Stock Market Sell Signal on S&P Global 1200 Confirmed by Various Charts

Stock-Markets / Stock Markets 2015 May 06, 2015 - 10:32 AM GMTBy: Brian_Bloom

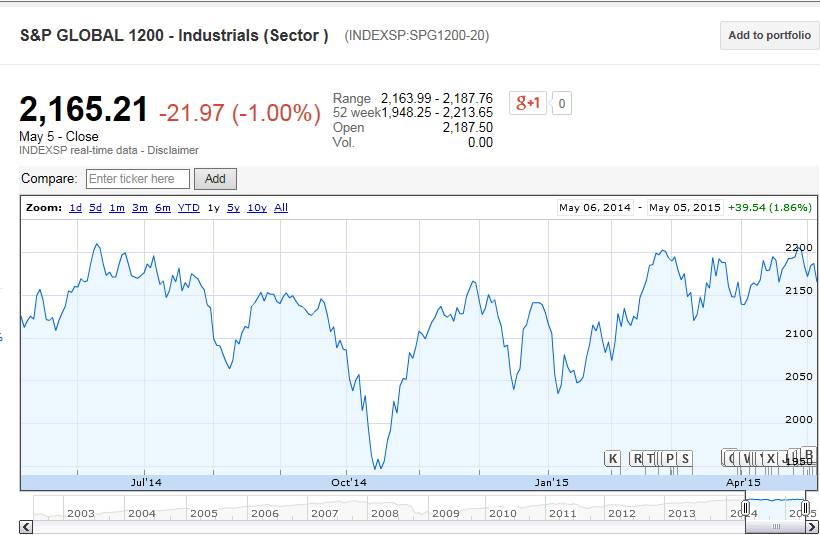

Global Economy at Threat - The S&P Global 1200 index gave a significant sell signal today. Charting is viewed by some as tea leaf reading. However, over several decades it has been demonstrated as an objectively useful tool to strategic thinkers who attempt to monitor the health of the financial markets. The charts below are telling us that Quantitative Easing has run its course and that it has become impotent in the fight to stave off a global recession. Central Banks are now no longer part of the solution; they are part of the problem.

Global Economy at Threat - The S&P Global 1200 index gave a significant sell signal today. Charting is viewed by some as tea leaf reading. However, over several decades it has been demonstrated as an objectively useful tool to strategic thinkers who attempt to monitor the health of the financial markets. The charts below are telling us that Quantitative Easing has run its course and that it has become impotent in the fight to stave off a global recession. Central Banks are now no longer part of the solution; they are part of the problem.

Below will explain why:

The sell signal on the S&P global 1200 chart below is evidenced by a lower low following retracement of break below the previously rising trend line. This is a potentially ominous development which the central banks will fight with everything at their disposal.

That they are fighting it is evidenced by the chart of the gold price – which is traditionally a safe haven, but the sell signal on the chart below might turn out to be a “false” signal – for reasons that will emerge in this analysis.

The US 10 Year yield broke above its falling trend line today. A break above 2.3% will “confirm” a possible change in yield’s trend

The US Dollar Index chart could go either way, but rising interest rates will not be good for either the US or the global economy.

Why would interest rates rise if money flows INTO the US?

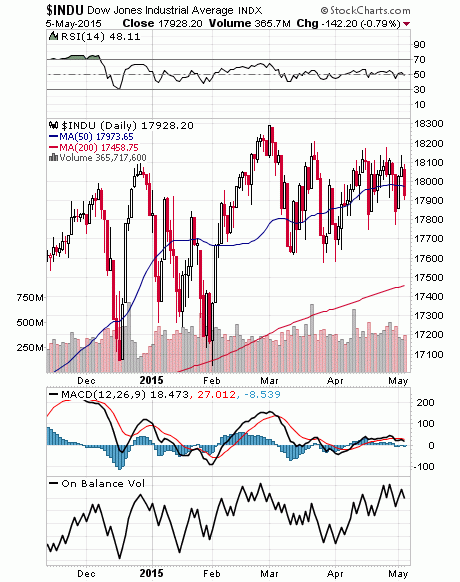

The Dow Jones Industrial Index is once again at critical level. It may be signalling that money is about to flow OUT of US markets. Note how the index is battling to stay above the 50 day Moving Average, which is now pointing down.

