U.S. Government Using Subprime Mortgages To Pump Housing Market Recovery

Housing-Market / US Housing May 06, 2015 - 09:54 AM GMTBy: James_Quinn

Taxpayers Will Pay Again - It seems hard to believe, but your government is purposely recreating the mortgage debacle of 2007 and putting you on the hook for the billions in losses coming down the road. In their frantic effort to generate the appearance of economic recovery they are willing to gamble with taxpayer’s money while luring unsuspecting blue collar folks into buying houses they can’t afford. During the previous housing bubble, greedy Wall Street bankers, deceitful mortgage brokers, and corrupt rating agencies colluded to commit the greatest control fraud in the history of mankind. This time it is your government, aided and abetted by the Federal Reserve, that is actively promoting the lending of money to people incapable of paying it back. And again, you the taxpayer will be on the hook when it predictably blows up.

Taxpayers Will Pay Again - It seems hard to believe, but your government is purposely recreating the mortgage debacle of 2007 and putting you on the hook for the billions in losses coming down the road. In their frantic effort to generate the appearance of economic recovery they are willing to gamble with taxpayer’s money while luring unsuspecting blue collar folks into buying houses they can’t afford. During the previous housing bubble, greedy Wall Street bankers, deceitful mortgage brokers, and corrupt rating agencies colluded to commit the greatest control fraud in the history of mankind. This time it is your government, aided and abetted by the Federal Reserve, that is actively promoting the lending of money to people incapable of paying it back. And again, you the taxpayer will be on the hook when it predictably blows up.

The FHA, created during the first Great Depression, is supposed to be self-sustaining through mortgage insurance premiums charged to homeowners, just like Fannie, Freddie, Medicare, Social Security, and student loan lending were supposed to be self- sustaining through taxes, fees, and interest. This agency was supposed to promote homeownership for lower income Americans, but has been used by politicians as a tool to capture votes, payoff crony capitalist benefactors, and as a Keynesian stimulus tool designed to kindle a fake housing recovery. They entered the fray at the tail end of the last Fed/Wall Street created housing bubble, insuring a huge number of subprime mortgage loans from 2007 through 2009. The taxpayer has already had to bail out this incompetent, politically motivated, joke of an agency to the tune of $1.7 billion in 2014.

Edward J. Pinto, a former Fannie Mae official, estimates that under standard accounting practices the agency is already insolvent to the tune of $25 billion. Mark to fantasy accounting hasn’t just benefitted the criminal Wall Street cabal, but also the bloated pig government housing agencies – Fannie, Freddie and the FHA. The FHA’s share of new loans with mortgage insurance stood at 16.4% in 2005 and currently stands at 44.3%. This is a ridiculously high level considering the percentage of first time home buyers is near all-time lows and low income buyers have lower real median household income than they had in 2005. Distinguished congresswoman Maxine Waters, who once declared: “We do not have a crisis at Freddie Mac, and particularly Fannie Mae, under the outstanding leadership of Frank Raines.”, prior to them imploding and costing taxpayers $187 billion in losses, thinks the FHA is doing a bang up job. Her financial acumen is unquestioned, so you can expect another bailout in the near future.

“Above all, we must strive to have a healthy, viable FHA that can continue to facilitate homeownership for first-time and low-income home buyers, while standing ready in the unfortunate event of another housing downturn.”

How could politically motivated government apparatchiks insuring subprime mortgages with down payments of 3.5%, using weak underwriting standards, easing restrictions on borrowers with past foreclosures, in a housing market poised to drop by 20% when this next Fed/Wall Street housing bubble pops possibly go wrong? The entire faux housing recovery, which has driven average home prices up 30% since 2012, has been driven on the high end by The Wall Street hedge fund buy foreclosures in bulk and rent scheme, along with hot money cash from Chinese and Russian oligarchs, while the low end is being propped up by Fannie, Freddie, and the FHA with their brilliant idea to insure 3.5% down payment mortgages to future foreclosure aspirants.

