UK Housing Market Seizes Up

Housing-Market / UK Housing Jun 11, 2008 - 01:16 AM GMTBy: Mike_Shedlock

The Telegraph is reporting House sales fall is steepest since the 1970s .

The Telegraph is reporting House sales fall is steepest since the 1970s .

The number of houses changing hands has "collapsed" to the lowest level in 30 years, an influential housing market survey shows today. Its report also says that gazundering, the controversial practice of buyers dropping their offer price after they have agreed to purchase a property, has returned.

Buyers are refusing, or unable, to hand over any money to purchase a house.

"The continuing lack of demand in the housing market is reflected in the collapse in transactions," says the report."

Tim Edmonds, an estate agent and RICS member, said: "Transactions have virtually halted. Where sales have been agreed, it is very difficult to get them through to exchange."

The report comes after economists warned yesterday that the Bank of England may increase interest rates later in the year because of rising inflation. Rates on the swap market - where banks borrow to fund fixed-rate mortgages - jumped yesterday. Those used to fund two-year mortgages rose from 6 per cent to 6.3 per cent.

It was the biggest one-day increase since 1992 and some specialists predict lenders will have to increase mortgage rates as a result.

My Comment : The UK is having problems related to two year notes as well. See Treasury Curve Steepening Bet Blows Sky High and Treasury Curve Steepening Bet Unwind Continues for US problems in 2 year notes.

Jeremy Leaf, a north London estate agent and RICS spokesman, said: "House price falls in themselves are awful, but only for those that have bought recently and need to sell.

"However, for the wider market they are not a problem. What really is serious is when buyers stop walking in through the door." My Comment : Price declines are only a problem for those who need to sell? Jeremy needs to wake up.

The Daily Telegraph disclosed last month that more than 1,000 estate agent branches had closed since the start of the year. The Centre for Economics and Business Research think-tank predicts that 15,000 agents will lose their jobs this year.

My Comment : That is just a down payment for what is coming.

House Prices Drop Most On Record

In May, House prices fell by biggest margin in 17 years .

House prices fell by 2.5 per cent this month - the biggest monthly drop since records began 17 years ago, according to Nationwide figures. The drop in prices during May also represented a seventh successive month of falls, the longest consecutive period of decline since 1992 when Britain was emerging from recession.

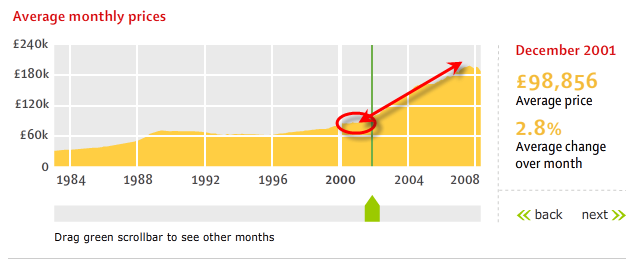

UK House Prices

click here for interactive slider graph

Home prices in the US are in the process of unwinding all the way back to 2000 prices. We are about 3 years into the bubble burst here. Should the UK follow suit, even to 2002 levels there is a lot of pain coming.

My belief is the global housing bubble is going to retrace all of this once in a lifetime boom, perhaps even more.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.