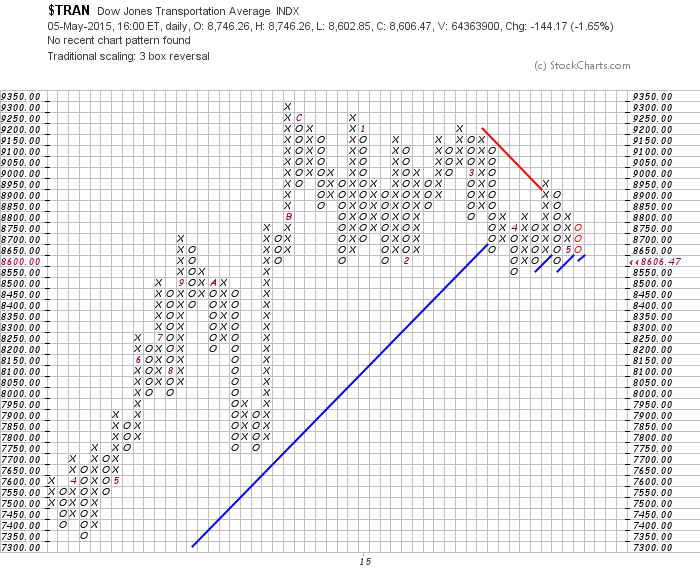

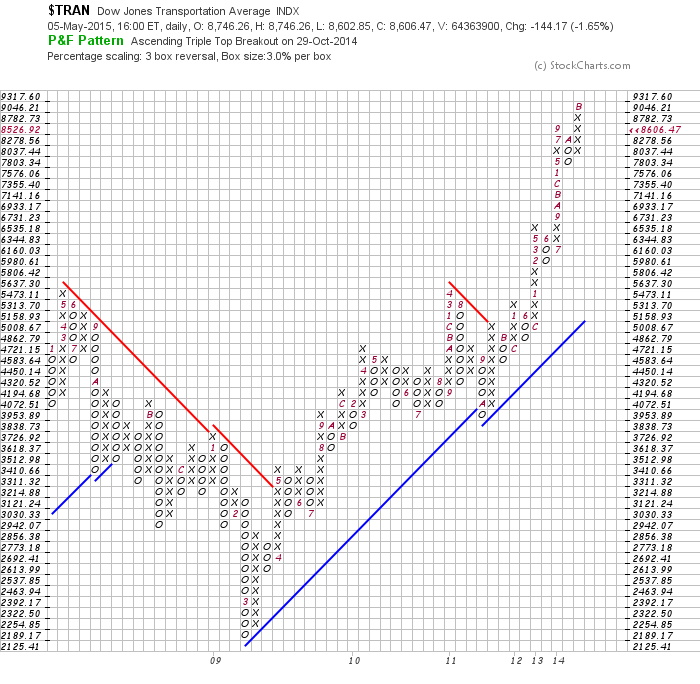

The Transport Index is at critical support. In terms of Dow Theory (that was developed well prior to the emergence of the 1930s Depression), if Industrials and Transports break down simultaneously, this would indicate the commencement of a BEAR MARKET

Note that even if transports enter a Secondary Bear Market , the index could fall significantly (to below 6,000)

