Gold Sentiment Not Bearish Enough

Commodities / Gold and Silver 2015 Mar 21, 2015 - 10:32 AM GMTBy: Jordan_Roy_Byrne

Precious metals are closing the week out with a good rally. The Federal Reserve nonsense proved to be a catalyst as it can be in either direction. Regardless of the Fed, the precious metals sector was oversold and due for a bounce. We wrote about that last week. Maybe this could be the bear market bottom. Maybe not. It concerns us that Gold is rebounding from an area of insignificant long term support amid sentiment that is not at a bearish extreme. Extreme bearish sentiment coupled with very strong support raises the probability of a major rebound or bear market bottom. I don't see that for Gold, yet.

Precious metals are closing the week out with a good rally. The Federal Reserve nonsense proved to be a catalyst as it can be in either direction. Regardless of the Fed, the precious metals sector was oversold and due for a bounce. We wrote about that last week. Maybe this could be the bear market bottom. Maybe not. It concerns us that Gold is rebounding from an area of insignificant long term support amid sentiment that is not at a bearish extreme. Extreme bearish sentiment coupled with very strong support raises the probability of a major rebound or bear market bottom. I don't see that for Gold, yet.

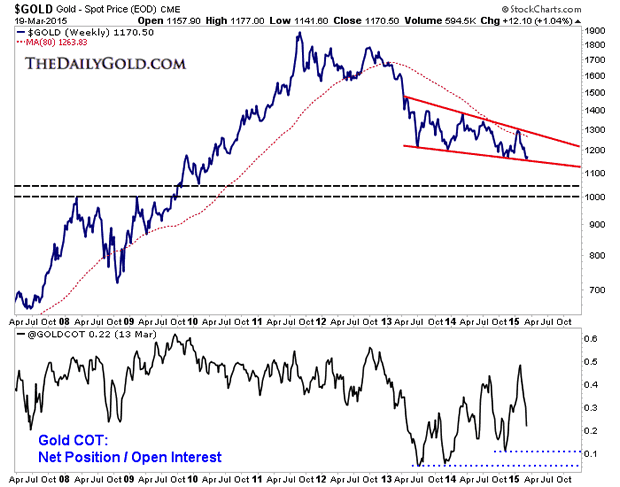

Below is a weekly line chart of Gold with its net COT position at the bottom. Gold will close the week around $1180/oz and avoid a break below the channel. However, Gold's COT is far from a bearish extreme. Gold's three best rallies in the past two years began with its net speculative position at or below 10% (of open interest). As of last Tuesday the net position was 22%. Gold may need this to be below 10% before it can bottom.

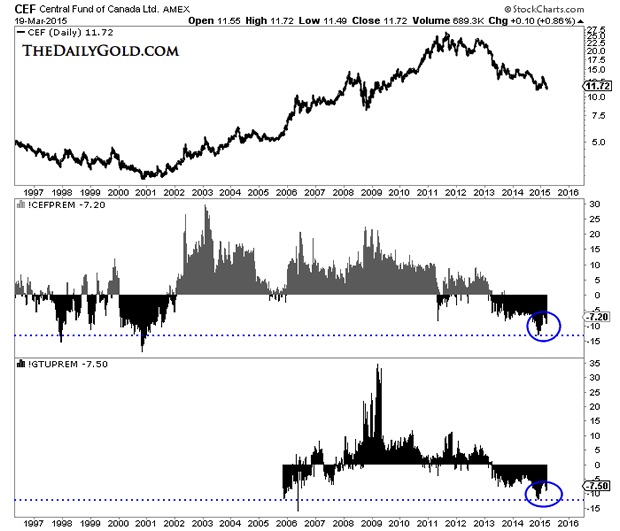

In the next chart we plot the premium/discount to net asset value (NAV) for a pair of closed end funds. CEF (which is shown at the top) is a closed end fund that owns Gold and Silver. GTU is a closed end fund which owns Gold. Both funds are currently trading at +7% discounts to NAV. While a 7% discount is big it is well below the largest discounts seen in late 2000 (~18%) and late 2014 (13%). GTU's largest discount was 12% in late 2014.

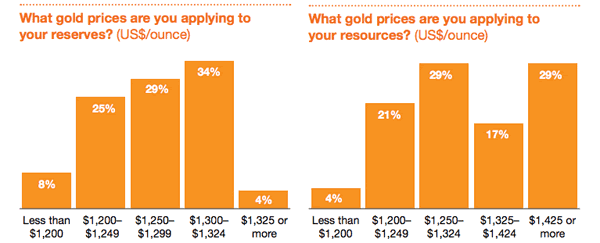

Interestingly, the mining companies aren't expecting or may not be prepared for $1000-$1100/oz Gold. The graph below is from consulting firm PwC. Look at how few companies are valuing their reserves and resources at sub $1200 Gold!

With the sector in a downtrend, bulls need to see some combination of extreme bearish sentiment, extreme oversold conditions and strong technical support. Metals and miners are rallying so sentiment figures to improve a bit before it can reverse course. In the big picture sentiment is quite bearish but the indicators argue it's not quite at an extreme. The COT is one example and the premium/discount in closed end funds is another. Technically, Gold does not have strong support until well below $1100/oz. We'd like to see Gold falling below $1100/oz, getting more oversold and nearing strong support with sentiment reaching bear market extremes. Those are the conditions for great buying opportunities that can lead to a bear market bottom.

Consider learning more about our premium service which includes a report on our top 10 juniors to buy for the coming bull market.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.