SPX Futures Appear Weak. WTIC and Gold May Be at Max Retracement

Stock-Markets / Financial Markets 2015 Mar 25, 2015 - 10:45 AM GMT Good Morning!

Good Morning!

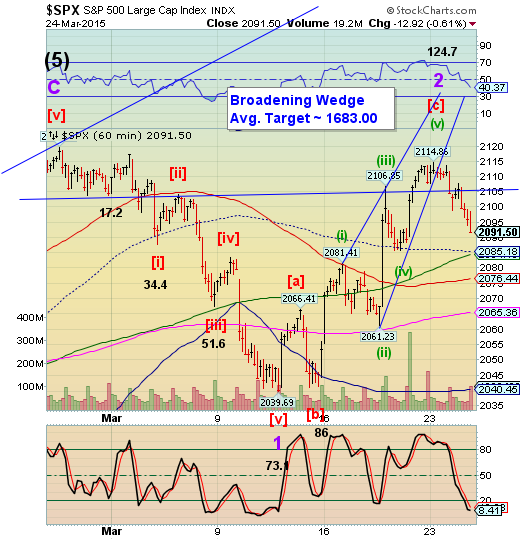

So far, SPX Premarket is going nowhere as of this report. This bolsters the argument that SPX must decline at least to its next level of support at 2085.18 before any retracement, since it completed an impulse from 2114.86 yesterday. It may go deeper, possibly to the 50-day Moving Average at 2065.36. It’s hard to label the squiggles in the Elliott Wave. One thought is that it may be doing a running correction with no visible retracement.

ZeroHedge reports, “After three days of unexpected market weakness without an apparent cause, especially since after 7 years of conditioning, the algos have been habituated to buy on both good and bad news, overnight futures are getting weary, and futures are barely up, at least before this morning's transitory FX-driven stop hunt higher. Whether this is due to the previously noted "blackout period" for stock buybacks which started a few days ago and continues until the first week of May is unclear, but should the recent "dramatic" stock weakness persist, expect Bullard to once again flip flop and suggesting it is clearly time to hike rates, as long as the S&P does not drop more than 5%. In that case, QE4 is clearly warranted.”

Durable goods Orders had a big miss this morning, adding fuel to the fire.

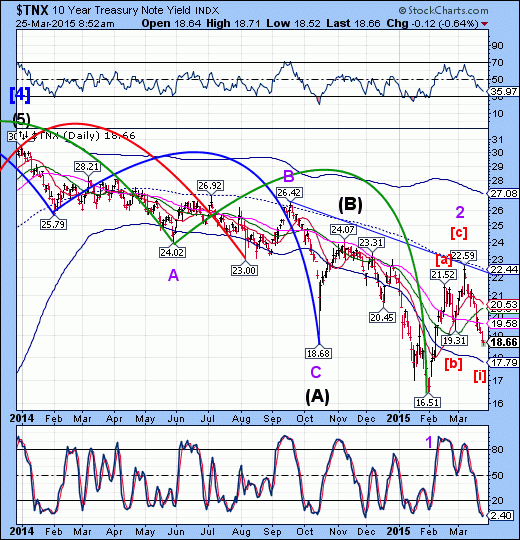

TNX appears to be completing its first impulsive decline from its Minor Wave 2 high. A Minute Wave [ii] may go as high as the trendline, causing some consternation among investors and the Fed. The next turn date happens to be Thursday or Friday, so there appears to be a bit more of a decline before what might be a lively retracement.

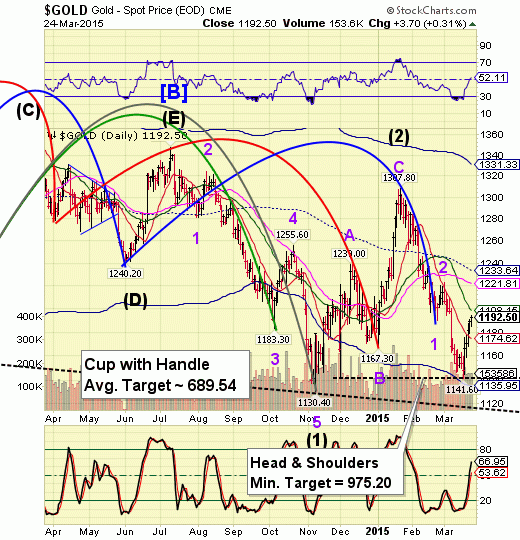

Gold reached a high of 1197.80 this morning before easing back. This is very close to the Intermediate-term resistance at 1198.16. We may look for a turn as early as tomorrow, which is a half-Trading Cycle or Friday, which is a Primary cycle Pivot day.

Crude oil challenged its 50-day Moving Average yesterday at 48.52. Its peak in the futures this morning was at 48.20, so it appears that the 50-day Moving Average is the stopper so far. It appears that a Trading Cycle Pivot awaits WTI this weekend, but if it cannot move any higher, this may be the beginning of a new decline in oil.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.