:05 AM GMTBy: John_Mauldin

When you were young and your heart was an open book

When you were young and your heart was an open book

You used to say live and let live…

But if this ever-changing world in which we're living

Makes you give in and cry… Say live and let die.

– Paul McCartney, the Bond movie theme, performed by Wings

I am not sure if my heart was ever that much of an open book, but I like to think I’m still relatively young. Nevertheless, I must admit that sometimes I want to “give in and cry.” This is especially so when I look at our nation’s public pension funds.

It’s not as if no one saw the problem coming. Experts, including your humble analyst, have been harping on it for decades. Politicians at all levels of government knew very well that a train wreck was inevitable and still did nothing. In some places, like Illinois, the politicians actually did something worse than nothing: they bought votes with promises of future benefits. Even worse, many states had their pension funds sell bonds, thinking they would be able to profit on the difference. Then along came the Great Recession. Oops. Stellar timing.

Now the future is here. Where are the benefits?

In this week’s letter we’re going to return to the worsening problem of public pensions. I offer an analogy between what is happening in Greece today and what will soon happen in Illinois. There are no easy solutions when you kick the can down the road, as politicians are going to find out.

Ten years ago this week my topic was “Public Pensions, Public Disasters.” Here is how I started this letter on June 17, 2005:

This week we will look with fresh eyes at an old problem: US pension funds, both public and private, are underfunded; and the situation is getting worse. And the US taxpayer is going to get to fund the difference. The recent slew of data on pension funds suggests that little is being done to correct the huge and mounting problems I have written about for years. Even the recent market upturns of the past few years have not been as big a help as they should have been.

I doubt anyone would have noticed had I led with that same paragraph today. Every word is just as true now as it was then.

- Pensions are still underfunded.

- The situation is still generally getting worse (with some exceptions, thankfully).

- Taxpayers are still going to fund the difference.

- Recent market upturns have helped some, but not as much as you might think.

I’ve visited the topic of pensions repeatedly over the years. Some of my headlines are darkly amusing in hindsight:

How Not to Run a Pension (my personal favorite)

Why have we not hit the wall yet? In that 2005 letter, I wrote this, referring to corporate pensions:

Let's look at a typical 60% stock, 40% bond asset allocation mix. Let's generously assume you can make 5% annualized on your 40% bond portfolio allocation in the next ten years. That means to get your 8% (assuming a lower average target) you must get 10% on your stock portfolio. Now, about 2% of that can come from dividends. That means the rest must come from capital appreciation.

Hello, Dow 22,000 in 2015. Care to make that bet with me? But pension plan managers are doing precisely that.

Here we are in 2015, and the Dow is at 18,115, not 22,000. The 10-year average annual total return (including dividends) in the SPDR Dow Jones Industrial Average ETF (DIA) was 7.99% as of 3/31/15. Stocks lagged about 2% per year behind what I thought pensions needed to see.

If stock performance didn’t bail out pensions, what about bonds? Was assuming a 5% annualized return back in 2005 a good move?

Actually, it was. The iShares Core US Aggregate Bond ETF (AGG) had a 4.77% 10-year average annual total return through 3/31/15. If you focused just on government bonds with the iShares 20+ Year Treasury Bond ETF (TLT), you had an average annual total return of 7.93%. However, you have to realize that the majority of those returns were capital gains and not actual interest income. Since rates really can’t drop all that much from here, and we are in a low-interest-rate environment for the foreseeable future, those types of returns are not going to happen in the next 10 years.

So, a balanced pension fund would have done better than expected in bonds, almost enough to offset the worse-than-expected return in stocks. That bought some time, assuming that the politicians provided the necessary contributions. As we will see, in many states they did not, so things have gotten decidedly worse even as the market has risen.

