Did The Fed Just Admit to Deep Uncertainty About Our Financial Security In Retirement?

Interest-Rates / Pensions & Retirement Apr 01, 2015 - 06:19 PM GMTBy: Dan_Amerman

Generally speaking, the chairperson of the Federal Reserve is treated by the mainstream financial media as being the very paragon of respectability. If the Fed says it - then the voice of economic authority has spoken, and we need to listen carefully.

Generally speaking, the chairperson of the Federal Reserve is treated by the mainstream financial media as being the very paragon of respectability. If the Fed says it - then the voice of economic authority has spoken, and we need to listen carefully.

Yet, recent comments by Janet Yellen have instead made her a source of "controversial" economic ideas, with some financial reporters and their editors apparently feeling a duty to protect their reading audience - and let them know this is not acceptable economic thinking, but rather is "far outside the mainstream."

Now what could the head of the world's most powerful central bank possibly say that would get the mainstream media to try to flip the narrative upside down, and turn her from the heart of authority to being a holder of unreliable and perhaps even fringe ideas?

Chairwoman Yellen's offense was to openly speak the truth about an issue that has been widely discussed by some of the leading economists around the world over the last couple of years, which is the concern about "secular stagnation".

As described in the CNBC article linked here, secular stagnation is an academic concept that has been around since the 1930s, and the article frames it as an "obscure" topic that correct-thinking economists don't worry about today.

What is not discussed in the various media articles is what matters, which is the wide ranging and potentially life-changing implications for all of us. For if it does turn out to be secular stagnation, then bond returns remain very low, stock returns fall, the chances for a new financial crisis increase, the risk of pension insolvencies increases, retirement standards of living fall, and the financial viability of Social Security and Medicare is undermined as well.

Why Secular Stagnation Matters To All Of Us

As explained in my tutorial on the subject linked here, secular stagnation refers to a long term (generally interpreted as 10 years or more) period of very little to no economic growth.

The tutorial is intended to serve as a quick introduction for the general public, but for those who are comfortable with macroeconomic theory, this linked e-book titled, "Secular Stagnation: Facts, Causes and Cures", edited by Coen Teulings and Richard Baldwin, is well worth reading. Published by the Centre for Economic Policy Research (CEPR), the Contributors to the book include Lawrence Summers and Paul Krugman, as well as numerous economists from such institutions as Harvard, MIT, Oxford, Cambridge, the International Monetary Fund and also the Principal Economist for the Executive Board of the European Central Bank.

Unfortunately, what was left out of the mainstream financial media's treatment of Yellen's comments was not only the extraordinary implications of secular stagnation, but also the tools being used to fight long-term stagnation. Instead, all that was discussed in the CNBC article for example was the concept of very low interest rates over a long term period of time.

While technically accurate, it misses the most important part, as you can easily see if you review the tutorial or go directly to the CEPR e-book.

That is, what matters most is the way that the nations of the world fight secular stagnation, which is not so much low interest rates - but rather creating negative interest rates in inflation-adjusted terms.

What so many leading economists agree upon is that if we're truly facing a long-term environment of stagnation, then investor behavior has to be changed. And the recommended tool of choice for changing investor behavior is effectively to punish those who follow traditional investment strategies. Interest rates are thus forced below the rate of inflation, creating a negative return in inflation-adjusted terms as a matter of policy.

In other words, the "cure" is what we've been seeing in practice for about the last five years or so with short-term interest rates.

So if you've wondered why you've been getting almost no interest in your checking, savings or money market account even while food and utilities and medical care continue to increase in price - this is the reason.

If you're a traditional investor, the pain you're feeling is a direct result of deliberate government policy. You're supposed to feel the pain. Pain is what makes people change their behavior. In this case the desired change in behavior is to pull your money out of the bank, and go take some risks. So you can at least stay ahead of inflation, and alleviate the pain.

These risks are ones you would not ordinarily take, but the theory is that the more people who are driven to seek out risk, then the greater the supply of low cost money to corporations and innovators, and the greater the resulting business development, and the more jobs that become created, until the stagnation is eventually broken.

This is happening right now on a major scale in Europe, and again - it's entirely intentional. A new massive program of quantitative easing by the European Central Bank is driving yields into negative territory, which has investors scrambling for alternatives, and is intended to drive them into taking risks that will help create economic development and jobs.

What needs to be understood is that for conventional investors, the implications are completely upside down compared to what is generally assumed in financial planning and retirement planning strategies. The entire basis of those plans, as we're taught, is that we will receive market-based positive returns, and that this interest will compound over time and thereby create wealth for us and fund our retirements.

