Cost of Negative Bank Interest Rates

Interest-Rates / Credit Crisis 2015 Apr 08, 2015 - 01:04 PM GMTBy: BATR

So you thought that the unimaginable could not happen. The signal is heard loud and clear. Keeping your money in a fiduciary account will not only earn no interest; there will be an actual cost of parking your funds in a bank relationship. The madness that has engulfed the financial sector is preparing to escalate the systematic looting of saved capital. Ponder the consequences of negative bank rates and ask, what exactly can anyone do or where can they place their money for safekeeping. The first objective of entrusting your funds to a financial institution is to have the ability to obtain access to the return of your capital.

So you thought that the unimaginable could not happen. The signal is heard loud and clear. Keeping your money in a fiduciary account will not only earn no interest; there will be an actual cost of parking your funds in a bank relationship. The madness that has engulfed the financial sector is preparing to escalate the systematic looting of saved capital. Ponder the consequences of negative bank rates and ask, what exactly can anyone do or where can they place their money for safekeeping. The first objective of entrusting your funds to a financial institution is to have the ability to obtain access to the return of your capital.

The Less Than Zero article analysis explains accordingly.

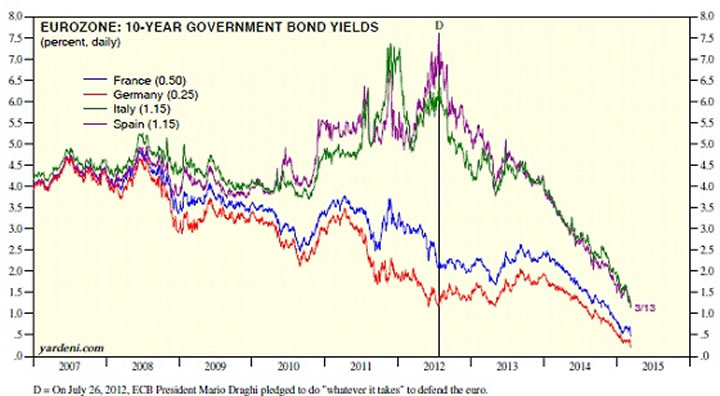

“Since central banks rates provide a benchmark for all borrowing costs across a country’s economy, yields on a range of fixed-income securities – including government bonds of countries like France and Germany – also slipped below zero. Banks are reluctant to pass on negative rates to retail depositors for fear of losing customers, even though that hurts their profit.

In theory, interest rates below zero should reduce borrowing costs for companies and households, driving demand for loans. In practice, there’s a risk that the policy might do more harm than good.”

Only a dullard would believe that banking institutions will not eventually drop their interest rate pay outs to depositors, as their own costs are taxed or central banking policy demands that the value of the currency must be diminished.

The example that Australia Wants To Tax Bank Deposits: Will The US Follow? This report poses an obvious question for anyone keeping money in the depository system.

“Several months ago, the government of Australia proposed to tax bank deposits up to $250,000 at a rate of 0.05% (5 basis points). To be clear, the proposal seems to plan on taxing the banks based on the amount of deposits they’re holding—but it’s pretty obvious this will be passed on to consumers in the form of lower interest rates.”

1. Taxes on bank deposits are generally the same as negative interest rates.

2. Taxes always start small… then increase over time.

3. Taxes are rarely used for their stated purpose.

4. If this can happen in Australia, is anyone foolish enough to think it can’t happen in the US or Europe?

Reuven Brenner, in The Potentially Devastating Consequences of Negative Rates, published in Real Clear Markets, the admittedly benedictory of this planned policy.

“The fact that the U.S. stock market has been - at least nominally - at an all-time high is not particularly surprising in such an environment. The problem is that stock-market signals no longer convey the information they did during normal times of positive interest rates. According to Bloomberg, companies have been buying back their shares at $5 billion per day, or roughly 2 percent of the value of shares traded on U.S. exchanges. Since 2009, they have bought back more than $2 trillion of their shares, spending about 95% of their earnings on buybacks and dividends, while issuing bonds at the low interest rates. Central banks' zero interest rate experiment brought about the profitable financial engineering and increased nominal stock prices. The latter do not signal improved real prospects, but only that the buying of one's own shares is a good investment with zero or negative interest rates.”

Individual net wealth has declined and real income has been in the tank since the 2008 meltdown is indisputable for the average family. Retirees have been hurt the most. The Negotium essay, Low Interest Rates Impoverish Savers makes the case that minuscule interest rates harm savers and concludes: “The submissive banking customer needs to take a hard look on continuing their depositing relationship with the commercial saving establishment.”

This determination is based upon pure common sense. The tangible purchasing power of the U.S. Dollar in this deflationary income scenario is buffeted by higher prices for staple and necessary costs. The end result is a loss of wealth and dim prospects of recouping the decrease in value of their cash.

What actions can be taken while your paper money can still be used to buy assets?

Even if a dramatic implosion of the international financial system can be forestalled or in a perfect world, avoided; the slow drop by drop decline in the marginal liquidity of the personal resources will accelerate even faster. All fantasyland prospects of prosperity returning as indebtedness continues are pure poppycock.

Going to cash presents another risk as author, Pater Tenebrarum’s assessment in The Consequences of Imposing Negative Interest Rates, indicates. “In the US, private persons who are found in possession of large amounts of cash must fully expect that it will be confiscated without trial or any evidence of a crime by means of the “civil forfeiture” procedure.”

Even if ready Federal Reserve notes are not stolen, the other danger is a currency recall. The “crayola currency” substitution, which has already taken place with hardly a whimper from the public, trained the population for a very real possibility that the U.S. Dollar may go extinct and a new fiat medium with a substantially lower purchasing power would be introduced.

Protecting capital in equities or bonds keeps your money at the mercy of the Corporatocracy. Stashing your notes in a saving account where a charge for keeping a deposit is certainly painful. None of these options are safe much less foolproof.

Buying physical metals has a strong historic record of preserving your remaining wealth. However, how long do you think it will take to criminalize holders of gold when the financial dam busts?

The only certainty known is that only the NWO elites have prepared their vision for global enslavement through the credit and debit paper transactions that they control. Populism demands a new era of monitory accountability and honest money.

Only from the ashes of central banking pillage through a political realignment of decentralized power can the world crawl back to solvency.

James Hall

Source: http://www.batr.org/corporatocracy/040815.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2015 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.