Crude Oil Price Breaks Above One Support, but the More Important One Still Holds

Commodities / Crude Oil Apr 09, 2015 - 09:44 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

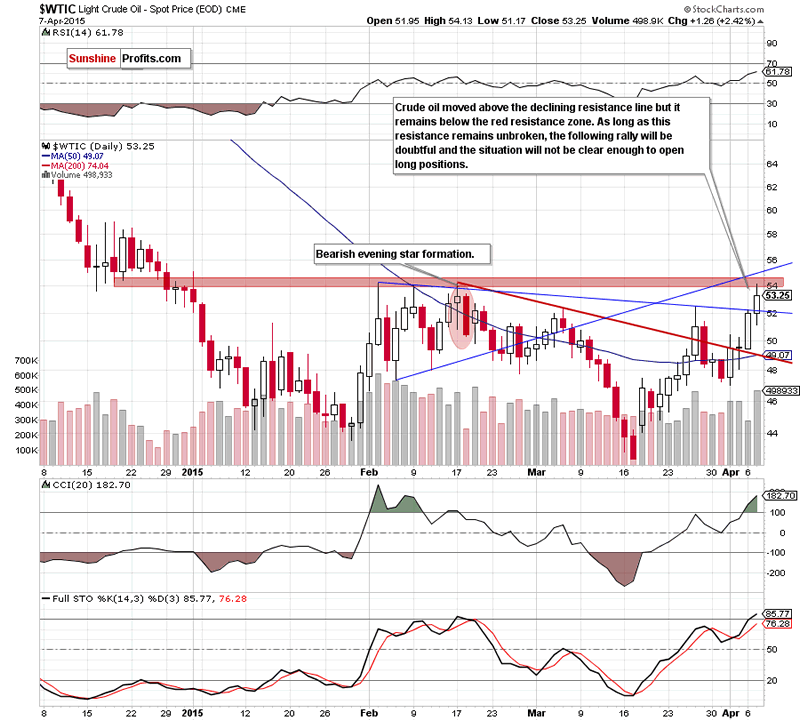

The last 2 days were quite encouraging for crude oil bulls as the black gold rallied above 2 declining resistance lines and the volume during yesterday's upswing was high. Is this enough to make the outlook bullish?

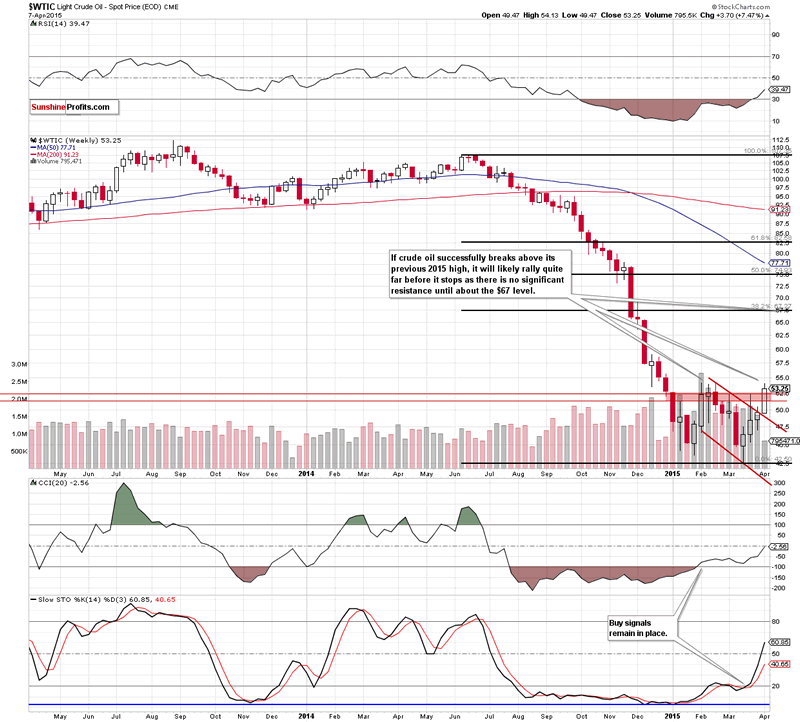

In short, it's almost (!) bullish. In our opinion, until crude oil moves above the Feb 2015 high, the outlook will not become bullish enough to justify opening long positions in crude oil. Yes, we are considering opening long positions at this time. Here's why (charts courtesy of http://stockcharts.com):

There's no significant resistance all the way up until the first of the classic Fibonacci retracement levels, which is much higher than the current crude oil price. Moreover, since the previous move lower was very sharp, we can expect a move back to be sharp as well. Consequently, paying extra attention to the crude oil market in the following days should be worth it.

If the potential size and sharpness of the rally are so high then why are we not opening long positions right away? Because we have not seen a breakout above the Feb 2015 high and consequently the chance of seeing such a rally soon is not very high just yet.

In yesterdays Oil Trading Alert, we wrote the following:

(...) in our opinion, as long as there is o breakout above this key resistance area further rally is questionable and a pullback from here in the coming week should not surprise us.

The above remains up-to-date. The breakouts above the declining resistance lines (marked on the above chart with blue and red) are encouraging, but are not enough, in our view, to make the outlook bullish. We're close to changing the outlook, though.

Please note that if we don't see the breakout and the downtrend resumes, the initial (!) downside target will be the red declining support/resistance line (currently around $49.20).

Summing up, although crude oil rallied visibly in the last 2 days and broke above 2 resistance lines, it didn't move above the most important resistance just yet and consequently, the outlook is not yet bullish enough to justify opening long positions in our view.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex, Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing list today

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.