Gold Remains the Fringe Preserve of the Smart Money

Commodities / Gold & Silver Jun 12, 2008 - 06:27 AM GMTBy: Mark_OByrne

Gold closed at $881.00 in New York and was up $13.20 and silver closed at $16.84 up 27 cents. Gold has subsequently given up some of yesterday gains and has fallen in Asia overnight and in early European trading this morning.

Gold closed at $881.00 in New York and was up $13.20 and silver closed at $16.84 up 27 cents. Gold has subsequently given up some of yesterday gains and has fallen in Asia overnight and in early European trading this morning.

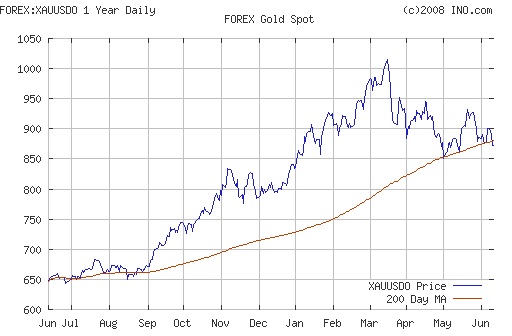

Gold is again taking its cue from oil which is down and the dollar which is up this morning. This trend may continue until we get a breakout out of the recent range bound trade between $850 and $950. The breakout is again likely to be to the upside. The 200 day moving average is at $856 is support and gold is an excellent buying opportunity at these levels.

Wheat, soybeans, corn and sugar all surged yesterday as did most commodities and the CRB Commodities Index surged to a new record high which does not bode well for inflation in the coming weeks and months.

While risk appetite remains high there would appear to be some increasing risk aversion as seen in the weakness in Asian stock markets overnight and international stock markets in recent days, and this will lead to diversification, inflation hedging and safe haven buying of gold.

Today's Data and Influences

US Jobless Claims and Retail Sales for May are due this afternoon and further negative numbers should support gold.

Gold Remains Fringe and the Preserve of the Smart Money

Gold remains off the radar of the vast majority of investors who remain determinedly focused on property and equities despite their dreadful performance in the recent months and their likely underperformance in the coming years. The majority of investors know little or nothing about gold and the what, why and how of investing in gold.

Investment Funds Look to Allocate Funds to Gold

Reuters reports that the Permal Group is looking to raise its exposure to gold to protect its assets against rising inflationary pressures. Omar Kodmani, a senior executive at New York- and London-based Permal expects gold prices to rise as inflation becomes entrenched in the global economy.

http://quotes.ino.com/chart/?s =FOREX_XAUUSDO&v=d12&w=1&t=l&a =200

"There are inflation issues in the world, it has been a problem since the beginning of the year because of the surge in food and energy prices," Kodmani said. "Surging food and energy prices have created inflation in a lot of countries, especially in emerging market countries, where imbalances relating to currency and interest rate policies are exacerbating the problem . "

"Inflation is something we have all got to learn to live with," he said.

Permal Group is one of thousands of investment funds and hedge funds that see the writing on the wall and are diversifying into gold and gold related investments. There is a multitude of these funds and they have huge multiples of the capital available to funds in the 1970's and this will help lead to a sharply higher gold price in the coming years.

An important fact unacknowledged by the bears (one of many) is that of $1,000 of investable products across all financial markets in recent years a mere $3 was invested in commodities - and gold is a subset of that 0.3 % allocation to commodities. While this allocation is increasing significantly, it is doing so from a tiny, tiny base and thus remains a fringe investment at best. This is changing and will continue to do so especially given the risky macroeconomic and geopolitical outlook.

Gold remains the preserve of the risk conscious and the knowledgeable

Gold remains the preserve of the risk conscious and the knowledgeable. It is slow monthly and quarterly money and allocations from individual investors, pension funds and institutions pushing up prices because they want a finite currency and hard asset and need diversification as many remain overweight equities (some dramatically so) and overexposed to property markets.

Gold remains a fringe investment. This will change in the coming months and years and gold will again become a mainstream asset class alongside property and equities. It will then likely experience mass participation and the herd will plow in as they unfortunately tend to do near market tops.

When gold is featured on the radio and t.v, there are a large number of companies selling gold then we will have reached the bubble stage and it will be time to sell. When gold is the investment topic du jour at dinner parties in the western world, it will be time to sell. When your taxi driver tells you to sell everything and buy gold then it will be time to sell your gold.

That day is a long way off yet.

Silver

Silver is trading at $16.60/16.70 per ounce (1130 GMT).

PGMs

Platinum is trading at $2018/2028 per ounce (1130GMT).

Palladium is trading at $423/428 per ounce (1130 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.