With Yemen Burning, Arab Spring II Is Underway

Politics / Middle East Mar 30, 2015 - 01:44 PM GMTBy: Money_Morning

Dr. Kent Moors writes: The worsening crisis in Yemen has provided a stark reminder of the immediate impact geopolitical events can have on oil prices.

Dr. Kent Moors writes: The worsening crisis in Yemen has provided a stark reminder of the immediate impact geopolitical events can have on oil prices.

I was asked to provide my analysis on CNBC's "Closing Bell" on Thursday afternoon, and to discuss the impact the crisis will have on oil prices.

Because this crisis is already having a big impact on the price of crude…

Oil Jumps on Conflict Fears

By mid-morning on March 26, West Texas Intermediate (WTI) had risen over 6% in less than 18 hours. Meanwhile Brent was up more than 5%, and was showing signs that it might be accelerating.

Behind this dramatic jump in price was the initiation of Operation Decisive Storm – air strikes against Houthi rebels in Yemen by Saudi-led coalition forces.

As reported by Saudi-owned Al-Arabiya TV, the coalition includes aircraft from the United Arab Emirates, Bahrain, Kuwait, Qatar, Jordan, Morocco, and Sudan, while Egypt, Jordan, Sudan, and Pakistan were ready to take part in any ground offensive. As part of the offensive, the United States was providing "logistical and intelligence support."

Some of these airstrikes were directed at the Al Anad air base in southern Yemen's Lahij Governorate, which was captured by rebels last week. Until a few months ago, this was the base the U.S. used to launch counter-terrorism operations in the region, especially against ISIS in Iraq.

But how quickly things have changed since then…

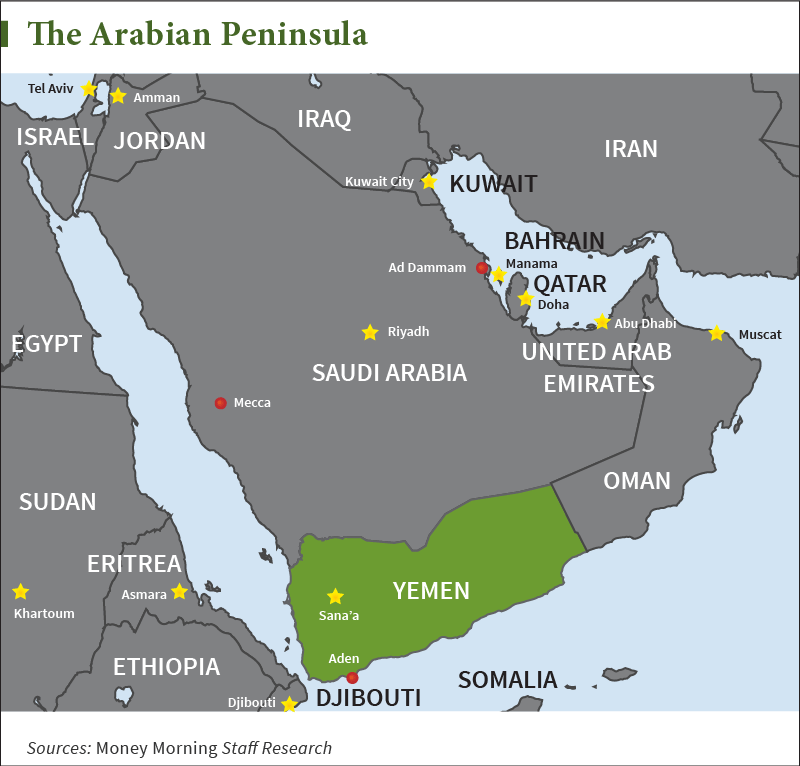

As it stands, the immediate impact on oil trading routes has been minimal. Yemen is located at the southwestern tip of the Arabian Peninsula at the entrance to the Red Sea, and a short boat ride from the Horn of Africa (hardly a stable place itself these days).

Given its location, little direct oil traffic moves north from here. The primary Saudi East-West Petroline oil pipeline connects to Yanbu on the coast well north of Yemen. About 5 million barrels a day travel via that route.

As you can see, the Saudis do have an extensive border with Yemen, and they have been moving troops to points along the border over the past few days, leading to speculation that ground forces may be next. The Yemeni port of Aden is currently under siege, and the current president is either in hiding or has already left the country.

Following the Arab Spring two years ago, Abdu Rabbu Mansour Hadi took over the presidency from long-time strongman Ali Abdullah Saleh. Saleh has the support of the Houthis, and they now control most of the country's military, including the air force.

That makes the U.S. and regional response much more difficult. In fact, the situation has all the hallmarks of a bloodbath just waiting to happen.

This Could Get Much Worse

Yemen is the fourth country in the area to unravel since the first Arab Spring unfolded – after Syria, Libya, and the ISIS insurgency in Iraq.

But this one is very different and far more deadly. The makeup of the parties involved is the real concern rattling the oil markets, not the direct impact of the crisis on current oil trading routes.

With the exception of events in the tiny country of Bahrain, the first Arab Spring was able to avoid the powder keg issue.

But not this time.

The besieged government in Sana'a, the Yemeni capital, is Sunni. The Houthis are Shiite, and strongly supported by Iran. The airstrikes yesterday have sunk Saudi-Iranian relations to their worst levels in decades.

Tehran has since condemned the attacks as an invasion, and promise all the help necessary to repel it. Ground troops that have amassed on the Saudi side of the border are likely to cross over into Yemen shortly.

As a result, I would not expect any further progress in the 5+1 nuclear talks with Iran from this point forward.

Unless Iran moves to block the Strait of Hormuz as a reprisal to the Saudi strikes, a reaction that would affect 20% of global crude oil exports and immediately bring in the U.S. fleet, oil prices should begin to recede a bit.

But that reprieve may not last very long.

As I have noted several times over the past month, the Arab Spring II will be much nastier than the first round of uprisings, especially if the Sunni-Shiite division becomes a central issue.

Keep in mind that countries in the region essentially bought off the opposition two years ago with massive additions to social welfare programs and government grants. All of them were funded when oil prices were much higher.

They do not have that luxury this time.

Source :http://moneymorning.com/2015/03/30/with-yemen-burning-arab-spring-ii-is-underway/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.