King Dollar Hurting Stock Market Corporate Earnings!

Stock-Markets / Stock Markets 2015 Apr 17, 2015 - 12:30 PM GMTBy: Puru_Saxena

BIG PICTURE - Let's face it; the strong US Dollar and weakness in the price of oil are hurting corporate earnings in the US and it is conceivable that both sales and profits for the S&P500 Index may decline during the first half of the year.

BIG PICTURE - Let's face it; the strong US Dollar and weakness in the price of oil are hurting corporate earnings in the US and it is conceivable that both sales and profits for the S&P500 Index may decline during the first half of the year.

Make no mistake; the strong greenback is hurting the American multinationals as their overseas sales and earnings are being diminished in their reporting currency. Furthermore, due to last year's slide in crude oil, the energy industry is really struggling and earnings in the sector have fallen off the edge of a cliff!

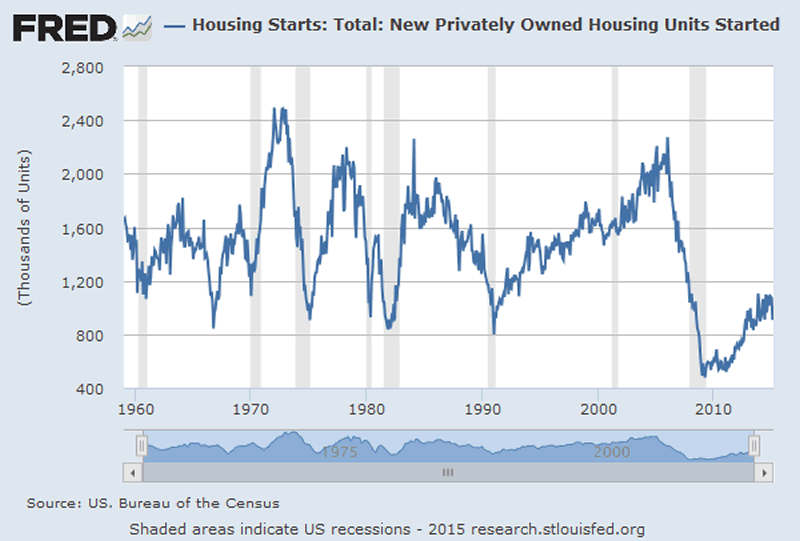

On the macro-economic front, recent data reveals that the US is dealing with deflationary pressures and the jobs market is also slowing down. Elsewhere, although the auto industry is doing very well, housing remains sluggish and this weakness is weighing down on business activity.

As you can see from Figure 1, despite the bounce since March 2009, housing starts remain depressed and they are still near the lower end of their historical range. It is interesting to note that whereas housing starts came in above 2 million per year between 2004 and 2006, they are now averaging just below 900,000 new units per year. In fact, with the exception of the global financial crisis, housing starts have been this low on only four occasions since the late 1950s!

Figure 1: US Housing Starts (Seasonally adjusted annual rate)

Source: St. Louis Fed

Bearing in mind the above scenario, we are of the view that the Federal Reserve will not raise its benchmark interest rate anytime soon. After all, at a time when both the Bank of Japan and the European Central Bank are engaged in QE, a rate hike by the Federal Reserve will make the US Dollar even stronger; thereby further hurting American exports and corporate earnings. Moreover, tighter monetary conditions will undoubtedly derail the fragile recovery in housing and this will only compound the deflationary pressures which the Federal Reserve has so desperately tried to avoid since 2008!

Today, the majority of financial commentators hold the view that the Federal Reserve will raise its benchmark rate later this year. From our perspective, given the factors discussed above, policymakers in the US will stay on hold for longer and it is likely that the Fed Funds Rate will remain unchanged by year-end.

If our assessment proves to be correct, the US stock market will remain strong and fast growing companies will reward investors. Although we do not possess a crystal ball, we believe that businesses which operate solely within the US and derive all of their sales and earnings in US Dollars will see their stock prices appreciate over the following months. Furthermore, in this slow growth environment, companies with robust sales and earnings momentum should attract investors' attention.

In terms of sectors, we suspect that airlines, apparel, asset managers, auto dealers and parts, banks, biotechnology, credit cards, footwear, healthcare, housing, restaurants, retail and technology will continue to perform well and outperform the broad market.

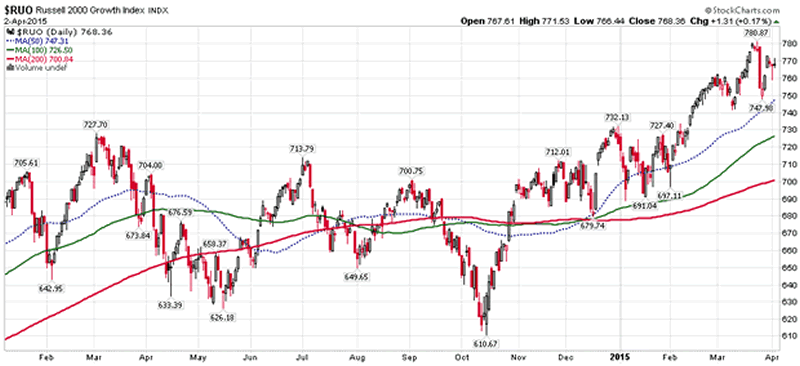

As far as market capitalisation is concerned, the small and mid-cap growth stocks are showing signs of strength and they may continue to do well over the following months.