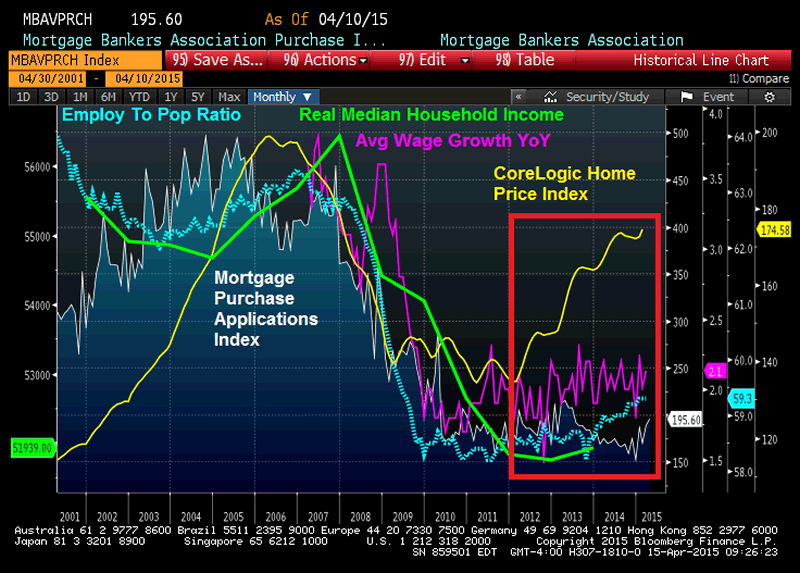

We have the employment to population ratio at 35 year lows. We have had stagnant real wage growth since 2008 as low paying service Obama jobs have replaced higher paying production jobs. We have real median household income at 1989 levels and still 9% below the 2008 peak. We have mortgage applications 56% below the 2005 peak and hovering at 1996 levels. We still have 4 million homeowners underwater in their mortgages. We have housing starts languishing 40% below the long-term average. We have the home ownership rate of 63.8% at quarter of a century lows. We have mortgage rates at all-time lows. And we have home prices soaring far above the inflation rate and wages because the Federal Reserve, in collaboration with the Federal government decided to create another housing bubble (along with stock and bond bubbles) to rectify the disastrous consequences of their last housing bubble.

This is the absolute perfect point in time when the FHA thinks it is necessary for them to lure low income, low IQ, credit challenged dupes into the housing market. Risky mortgages are increasingly being underwritten by thinly capitalized non-banks and guaranteed by the FHA. In 2012 the large Wall Street banks represented 65.4% of FHA-backed loans. That number is now 29.6%, as even the risk seeking Wall Street criminal banks have come to their senses and realize loaning money to people that won’t be able to repay them will end badly – AGAIN. In their place, dodgy mortgage brokers (non-banks) now represent 62.2% of the FHA lending. Of course, once these low life mortgage brokers make the loans, Wall Street will package them, get a AAA rating from their bitches at S&P or Moodys, and then peddle them to yield seeking pension plans and life insurance companies. Sound familiar?

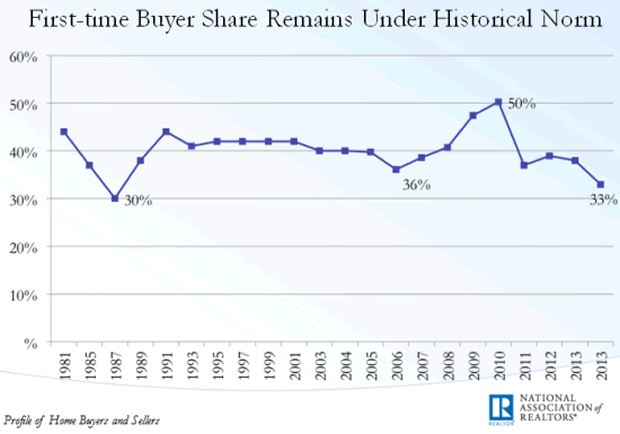

If you thought the FHA was supposed to help young, employed, first time home buyers who have a limited credit history, you would be badly mistaken. There is a reason first time home buyers only make up 29% of all home buyers, near the all-time low. Over history, when the housing market was not being manipulated by warped Federal Reserve monetary policies and government intervention, first time home buyers accounted for 40% to 45% of all home sales. Even with all-time low mortgage rates, courtesy of the Fed’s ZIRP, the lack of jobs, crushing student loan debt, low wages, and over-priced homes has kept traditional young buyers out of the market. But, the FHA’s goal is to convince anyone who can fog a mirror to get into the housing market before it’s too late.

