Two of the World's Best Investors Want You to Own This Currency

Currencies / Gold and Silver 2015 May 29, 2015 - 05:26 PM GMTBy: DailyWealth

By Brian Hunt and Ben Morris: They're not all household names like Warren Buffett...

By Brian Hunt and Ben Morris: They're not all household names like Warren Buffett...

But they're superstars in the money-management business... And you can learn a lot by looking at how they're investing.

One of the main goals in our DailyWealth Trader service is to pass along insights, strategies, and actionable ideas from top money managers. These elite investors have decades of experience, high-level contacts, huge research budgets, and long track records of success.

We'd be fools not to "look over their shoulders" for investment ideas...

So today, we're sharing an important idea held by two of the best in the business: Paul Singer and Ray Dalio.

Singer runs the $24 billion fund, Elliott Management. His fund averaged 14% annual returns from 1977 to 2012, with only two down years. Singer has degrees in both law and psychology... And he's well known for investing in debt from bankrupt companies.

Singer is extremely concerned about the state of the world's monetary system right now. Many governments have taken on debts and obligations they can't pay back with sound money. They plan to pay back their debts with debased, devalued money. Singer also believes extremely low interest rates have encouraged people to speculate and make bad investments.

Given all this risk, Singer sees gold as a great hedge against a potential financial crisis... And he's urging investors to own some.

Regular readers know we see gold as a form of "real money"... and one of the ultimate ways to protect yourself against a financial crisis. (You can read a full explanation in this educational essay.)

Dalio calls gold a currency, like the dollar or the euro... It's an alternate form of cash.

Dalio is one of the world's most respected big-picture economic thinkers... and one of the most successful. In 1975, Dalio founded Bridgewater Associates. The firm has averaged 13% annual returns... And Dalio has grown Bridgewater into the world's largest hedge fund. It now manages around $170 billion in assets.

Lots of investors don't remember a time when folks didn't believe in paper currencies and needed an alternative. But Dalio makes the important point that there's nothing new in the investment world. Just because it hasn't happened in our lifetimes doesn't mean it's impossible.

Gold was used as money throughout history... And as Dalio explained in an interview with the Council on Foreign Relations, folks could turn to gold again in a currency crisis. The precious metal could be seen as an economic "barometer."

Dalio said, "It's not sensible not to own gold." He doesn't suggest putting all of your money into gold. But if you don't own some, he says, "you don't know history and you don't know the economics of it."

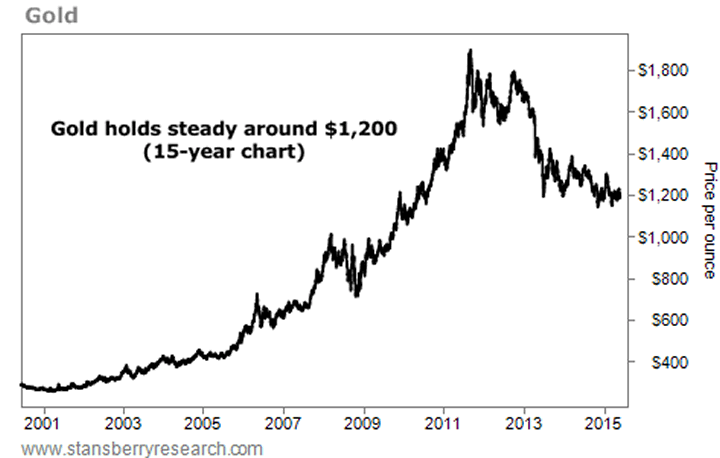

Two of the world's smartest, most successful money managers encourage investors to own gold... And we see this as an ideal time to buy, near multiyear lows.

The best way for most folks to own gold is in "bullion" form... buying physical gold coins or bars. Buy some gold today... Store it somewhere safe... And hold it the rest of your life.

You may never need your gold. But like car or home insurance, if you do need it, you'll be glad to have it.

Regards,

Brian Hunt and Ben Morris

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.