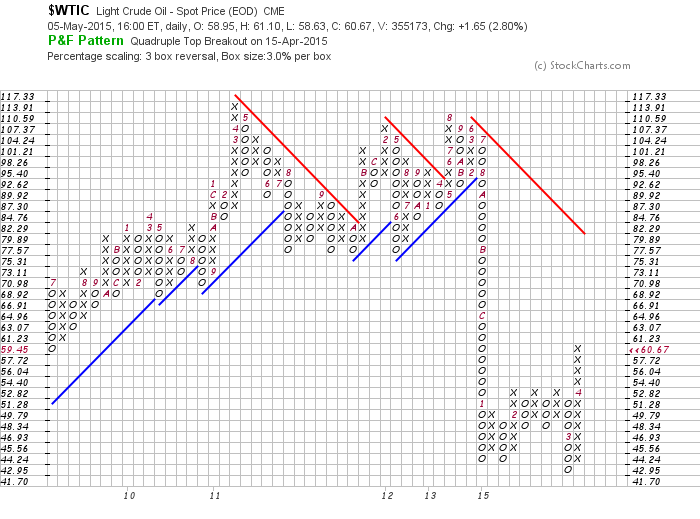

Conceptually, given that 90% of the US’s transport infrastructure is powered by oil, a continued rise in the global oil price might wreak havoc to the US economy (trouble in the Strait of Hormuz might interrupt the Middle East oil supply line)

(BB Aside Note in relation to the Strait of Hormuz: I will be writing an article to demonstrate that Iran is very probably a “Straw Man” of China and that Iran’s behaviour in the coming weeks should be viewed in that light)

If money flows out of the US because markets are falling, the US dollar Index will fall and US interest rate charts will break up – but, with S&P Global 1200 giving a sell signal, where will the money go?

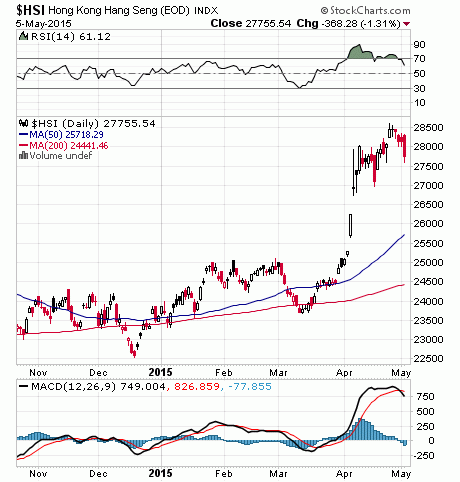

The Hang Seng Index could fall to cover the gaps, so it won’t flow into China. Indeed, other evidence suggests that money is flowing out of China.