To get some perspective on how the FHA is actively creating the next multi-billion dollar taxpayer bailout, you need to understand FICO credit scoring. Here are the categories:

• Excellent Credit: 781 – 850

• Good Credit: 661-780

• Fair Credit: 601-660

• Poor Credit: 501-600

• Bad Credit: below 500

The average FICO score of all Americans is 687, barely above the Fair Credit level. The average for Americans getting a mortgage is 724, down from 750 in 2012, as the reckless mortgage brokers have taken share from the banks. It is only rational that people with good credit should be the only people borrowing hundreds of thousands of dollars for 30 years. Not in the eyes of the FHA and their politician overseers, who buy votes by doling out free shit to their constituents. Why not houses? You can get an FHA loan with a credit score as low as 500, so long as you have a 10% down payment. And once you hit a 580 credit score, you only need a 3.5% down payment. Credit scores below 600 mean that you have significant derogatory information on your credit report. In other words, you have proven to be a deadbeat. Credit scores below 600 are the result of missing multiple payments on credit cards and auto loans; having multiple collection items or judgments; and potentially having a very recent bankruptcy or foreclosure. Sounds like someone I’d loan money to.

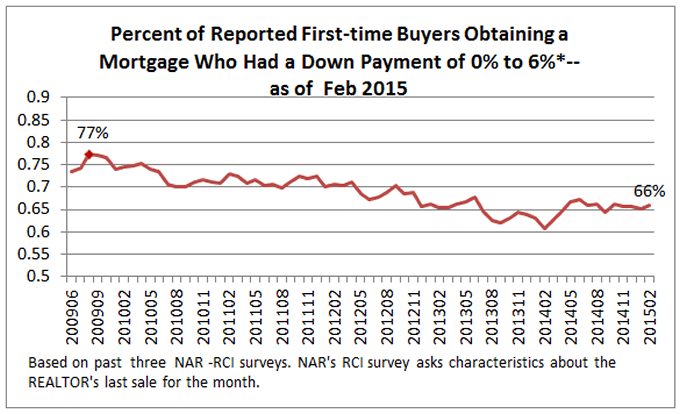

After financial institutions lost hundreds of billions (covered by American taxpayers at the point of a gun through TARP) by peddling low or no down payment mortgages for $500,000 McMansions to deadbeats with no willingness or means of repaying, the percentage of low down payment mortgages rationally plunged from 77% to 60% for first time buyers. Low down payment mortgage loans are a high risk proposition. It wasn’t that long ago when a borrower had to put up 10% to 20%. If you can’t save enough for a 10% down payment then you probably shouldn’t own a house. If your down payment is less than 8%, you are immediately underwater as the costs to sell a home usually total 8% of the selling price. The percentage of first time buyer mortgages with a low down payment mortgage has risen to 66% in the last year and is headed higher, as the FHA is pushing hard on their 3.5% down payment loans.

As a general risk guideline, your monthly mortgage payment, including principal, interest, real estate taxes and homeowners insurance, should not exceed 28% of your gross monthly income. Total debt to income generally cannot exceed 43% of your gross monthly income. These guidelines have worked for decades in assessing whether a borrower can afford a mortgage. Why would an arrogant bureaucratic agency, controlled by politicians like Mel Watt and Maxine Waters, follow standard industry risk standards when they are only gambling with taxpayer funds? The FHA is exempt from the qualified mortgage requirement of a 43% debt-to-income ratio. Many loans have a debt-to-income ratio above 55%. Even worse, the FHA only looks at mortgage payments in their calculation. What do you think the odds are of a borrower with a 580 credit score, making $3,000 per month with a $1,500 monthly mortgage payment, of defaulting? They would be high under normal circumstances, and will be off the charts after the next financial bubble bursts and millions are put out of work again.