If you review Figure 2, you will note that despite the recent pullback in the major US indices, the Russell 2000 Growth Index has stayed firm and (so far) it has not shown any signs of weakness. As you can see, the Russell 2000 Growth Index is currently trading above the key moving averages and its most recent reaction low was above the previous bottom established in early March.

In our opinion, the ongoing strength in the Russell 2000 Growth Index is a bullish omen for the broad stock market. After all, if the US was about to enter a primary downtrend (bear market) anytime soon, the growth stocks would not be outperforming the major indices which are comprised of the more well-established and mature companies. The mere fact that capital is staying in the more cyclical, growth stocks indicates that the market is currently not worried about an economic recession.

Figure 2: Russell 2000 Growth Index - bullish omen?

Source: www.stockcharts.com

Supporting our bullish hypothesis is the NYSE Advance/Decline Line which has climbed to a record high! The NYSE Advance/Decline Line measures the market's breadth and in the past, it has always topped out several months before the end of the bull market. Therefore, the ongoing strength in this key indicator is another bullish omen for Wall Street.

Over in Europe, the ongoing QE program is benefiting the stock market and this is in line with our expectation. You will recall that several months ago, we recommended exposure to European stocks and since then, the major indices have performed well.

As you can observe from Figure 3, after the European Central Bank's QE announcement, the Dow Jones EURO STOXX 50 Index has appreciated sharply and it is now trading at a 7-year high. Even though this index has risen by approximately 20% since the beginning of the year, it is still trading considerably below the all-time high recorded in 2007. If our assessment is correct, that level will be surpassed during the course of this primary uptrend.

Figure 3: Dow Jones EURO STOXX 50 Index (weekly chart)

Source: www.stockcharts.com

As far as some of the individual European stock markets are concerned, it is encouraging to note that both the London Financial Times Index and the German DAX Composite are currently trading just beneath their all-time highs and the French CAC 40 Index has also climbed to a multi-year high!

Over the following months, the major European stock markets should continue their northbound journey, thereby rewarding investors. However, we believe that the European Central Bank's QE program will devalue the single currency even further, so foreign investors should consider hedging their exposure to the Euro.

For our part, we have gained exposure to Europe via currency hedged funds, so our clients are enjoying the rally in equities, without suffering the consequences of a weakening Euro. From a short-term perspective, the Euro looks oversold and a counter-trend rally cannot be ruled out, but the single currency should eventually be worth less than the US Dollar.

Turning to the Asia, it is noteworthy that our preferred stock markets (China, India and Japan) are performing well and they are likely to continue their northbound journey. Elsewhere, the stock markets of Hong Kong and Singapore are trading just beneath overhead resistance and a respective close above 25,400 and 3,465 will confirm the breakout to multi-year highs. Last but not least, the stock markets of Taiwan and Thailand are currently trading near their all-time highs and they seem to be poised to appreciate over the following months.

From a short-term perspective, although the Indian stock market has pulled back somewhat, both China and Japan are showing no signs of weakness. If anything, China's stock market is simply ignoring the ongoing pullback on Wall Street and it has now climbed to a multi-year high.

You will recall that we first turned bullish on China several months ago and since then, the Shanghai Composite Index has appreciated sharply. If you review Figure 4, you will note that over the past year, the Shanghai Composite Index has overcome a number of overhead resistance levels (blue solid lines on the chart) and this is impressive price action!

Although anything can happen, we are of the view that the Shanghai Composite Index will now rally towards its all-time high recorded in 2007 and it may eventually surpass that level. Remember, during the previous bull-market, the Shanghai Composite appreciated by over 500% within 2 years! So, it is conceivable that China's stock market may pull off a similar feat during this cycle.

Figure 4: Shanghai Composite Index (weekly chart)

Source: www.stockcharts.com

Although China's economy is slowing down, its policymakers have recently signaled that they are willing to take the necessary steps to ease monetary conditions. Thus, it is probable that Chinese equities will benefit from cuts in interest rates and lowering of the banks' minimum reserve requirement ratio.

Given the above, we are maintaining our investment exposure to China's A-shares and it is our firm belief that the Shanghai Composite will be a star performer over the following year.

In summary, the sluggish economic backdrop is forcing the major central banks to persist with expansionary monetary policies and in this environment, stocks are likely to remain the prime beneficiaries. If our analysis is sound, the stock markets of the developed world (Europe, Japan and the US) should continue to outperform the developing world; although we remain very optimistic about Chinese and Indian equities.

Although the ongoing bull market in stocks will be punctuated by short-term volatility, the primary uptrend should continue for the foreseeable future. Accordingly, both our equity and fund portfolios are currently fully invested in our preferred investment themes.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2014 Puru Saxena Limited. All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.