It is not the case that all pension funds stayed balanced for the whole decade. We had some severe bumps in 2008-2009. More than a few pension managers tweaked their strategies in response. Adding alternative investments to the mix has been a popular enhancement. The degree to which they enhanced your performance depends almost entirely on the alternative managers you picked. And if you were picking by means of hindsight, relying on past performance, you probably didn’t pick good managers for the recent environment.

So, to generalize, most pensions had “OK” investment returns in the last ten years but not enough to catch up without increasing contributions from governments, which in the main did not happen. However, those returns at least kept them on an even keel. Until the next recession, that is. But the modest performance managers eked out most certainly did not give legislators the luxury of promising even higher benefits to their retirees. But – you guessed it – many politicians made those promises anyway.

Spending Money You Don’t Have on Promises You Can’t Keep

Unless you are a national government and can print your own currency, and with enough effective means to discourage would-be foreclosure, you can run a spending deficit for only so long. Greece is presently learning this the hard way.

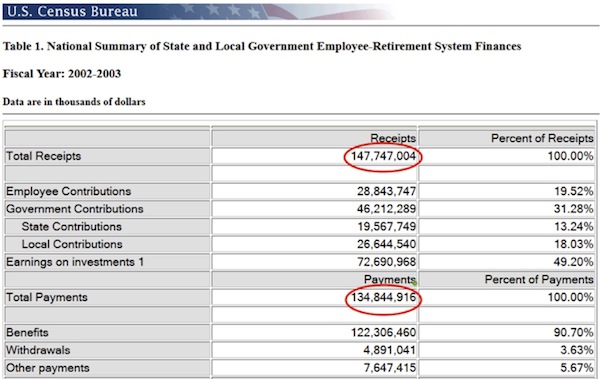

State and local governments in the United States must, by law (with the rare exception), somehow balance their budgets. So must their pension plans. As of ten years ago, they were generally succeeding. Here is Census Bureau data for FY 2002-2003:

Source: https://www.census.gov/govs/retire/ret03t1.html

State and local pensions had total receipts of $147.7 billion that year and total payments of $134.8 billion. This is aggregate data, so any given plan might have done better or worse. Still, the overall picture doesn’t appear to be bad. Why was I so worried?

As my mother would often remind me, appearances can be deceiving. I was worried because we knew the next tens of millions of Baby Boomers would soon start retiring, driving payment obligations sharply higher. Simply doing the math told us that even given the robust assumptions that pension funds were making, many pensions were going to be massively underfunded in the future. And if you made more realistic assumptions, there were numerous pension plans that were going to be in serious trouble.

Notice too that about half the total receipts came from earnings on investments instead of employee or government contributions. That’s important, as any portfolio manager knows, because you can’t spend an entire year’s earnings if you also need to accrue long-term capital gains. You have to reinvest. In fact, the bulk of planned payments in 30 years don’t come from current contributions but come instead from compounding returns on current portfolios. If you are using those current portfolios to pay benefits today, the money clearly will not be there. And every dollar you pay out today that should be used for investing means that eight dollars will not be there 30 years in the future. And that’s assuming you get the better-than-7% returns everyone is projecting they will make.

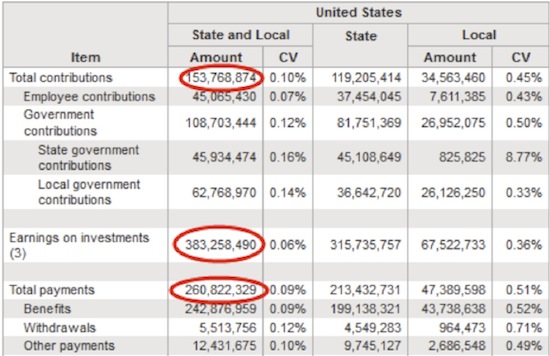

Now, let’s fast-forward ten years from 2003. The Census Bureau changed its data format, but I believe this is a comparable data set for 2013.