People who are serial defaulters with 580 credit scores cannot expect to get the lowest rates. They should expect to see interest rates that are at least three percent higher than interest rates awarded to borrowers with good credit. Even the 3.5% down payment requirement is flexible for the FHA. The FHA is perfectly willing to accept a gift or inheritance as a down payment. So, you could have no savings, a 580 FICO, a 50% debt-to-income ratio and a gift from your parents and that would be sufficient to get you a loan. And it gets better. The transaction can be designed with the buyer paying a higher price but getting a credit for closing costs that covers the 3.5% down payment and other fees. Therefore, a serial deadbeat can purchase a house with a government guarantee without putting up one dime of their own cash. Sounds like a great deal for the taxpayer.

I have personal experience with a current FHA mortgage transaction as my 79 year old widowed mother is in the midst of selling the 900 square foot row home that she has lived in for 58 years in the first ring of suburbs outside of Philadelphia. It was once a vibrant middle class neighborhood of working folk, but has been gradually decaying as the old guard dies off and is replaced by lower class Section 8 tenants. She is selling ten years too late as prices have dropped 30% since 2005. She asked $72,900 and received an offer within two weeks of $66,000, with a $4,000 closing credit. My siblings and I didn’t expect her to get an offer in the 60s, as the dump next door was sold for $30,000 and went Section 8 a couple years ago. Anyone buying this house is destined for another 30% loss over the next ten years. So we told her to take the offer before it was too late.

My brother and I met the realtor at her house after work a couple weeks ago. We sat around the dining room table that had seen so many family gatherings over the last half century and discussed the particulars of the deal and the buyer’s background. It was an enlightening glimpse into the Federal government’s futile attempt to engineer a housing recovery on the backs of hard working tax payers with good credit. The buyer is a 20 something guy living with his parents, with a girlfriend and a young kid. He reportedly makes $29,000 per year. His girlfriend was not on the mortgage application. The only logical explanation is she has bad credit. He is putting 3.5% down and getting an FHA guaranteed mortgage. The $4,000 closing credit will cover his 3.5% down payment and closing costs. He evidently has no money to put down when purchasing this home. Sounds promising.

As a high risk borrower he will be lucky to get a 5.5% rate mortgage. In a world where risk mattered, it should be 7.5%. He should thank Ben and Janet for encouraging this type of mal-investment across the country with their 0% interest rate policy. His monthly cost to own this home would be approximately $800, or about 33% of his monthly gross income. Of course, no one brings home their gross income. The $800 would be about 40% of his take home pay after taxes. He did arrive at the house in a nice car, so it is very likely he has at least one auto loan of $20,000 or more. If he doesn’t have a dime to put down on the house, he is likely acting like a true American and rolling a $10,000 credit card balance at 17% interest. His total debt payments assuming a six year auto loan at 3% and making the minimum payments on his credit card would total at least 55% of his monthly gross income. Lucky for him, the FHA doesn’t worry about his non-mortgage debt payments.

So this guy comes home each month with about $2,000 of income and pays out $1,300 in debt payments, leaving him $700 to pay for health insurance, food, utilities, cable, cell phones, entertainment, and any vices he and his baby momma may have. If this isn’t a recipe for default, nothing is. No bank in their right mind would loan this man $66,000 for 30 years at 5.5%. That’s where the crooked nonbank mortgage companies enter the scene, just as they did when their patron saint Angelo “the tan man” Mozilo was roaming the land doling out billions in subprime mortgages while cashing in his stock options in 2005. Remember back in the glory days from 2002 through 2007 when mortgage company fronts, staffed by used car salesmen, pizza delivery guys, and convicted criminals peddled no-doc, negative amortization, liar loan, subprime slime to every Juan, Bubba and Lakeisha, filling the derivative pipeline for Wall Street to destroy the financial system? They’re back.

