Is Simple Incompetence The Real Source Of Crises?

Stock-Markets / Credit Crisis 2008 Jun 10, 2015 - 04:06 PM GMTBy: Dan_Amerman

There are two quite different narratives for explaining the financial crisis of 2008, the resulting Great Recession and the chances for a new crisis. The first narrative revolves around theory and jargon. It's Keynesian versus Austrian economics, it is societal debt levels, it is fractional reserve lending and the velocity of money, and so forth.

There are two quite different narratives for explaining the financial crisis of 2008, the resulting Great Recession and the chances for a new crisis. The first narrative revolves around theory and jargon. It's Keynesian versus Austrian economics, it is societal debt levels, it is fractional reserve lending and the velocity of money, and so forth.

There is a much simpler perspective, which is that no matter how exalted the credentials or how elevated the position, at the end of the day we're all human. Which means we're all vulnerable to getting in over our heads and just plain screwing up. And if these mistakes – which effectively result from our not being as good as we think we are – occur at a high enough level, then that has the potential to change economies and investment returns for entire nations, as well as the global financial order, and sometimes for decades to come.

It is this common sense and almost universal understanding that people sometimes get in a complicated mess, then take actions to try to get out of that trouble, but make big, whopping mistakes instead – that may be the most likely source of a potential future crisis.

Was Incompetence The Cause Of The Financial Crisis Of 2008?

Some people will tell you that it was greedy incompetence on the part of Wall Street that created the financial crisis of 2008. Other people will tell you that it was governments intervening in markets, forcing banks to lend to people with poor credit histories who lacked the capacity to repay loans, on the grounds that they had the same right to mortgage lending as their more affluent counterparts.

There is truth within both perspectives, albeit with neither one containing the whole truth.

But there is a third and far simpler explanation. And that is that the financial crisis of 2008 came about as the direct result of Federal Reserve incompetence – in two separate areas.

The first mistake stemmed from the United States being in a recession following the collapse of the tech stock bubble. Now recession following prosperity is of course part of the unending business cycle that has dominated economies over the centuries.

But what made this time different is that the economists running the Federal Reserve believed that their expertise and skills were so great that they could intervene and override the normal business cycle. By making money cheap and interest rates low, they could stimulate the economy and thereby shorten the duration and depth of that otherwise quite normal recession.

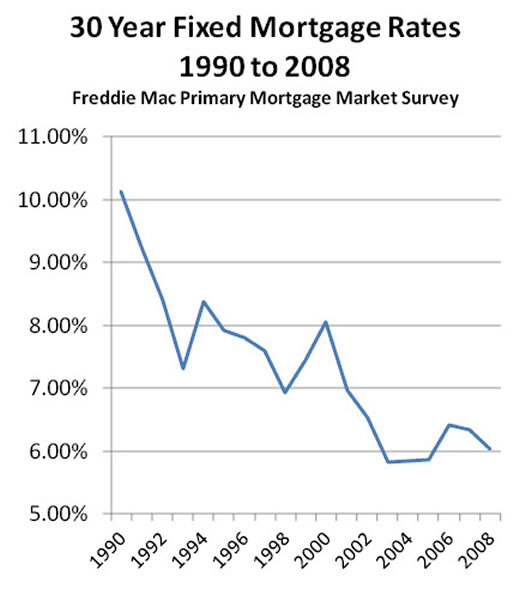

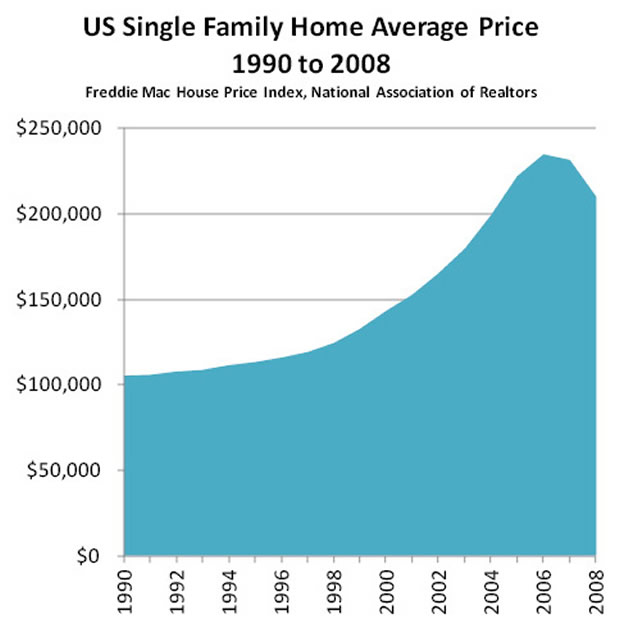

So as shown in the above graph, the Fed drove interest rates to the lowest levels that had been seen in 30 years. And this decrease in interest rates made mortgage payments the lowest they had been in many years, which in turn helped fuel a radical increase in home prices, as seen in the following graph. Lower interest rates were not the only factor – but they provided the essential fuel that enabled everything else.

Simultaneously, the Federal Reserve is the regulator for the US commercial banking system. And under its supervision (or lack thereof), the banking industry created a huge, fantastically complex – and fragile – market in derivative securities, which if stressed could bring down the entire global financial system. With the market in subprime mortgage derivative securities – which was the actual trigger for the financial crisis of 2008 – being only a very small part of the larger derivatives market.

Why the Fed was never held accountable for failing in its duties as banking regulator is a rather interesting question, when we step back and place things in perspective. After all, preventing banking crises was one of the main reasons the Fed was created in the aftermath of the Bank Panic of 1907 – it is core to why the Fed exists at all. And they failed at it, miserably. They completely failed to control risk, with this failure in regulatory oversight nearly bringing the entire system down in 2008.

But rather than being censured or punished, or even replaced altogether, the Federal Reserve was effectively rewarded with vastly increased powers over the US economy and markets.

So we have, 1) a failure in monetary policy which facilitated the creation of an "asset bubble" in the US real estate market. Even as, 2) regulatory incompetence allowed risks in the US and international banking systems to spiral completely out of control, without the Federal Reserve seeming to even notice that it was happening.

And it was when the popping bubble slammed into the newly fragile and high risk banking system – that the global financial order almost melted down.

Now because each of these sources of the financial crisis of 2008 were preventable, then arguably the crisis would never have occurred – if the Federal Reserve had simply been competent in performing its two core duties of acting as monetary steward and banking regulator.

It is interesting that this simple explanation for why the financial crisis of 2008 happened is not more widely acknowledged or discussed. The reason for that may be that it doesn't fit with any particular political or media narrative at the moment, but even more likely it's that relatively few people have any idea of what the Federal Reserve really does.

In any event, the current situation is such that there are no penalties for incompetence. And that being the case, the same basic group of people whose mistakes in judgment arguably were the primary source of the financial crisis 2008 – are still collectively in power, and aren't feeling any pressure to change their behavior.

Now while this may be advantageous for the economists involved, there can be real problems for a society when it comes to having its chief decision makers being shielded from the consequences of incompetence.

And this is particularly the case given the extremely complex and fragile place in which the global financial system currently finds itself.

The Complex & Dangerous Challenges Ahead

Part II of this article discusses four major challenges currently faced by the Fed and other central banks, each of which is arguably more difficult than the situation was before the last crisis, as well as the risks when individuals wield vast powers which exceed their own competence.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.