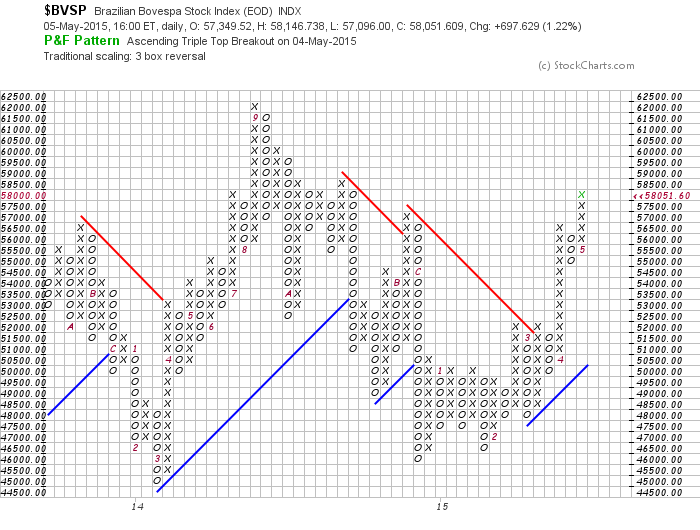

The Brazilian market is ramping up

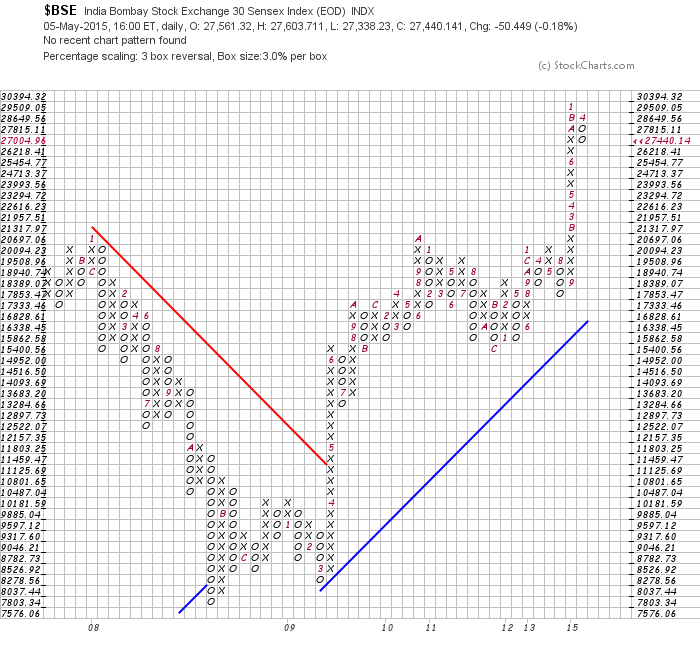

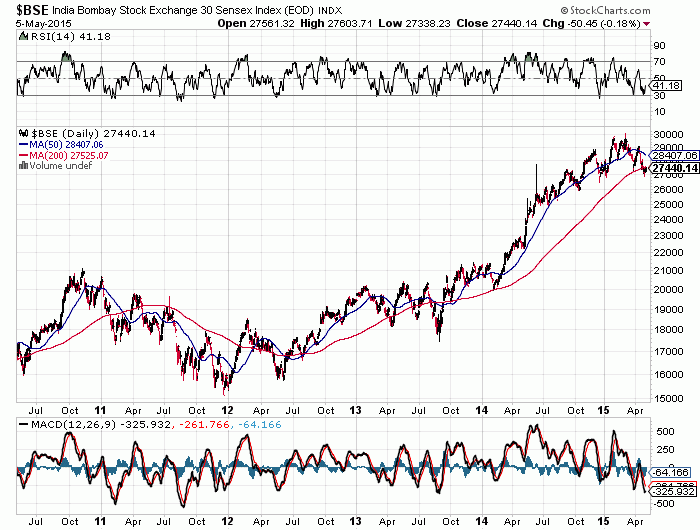

The Bombay Stock Market in stratosphere. It is in a high risk area

Indeed, sell signals have been given (breaks below 50 and 200 Day MA)

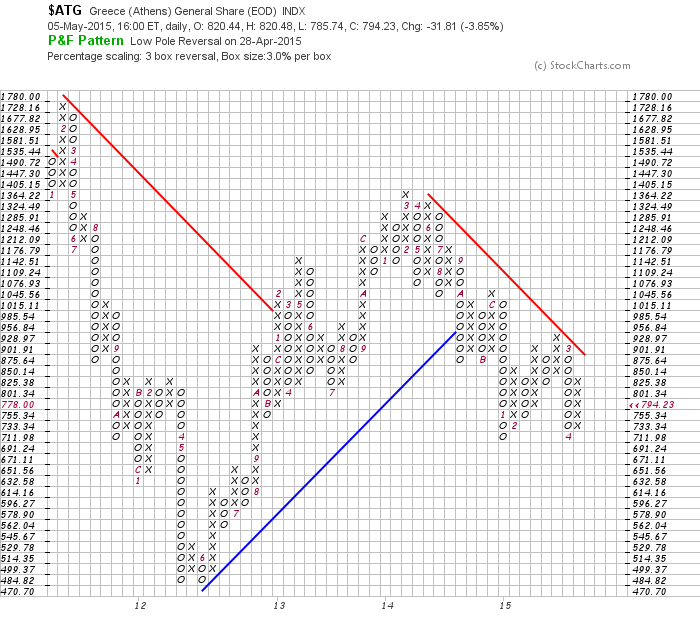

Athens Stock Market might reveal a bearish high pole reversal in the coming days. This would imply (should it happen) that the Athens market could slump below its previous lows. Conceivably, a blow-up of the Greek sovereign debt problem might be used by the world’s Central Banks as a Straw Man for to camouflage the real impact of QE and the role that it played in what seems about to manifest.

