Government's Share of Minimum Wage Increase

Politics / Wages May 06, 2015 - 10:41 AM GMTBy: BATR

The working poor suffer disproportionately from the offshoring of high paying jobs. The upsurge an hour in the minimum wage economy is the net result of a consorted effort to lower the standard of living of not just the struggling impoverished but for all scrambling households. When the communist manifesto advocated a progressive income tax, the proletariat was supposed to get a sliver of social justice. Just how well did that hogwash turn out?

The working poor suffer disproportionately from the offshoring of high paying jobs. The upsurge an hour in the minimum wage economy is the net result of a consorted effort to lower the standard of living of not just the struggling impoverished but for all scrambling households. When the communist manifesto advocated a progressive income tax, the proletariat was supposed to get a sliver of social justice. Just how well did that hogwash turn out?

The practice of upward mobility is virtually extinct. As the broken economic model intensifies, the consequences of 20.7% of Jobs in Baltimore Are Government Jobs, should be apparent.

“Of the 364,200 total jobs in Baltimore City in March, 75,500—or 20.7 percent—were jobs working for the government. That included 39,400 state government jobs, 26,000 local government jobs, and 10,100 federal government jobs.

By contrast, there were only 11,600 manufacturing jobs in Baltimore City, according to BLS. That means government had 6.5 times as many employees in Baltimore City as all of the manufacturers located in the city.

Nationwide in March, according to the BLS, total employment was 141,183,000. Employment by government was 21,898,000. Thus, 15.5 percent of the jobs nationwide were government jobs.”

Add to these stats, the Bureau of Labor Statistics states that Minimum wage workers account for 4.7 percent of hourly paid workers in 2012. The accompanying chart illustrates that teens and women compile a greater number of minimum wage employment.

“In 2012, there were 3.6 million hourly paid workers in the United States with wages at or below the federal minimum wage of $7.25 per hour. These workers made up 4.7 percent of the 75.3 million workers age 16 and over who were paid at hourly rates.”

Such lower opportunity entry level jobs are disturbing when the odds are that these workers will not be able to advance into more lucrative positions. Raising by government fiat an arbitrary minimum pay floor is naïve without fundamental changes to the entire tax system.

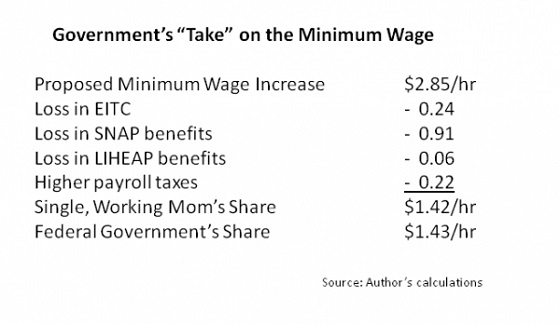

Net take home pay is the bottom line. Economic analysis of the real world effects from punitive taxation implications usually goes under reported of ignored completely. The American Enterprise Institute in an essay, Some minimum wage workers would face a 50% tax rate if Obama an floord Dems raise the minimum wage to $10.10 per hour, will shock the open minded.

“Forbes contributor Jeffrey Dorfman crunches the numbers and finds that a single mom (with one child) working at the minimum wage would face the equivalent of a 50% tax rate (from both higher payroll taxes and a loss in government benefits) if Obama is successful at raising the federal minimum wage to $10.10 per hour. Here’s how some minimum wage workers would be taxed at a higher rate than the “top 1%” by Obama’s “compassionate” 40% minimum wage hike:”

Examine this research and consider the sober implications that any society that intentionally restricts a market opportunity financial system will result in a permanent poverty underachieving economy.

Finally, David R. Henderson of the National Center of Policy Analysis provides evidence that Most of the Benefits of a Minimum Wage Increase Would Not Go to Poor Households.

“From 2003 to 2009, the federal hourly minimum wage rose in steps from $5.15 to $5.85, and then from $6.55 to $7.25. Between 2003 and 2007, 28 states increased their minimum wages to a level higher than the federal minimum. San Diego State University economics professor Joseph J. Sabia and Cornell University economics professor Richard V. Burkhauser examined the effects of these increases and reported their results in the prestigious Southern Economic Journal.1 They “find no evidence that minimum wage increases between 2003 and 2007 lowered state poverty rates.”

This pre 2008 meltdown evaluation has worsened since the zero interest rate and no small business loan environment has intensified. The Campaign to begin for a $15 minimum wage in D.C. is misguided. Without supporting a total revamp of the federal, state and local tax system, disappointment is inevitable.

Since the central planning intrusion of government has created greater poverty, would not a prudent population start looking towards a better alternative?

One such substitute is a Fair Tax based upon consumption. A central and primary method to grow employment and even more important, create living wage positions, is to adopt a merchant economy.

Big business has never been the engine of substantial and continual growth. Unless the velocity of money transacted in voluntary business decisions open up, the future will be relegated to subsistence level, at best.

In order to broaden a prosperous society, the private sector must be able to innovate, produce and expand. Labor that works for wages must develop the skills to make their contributions to their employers more valuable. That’s reality; and if one sincerely wants to lift the boot straps of the underclass, starts with a dose of candor.

When a government tax policy confiscates the earned rewards of honest work and promises to offer public substitute benefits that are on a sliding downward scale of efficiency and value, only a fool will accept that this formula will offer a chance to claw out of the poverty cycle.

The fact that most consumers are guarded in spending, what little disposable money their meager income allows, is core to this hamster wheel economy.

Confidence will not return, when the government continues to be the primary obstacle for keeping people on the treadmill.

Corporatists have done their best to destroy the middle class. They will never provide a solution for the underprivileged. Government’s record is even worse. Those who will survive in the controlled economy will work towards conducting free enterprise among the enlightened consumers who understand that a brighter future is achieved through intelligent and perseverance. Thoughtless demands for a $15.00 an hour minimum just because one needs more money only results in higher unemployment.

James Hall

Source: http://www.batr.org/negotium/050615.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2015 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.