U.S. Fears a European “Lehman Brothers”

Stock-Markets / Credit Crisis 2015 May 05, 2015 - 02:52 PM GMTBy: GoldCore

European complacency regarding Greek default and exit is high – Tett

European complacency regarding Greek default and exit is high – Tett- Narrative to reassure investors that markets have already priced in effects of Greek default

- U.S. Council on Economics is alarmed by risk being taken by European elites to bring Greece to heel

- Greek default would cause a new and very “unpredictable” paradigm – huge uncertainty in markets

- U.S. policy makers fear unforeseeable knock-on effects

Gillian Tett, markets and finance commentator and an Assistant Editor and former U.S. Managing Editor of the Financial Times, wrote an important and little noticed article last week questioning complacency on the part of European policy makers regarding a Greek default and potential exit or ‘Grexit’.

Tett wrote that statements out of Germany that Europe could manage a potential Greek exit and that markets had already priced in that eventuality had alarmed certain policy makers in the U.S.

The German stance was a reflection of their frustration with the lack of progress made over three months of talks with Greece and a consequent hardening of tone. However, U.S. officials are alarmed by the risk they see in European complacency to a Greek exit.

Tett is highly respected both in journalism but also in financial and economic circles. In her previous roles, she was U.S. Managing Editor and oversaw global coverage of the financial markets. In March 2009 she was Journalist of the Year at the British Press Awards. In June 2009 her book ‘Fool’s Gold’ won Financial Book of the Year at the inaugural Spear’s Book Awards.

In 2007 she was awarded the Wincott prize, the premier British award for financial journalism, for her capital markets coverage. She was British Business Journalist of the Year in 2008.

Tett quotes Jason Furman of the U.S. Council on Economics as saying that a

“Greek exit would not just be bad for the Greek economy, it would be taking a very large and unnecessary risk with the global economy just when a lot of things are starting to go right”.

She adds that U.S. officials have privately expressed deeper concerns about the situation. She puts the difference in attitudes down to two main factors.

The first is that Germany, as a 30% stakeholder in Greek debt, has a lot to lose from leniency toward the Greeks while the Americans have first hand experience – with the Lehman Brothers crisis – of how quickly financial contagion can spread causing a crisis to spiral out of control.

Tett makes three key points regarding the Lehman’s crisis which she believes are pertinent to the current attitude towards the Greek situation.

Firstly, it is nigh on impossible for policy makers to predict and protect against every eventuality that crops up in a crisis. Tett reminds readers that in the wake of the Bear Stearns crisis regulators worked “obsessively” to avert a major crisis and yet could not contain Lehman Brothers catastrophe six months later.

This was because they were focussed on risks posed to the derivatives markets whereas it was an overlooked legal issue which precipitated the Lehman’s crisis, “namely that the UK bankruptcy code ringfenced investor assets differently from New York’s.”

Secondly, if Greece were to fail it would likely bring attention to bear on other debt-laden European economies. When the Greek finance minister made the comment that Italy’s debt was also unsustainable, it was met with hostility but not too many were willing to utterly refute it.

Tett argues that a Greek failure would lead, as Lehman’s did to “wider policy uncertainty: when Lehman failed, the entire paradigm for finance suddenly seemed unpredictable”.

The third point is that “political turmoil matters”. She argues that what really sent the markets into free-fall back in 2008 was the unexpected political decision by the U.S. not to bail out Lehman’s. Political uncertainty stemming from a Greek default and possible exit could cause a similar crisis in Europe and then globally.

Tett acknowledges that the economies of vulnerable countries like Ireland and Spain have been improving which may insulate the eurozone somewhat from contagion.

However, she argues that

“the sheer opacity of financial institutions still creates plenty of scope for nasty logistical and legal surprises” and adds that “there is no guarantee that political surprises would end with a Greek exit; as in 2008, it might initially create more policy uncertainty.”

She sums up by writing that while the Europeans may be able to handle the initial effects of a Greek default, the Americans are concerned by secondary knock-on effects

“Not least because there is a fourth lesson from Lehman Brothers: when a crisis hits, the value of afflicted entities tends to shrivel. The hole in Lehman’s balance sheet became much bigger than anyone imagined. And that is a scary thought to contemplate in relation to any Greek exit scenario — not just for Greece but the entire eurozone.”

Tett is one of the most insightful financial analysts today – she is highly respected and rightly so. She has written favourably on gold due to it being a tangible asset and this tangibility is important in a world where assets and money are increasingly forms of digits on computer screens.

Breaking Gold and Silver News and Research Here.

MARKET UPDATE

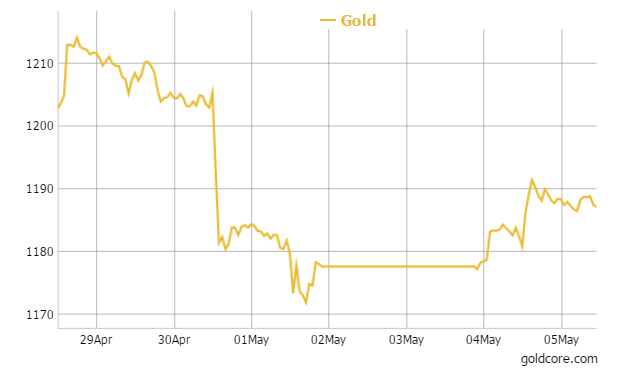

Today’s AM LBMA Gold Price was USD 1,187.40, EUR 1,070.94 and GBP 785.59 per ounce.

Friday’s AM LBMA Gold Price was USD 1,179.00, EUR 1,049.24 and GBP 771.04 per ounce.

Markets in London were closed yesterday but gold and silver saw price gains of 0.92 and 1.6 per cent respectively.

Last week, gold was flat and incurred a marginal 0.05 per cent loss but silver rose 2.8 per cent last week.

Gold in U.S. Dollars – 1 Week

In Asia overnight, Singapore gold prices ticked marginally higher but those gains were lost in London trading this morning.

Markets will focus on monthly jobs data on Friday which should give more clues on whether the Federal Reserve will be raising interest rates any time soon. We suspect not given the recent weak data; this should support gold.

A weak jobs number this week should see gold rise above the $1,200 an ounce level again.

The European Commission slashed Greek economic growth and primary surplus projections today. They forecast deeper price falls and a higher public debt as a result of uncertainty that has dogged Athens policy direction since late 2014.

ECB governing council member Christian Noyer said the spike in eurozone government bond yields in recent days was not a cause for concern.

Assets in gold exchange-traded products held near a six-week high. Gold ETFs holdings were at 1,626.81 metric tons on Monday from 1,627.3 tons on Friday, the highest since March 19, according to data compiled by Bloomberg.

In Europe in late morning trading gold bullion was flat at $1,188.44 an ounce. Silver was down 0.15 percent at $16.43 an ounce and platinum fell 0.29 percent at $1,147.49 an ounce.

Important Guide: 7 Key Gold Must Haves

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.