Tense Days for Bitcoin

Currencies / Bitcoin May 29, 2015 - 01:34 PM GMTBy: Mike_McAra

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

Barry Silbert, a Bitcoin investor, might think that companies in the like of Western Union and MoneyGram will be devastated by Bitcoin, we read on the Entrepreneur website:

The near-demise of Kodak is a famous parable in business circles, illustrating the need for deeply-entrenched organizations to adapt in the face of evolving technology.

Financial service firms like Western Union and MoneyGram aren't far behind, according to noted Bitcoin advocate and investor Barry Silbert. "You should be able to move money and value instantaneously and it should basically be free," Silbert told Entrepreneur at this year's Inside Bitcoins conference in New York City.

Though leading players in the space currently have the opportunity to incorporate Bitcoin into their businesses, they likely won't, Silbert believes, which will eventually precipitate "a slow death."

While we think that Bitcoin has the potential to revolutionize the payments system all over the world, we would emphasize the world "slow" here in the sense that significant changes would not be seen until a few years from now, at the very quickest. The development of Bitcoin-based solutions will take some time and the same goes for Bitcoin regulation. It might turn out that new rules will have to be written not only for cryptocurrencies but also for general digital ledger systems. This remains to be seen.

All of this means that payment giants like Western Union and MoneyGram will have time to react. They might turn out to embrace ledger systems at some point in the future. The same might be the case for credit card companies like Visa and Mastercard. So, payment companies are still very far from any Kodak-style demise. We'll see how they respond to the development of cryptocurrencies.

For now, we focus on the charts.

There were no major changes yesterday. Recall our last alert:

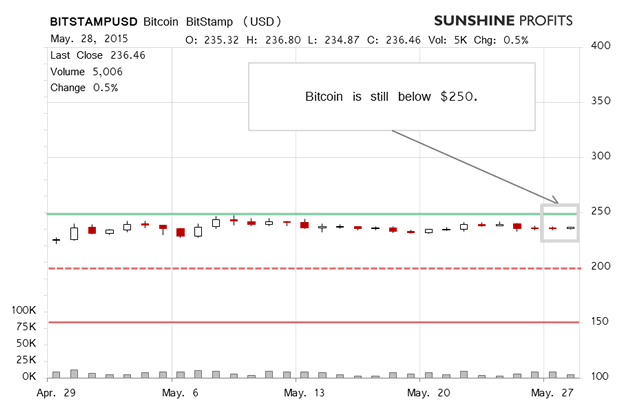

On BitStamp, not much happened yesterday. The price didn't move, the volume was similar to what we had seen on the day before, not really high, but not low either. Does this mean that Bitcoin is now boring?

We don't think so. We realize that the lack of movement in the cryptocurrency might be tiring in the sense that the situation is tense but there has been no resolution in the form of a violent move. The fact that Bitcoin hasn't really moved makes the situation all the more interesting. There's no use in paying attention to Bitcoin only after it has moved significantly. It is before such movements that the most attention ought to be paid to potentially position oneself appropriately in the market. And this might be the time to do so.

Yes, Bitcoin hasn't moved but there is a possibility of a stronger move in the coming days or weeks. Bitcoin is still below $250 (green line in the chart), the trend seems to be unbroken, the upside might be limited by $250 and, at the same time, the downside seems to be more appealing with $200 (dashed red line). Have we already seen the beginning of the move? There's not much to confirm that so far, but the current short-term outlook remains bearish.

This is still the case today. Bitcoin is below $250, there has been no significant action, the volume hasn't been strong (this is written around 7:30 a.m. ET). Currently, Bitcoin might still trade sideways for some time or even go up slightly before taking a more significant dive, in our opinion.

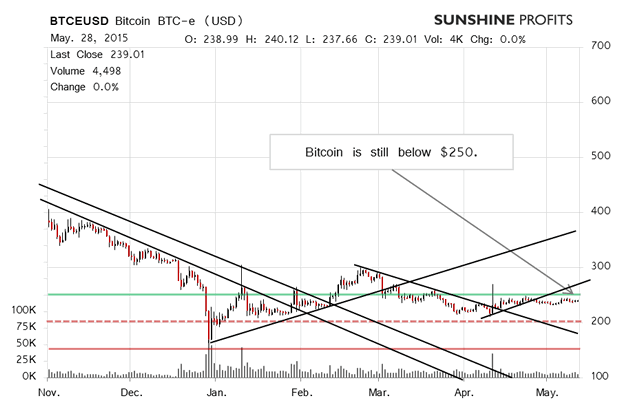

On the long-term BTC-e chart, there has been no change either. Our previous comments remain up to date:

(...) we see Bitcoin below $250 (green line in the chart). This is basically the same what we saw yesterday. Again, this is not really boring as from the long-term perspective it seems that Bitcoin is below both $250 and the recent possible rising trend line. This is a rather bearish picture in the sense that Bitcoin could now drop off to around $200 (dashed red line). Will it do so now? There's no way of telling for sure as nothing is certain in the markets, but the current environment points to a possible bearish outcome.

A move to the upside is still possible, mind. In our opinion, such a move could be limited and followed by even more declines. At the current moment, however, our best bet is on the move down in the next couple of weeks.

The stalemate below $250 seems to continue. This is precisely what makes the situation interesting. We might see a more significant move in the future. In our opinion, the current time is one where positions for the next big move should be considered.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.