These parasites don’t worry about individual risk, financial risk, or systematic risk. They care about upfront fees and their ability to package their toxic subprime mortgages and dump the risk on someone else before it all blows up again. They are willing to issue mortgages to people unlikely to repay because there is a big difference between the risk that faces the company, and the risk that faces the blood sucking founder of the mortgage front. It’s a perfect opportunity for shysters and scumbags. You set up a mortgage company, and take extraordinarily opulent commissions on all loans you book. In this Fed created paradise of low interest rates, investors are desperate for yield. An FHA loan provides the opportunity for an investor to receive a good yield and a guarantee from the Federal government – aka YOU THE TAXPAYER.

The conscienceless CEO and executives of these MBS machines revel in the vast commission revenue as the loans are booked. These companies retain little or no capital on their balance sheets. Instead, they pay dividends to the owners as quickly as possible, before the bottom drops out. When the next Fed induced financial crisis happens the mortgage company will go bankrupt, but the slimy owners will walk away unscathed. These fly by night operations are booking as much business as possible before the music stops playing. When the music stops, the taxpayer will be on the hook again, as the FHA will need a $25 billion to $50 billion bailout. The FHA is flying under the radar, still in the shadow of equally insolvent Fannie and Freddie. Their mission is supposedly to help lower income people achieve the American Dream, but their politically motivated actions today will lead to millions of borrowers experiencing an American Nightmare and taxpayers footing the bill for their crackpot Keynesian scheme, aided and abetted by the Janet Yellen and her Fed cronies.

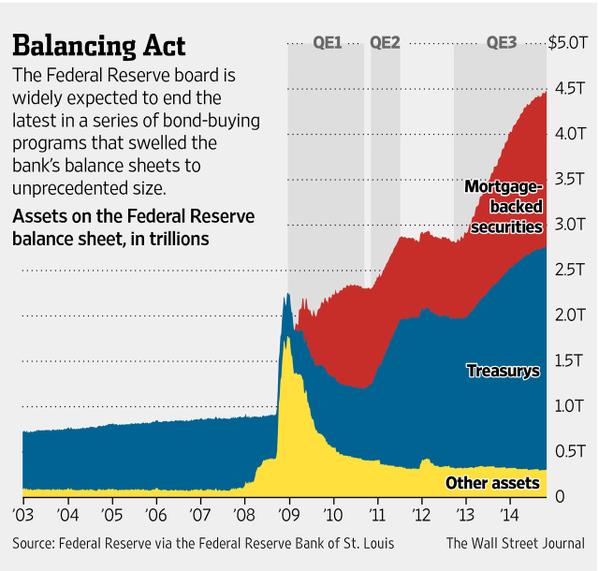

The FHA has $64 billion of liabilities on their balance sheet supported by $3 billion of capital. They are currently accelerating their guarantees to subprime borrowers with 3.5% down mortgages. Fannie and Freddie will purchase mortgages with only 3% down payments. Wall Street issued $1 trillion of mortgage backed securities last year, with the Fed buying 20% of the issuance as part of QE3. If this sounds like a replay of the waning days of the last Fed induced housing bubble, it’s because it is. Both debacles have been fueled by the mal-investment created by an easy money, excessively low interest rate environment, designed to benefit bankers, billionaires, politicians and mega-corporations. The Fed already has $1.7 trillion of Wall Street generated toxic mortgage debt on its bloated balance sheet. By the time this imminent catastrophe runs its course, there will be another trillion of toxic mortgages polluting their insolvent balance sheet.

To paraphrase H.L. Mencken, anyone who wants the government and Federal Reserve to create a housing recovery, deserves to get it good and hard, like a four by four to the side of their head. Subprime mortgages, subprime auto loans, and subprime student loans driven by preposterously low interest rates are the liquefying foundation of this fake economic recovery. Most rational people would agree that loaning money to people who will eventually default is not a good idea. But it is the underpinning of everything the Fed and government apparatchiks have done to keep this farce going a little while longer. It will not end well – Again.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.