Apparently, the Census Bureau also decided to pull investment earnings out of the contribution subtotal. Total 2013 contributions were $153.8 billion. Total payments were up to $260.8 billion in 2013, thanks to my fellow Baby Boomers. That would seem to leave a big deficit. It didn’t, because the plans also had $383 billion in investment earnings. About $107 billion of that went immediately to pay retirees.

Again, the problem with these numbers is that there is no guarantee investment earnings will be this high in any given year. That number could even be negative, as it has been at times in the past. Then what?

In 2013, CalPERS managed $230 billion. The fund calculates that it is underfunded by $80 billion. The management arrives at this number by assuming they will make 7.5% (which they only recently dropped from 7.75%). In 2009, they estimated that the fund was underfunded by only $49 billion. That means they missed their target by $30 billion in a roaring bull market.

In a December 2011 study, former Democratic assemblyman Joe Nation, a public finance expert at Stanford University, estimated that CalPERS’s long-term pension debt is a sizable $170 billion if CalPERS achieves an average annual investment return of 6.2 percent in years to come. If the return is just 4.5 percent annually – a rate close to what more conservative private pensions often shoot for – the fund’s long-term liability rises to a forbidding $290 billion. (Steven Malanga)

Last year I was in Norway. It has a sovereign fund that is larger than CalPERS but that benefits from some of the best management in the world. My talks with people involved in the fund and those who are very familiar with it suggest that they would be very happy to get 4% over the next 5–10 years. CalPERS ranks in the bottom 1% of all pension fund managers. Given all the resources they have, they are spectacularly bad at managing money. And when I say “they,” I mean the board of directors.

Malanga points out that CalPERS is a wholly owned subsidiary of the government-employee trade unions that control the board. He painstakingly chronicles the extent to which the unions dictate policy and investment decisions, leaving the professional management shackled.

And this is the issue. Nearly every public pension plan dramatically overstates its future potential income and returns, which makes the unfunded liabilities look better than they actually are. In coming weeks we’re going to be exploring in depth why the next decade is going to provide, on average, lower returns for pension funds and individual investors who are mired in traditional forms of investing.

In May, Moody’s downgraded Chicago bonds to junk status. One of their examiners pointedly asked, why is Chicago any different in Puerto Rico? Why indeed? My friend Mish Shedlock believes that Chicago is not alone in its misery. He thinks at least seven Illinois cities are in serious and immediate trouble. Detroit was not the last major city that will have to default on its obligations.

Sidebar: I know that many people invest in municipal bonds. Many of these, in fact most, are solid investments. Then there are some real dogs that are going to be extremely problematic. You need to look at, or have someone who is knowledgeable look at, bonds in your portfolios. I’m sure there are some properly run cities in Illinois, but I think I would throw the baby out with the bathwater there. There is no telling what politicians are going to require taxpayers in cities to do. It wouldn’t be the first time they took from the have-cities and give to the have-nots. Sadly, to my great chagrin and embarrassment, we did exactly that in Texas when we were forced to do so by judges.

State and local pensions, in aggregate, are running severely negative present cash flow. If we get a bad market year (and we will), they will have to dip into their principal, cut benefits, turn to taxpayers, or borrow cash. Local governments can also file bankruptcy; states can’t, except in theory. We may see that theory tested in the next 10 years.

None of those choices are good. If pensions have to sell into a falling market, cash flow will fall even more. Such a scenario probably means the economy is weak and tax revenues are falling. That makes raising taxes and issuing bonds problematic.

Cutting benefits might be the only choice. But guess what: in many states, cutting benefits to current retirees is unconstitutional. Let’s look at the dilemma this poses for one state.

Courtesy of Bloomberg, here are the ten most underfunded state pension plans as of 2013, the latest available data. Notice how poorly – one could almost use the word disastrously – these bottom 10 states have performed in what has essentially been a bull market for the last five years. Their funding ratios have dropped anywhere from 15% to 25%. And that was in good times!

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.