If we accept the chairperson of the Federal Reserve as a knowledgeable authority, and thereby accept the possibility of secular stagnation, then we have to accept the possibility that for years to come as a matter of governmental policy we will lose money if we follow the usual investment advice, as the process of what is supposed to be wealth creation is reversed into a process of wealth destruction.

Now from the perspective of a financial firm whose livelihood depends upon one's clients following the usual investment advice, perhaps one could see how this is extremely dangerous information that is being circulated. If the general public ever genuinely understood the potential implications - there could be changes in investor behavior on a massive basis.

Of Stocks & Bubbles

The implications go well beyond just interest rates, for secular stagnation also means very little economic growth in real terms.

Again, as with interest rates, this is something we've been seeing in practice with the US economy for some years now. The economy is continuously presented as being on the edge of a breakthrough, and then another round of disappointing economic news comes out that things aren't quite working as planned.

Now when it comes to stock returns, they are of course usually driven by economic growth on a fundamental basis. So if the economic growth is low or nonexistent, then we should expect much lower stock market returns in the future than what we've seen in the past.

Also, as covered in this analysis linked here, when you study the research - there is another danger with secular stagnation.

The basic idea is that when enough people are forced to take higher risks with their money and investments than they would otherwise like to - which is the whole essence of the measures for fighting secular stagnation - then all of this cheap and easy money leads to a very strong possibility that a series of financial bubbles will be created.

And as history has taught us well, the popping of those financial bubbles can lead to severe financial crisis.

So we face the potential 1-2 combination of much lower interest income, indeed negative returns, and much lower stock market returns - unless investors around the world take the actions that these theoretical economists want to force, which is to take on more risk.

Which then creates the possibility of financial bubbles, which leaves us with very low returns - until the floor drops out.

Financial Security In Retirement

There is a potentially even bigger issue, which is that the projected funding for Social Security and Medicare is based upon the assumption of historic rates of economic growth continuing into the long term future.

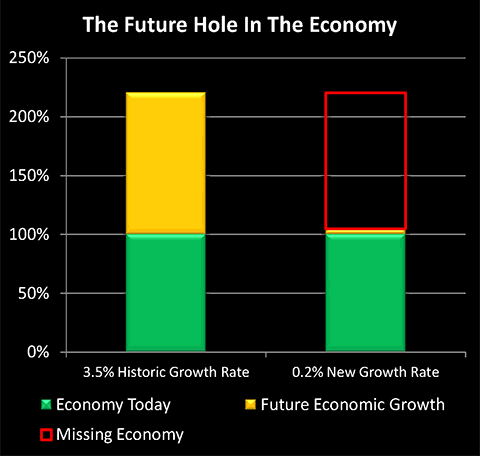

The following two graphs may be helpful in understanding this essential point. When people talk about future shortfalls, usually they are talking about projections which are themselves based upon the assumption that we know the future, and that it is one of steady economic growth at historical rates.

As shown in the first graph, and as developed in more depth in this analysis, the economy is expected to double in size in a little more than 20 years - assuming historical growth rates. There are a number of reasons why this growth might not happen, including the slower growth rates of heavily indebted nations, or the slower growth rates of nations with rapidly aging populations, or future potential economic and/or financial crises, or a shift in economic growth from the West to Asia... or it could be "all of the above" coming together into one package labeled "Secular Stagnation."

What does secular stagnation look like? That would be the hollow part of the right-hand bar. What a long-term lack of economic growth means is a necessary void in the future, an emptiness where the phantom wealth which was assumed and counted upon - fails to materialize in practice.

People don't usually think about it that way, but when we talk about the solvency of Social Security, or Medicare, or the value of long-term stock returns - those are generally all based on wealth that doesn't actually exist yet. Rather it is wealth that is merely assumed into existence, by taking historical growth for the United States during a time of economic prosperity and even world domination, and projecting them forward indefinitely into the future.

To be clear, then, to have the rug pulled out from underneath what we are told the financial future will be doesn't actually take any great crisis, or catastrophe, or collapse, or any other sort of world-changing "high drama" scenario. Oh, those could indeed happen, but they aren't actually needed for the future to unfold in an entirely different way than what the voice of financial authority tells us will be the case.

All it takes is for the assumed growth to not occur.

That's what secular stagnation truly is - not a doomsday event, but a big, gaping hole in the future. It's hypothetical wealth that simply fails to materialize. With any financial security or investment returns based on assumptions about that future wealth - also failing to materialize.

Part II

The 2nd part of this article discusses the grave threat that secular stagnation poses for Social Security, Medicare and other retirement promises, as well as how even allowing for the possibility can require changes in how we plan for retirement.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.