So where will the money go?

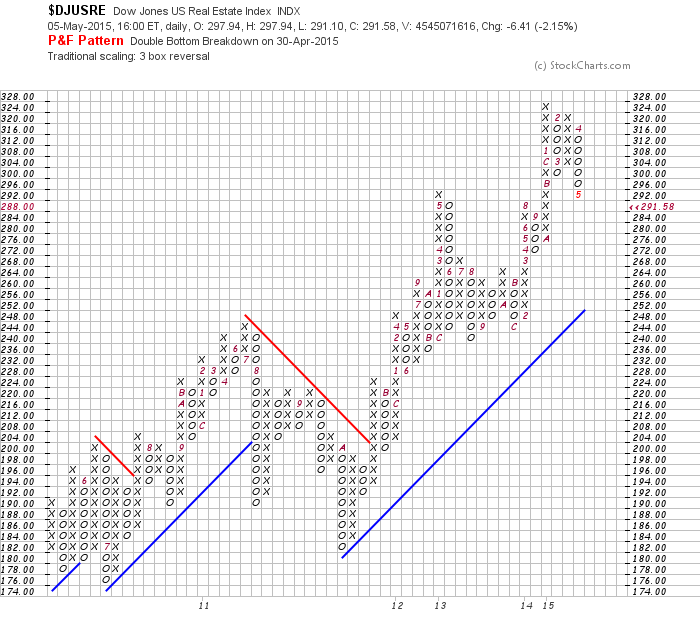

Not into US Real Estate

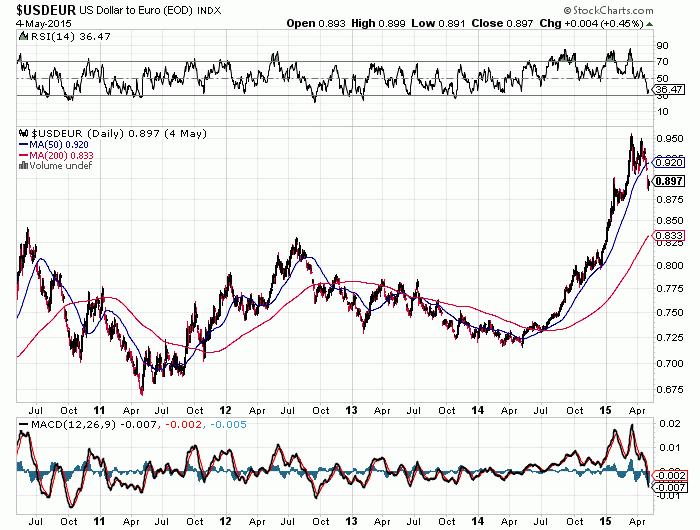

Short term, it might flow into Euros (to cover the gap following the break below the 200 day MA)

But if Grexit manifests, then long term is anyone’s guess. In this context the gold price might “catapult” upwards if central banks withdraw from the gold markets. Unfortunately, a catapulting gold price will not serve to protect the global economy.

Conclusion

Taking all the above charts into account (and allowing a time lapse for one last burst of Central Banking shenanigans), the most likely outcome is that the global money supply will shrink as losses are incurred in the coming equity Bear Markets; because QE will have been proven impotent. The gold price should be watched very carefully for signs of upside reversal.

So this begs the question:

What should be done about all this? The answer is that the quicker we jettison the political posturing in a “democratic” world where both sides are really just throwing rocks at each other, the quicker we can close ranks and work out lasting solutions. Central Banks have lost the plot. The answers lie in “value-add” not in “money supply or capital market management”. China will not be a saviour of the global economy. To the contrary, China has its own agenda that runs counter to the Western value hierarchy. Arguably, the recent Iranian behaviour may be part of the Chinese Wu Chi strategy. My two fact based novels were an attempt to introduce and explore a “value-add” approach to solving the coming problems.

Author, Beyond Neanderthal and The Last Finesse

Links to Amazon reader reviews of Brian Bloom’s fact-based novels:

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2015 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.