The Only Time Debt Is Profitable

Personal_Finance / Debt & Loans Mar 18, 2015 - 09:10 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: The other day I saw an ad for a mattress store that offered financing, so you can “sleep in peace” on your brand-spanking-new $7,000 mattress set. (Talk about irony!)

Keith Fitz-Gerald writes: The other day I saw an ad for a mattress store that offered financing, so you can “sleep in peace” on your brand-spanking-new $7,000 mattress set. (Talk about irony!)

Debt is the American way. It makes the impossible possible. It’s seen as benign or even good.

It’s not.

Personal consumer debt is one of the most dangerous financial products ever created.

Federal Reserve data show that Americans owe $11.74 trillion as of 2014. Some $882.6 billion of that is credit card debt, $1.13 trillion is student loans, and another $8.14 trillion is mortgages. An estimated 119.3 million indebted households carry an average of $15,257 each, or more than double the $7,117 carried (and paid off monthly) by non-indebted households.

The way I see things, debt is nothing more than “plastic prosperity” that makes you feel like you have more spending power. It’s a myth that’s been sold to the American public methodically and systematically for 30 years. And it wrecks lives.

Getting out of debt (or avoiding it entirely) is an absolute imperative when it comes to building Total Wealth.

But as an investor, there is one instance where you should consider taking on debt.

There’s one instance where debt can even be profitable.

First Thing’s First – Get Debt Out of Your Life

Before I can show you the one way you can use personal debt to your advantage, it’s really important to step back for the bigger picture.

Washington believes personal debt is absolutely essential to the economy, noting repeatedly that both industrial output and employment would suffer if consumer credit diminished. What else would you expect them to say?

But Washington’s got it wrong.

Rising credit usage is a sign that more families have to borrow to make ends meet. It’s not a sign of returning consumer confidence, but proof positive that everything’s getting more expensive.

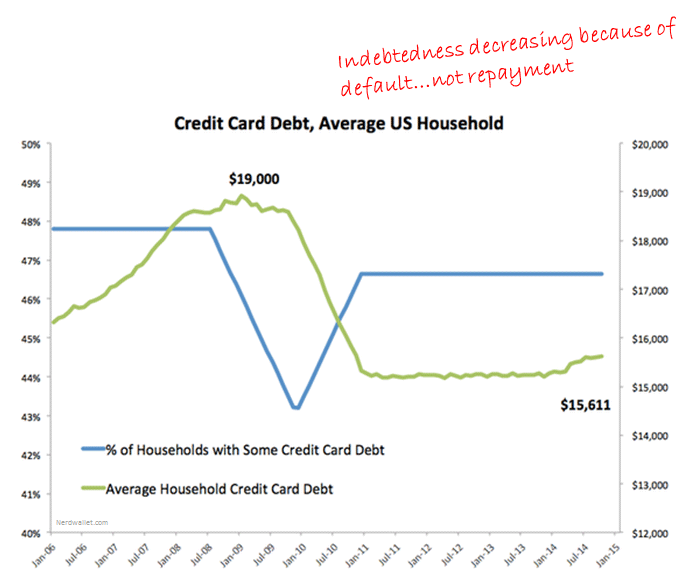

Critics – and debt proponents – screech that overall debt levels are dropping and that this is a sign that the economy is getting stronger. They’re right on one count… overall indebtedness has fallen from $19,000 per household at the height of the financial crisis to $15,611 as of January.

Here’s what they’re missing.

If you look closer, indebtedness is actually decreasing because more people are defaulting instead of repaying what they owe. Charge-offs – that’s what the credit companies call uncollectable debt – rose to 10.9% by 2010, up from 3.1% in 2006. That figure has since fallen back to approximately 3.25%, but only because so many people have already been wiped out of the credit markets.

At the same time, banks tightened lending standards so they restricted credit. This, too, contributes to a drop in overall debt figures.

There has been no structural change in consumer credit whatsoever. The “improving data” the Fed talks about constantly does not reflect fiscal prudence.

Simply put, you cannot encourage prosperity and build sound financial security on borrowed money, even though our government seems to think so.

Except in one instance.

The One Way to Make Debt Profitable

Data shows that 30% of American families own their homes and don’t have to worry about monthly payments to banks.

Props to them! Either they bought their homes flat-out, or they’ve already worked off their mortgage. Either of those things is a wonderful accomplishment.

And if you’re buying a home now?

I get asked a lot about whether it makes sense to pay off a mortgage early at a time when many Americans have refinanced at historical lows or are buying homes at rates that are still artificially low.

I think it comes down to opportunity cost.

Buying a home is that one instance where you do want to use debt to your advantage – but only if you have to, and only if you understand the alternatives.

For example, according to Bankrate.com, the average interest rate in the U.S. for 30-year mortgages is 3.97% (as of the week of March 11). That’s less than one-third of the 12.39% that the S&P 500 returned in 2014 alone, and 58% less than the 9.5% the market has returned on average every year since 1871.

So at the risk of annoying every real estate lender and agent from Portland to San Diego, there’s a good case to be made at the moment that you’re better off investing than buying a home. The former is an asset, the latter a liability that keeps you out of the rental market.

Even so, many people – including me – want to own their home. Going into debt as part of the purchase is a necessary evil, albeit not a hopeless one.

Here’s how to make the process work in your favor…

Three Rules for the One Time You Should Welcome Debt Into Your Life

1) Borrow as little money as possible.

I know this sounds obvious, but it’s not. People get caught up in the home-buying process. They forget that professional realtors are paid on commission based on the purchase price, not how much money you’re going to save. Mortgage bankers are the same way, generally speaking. So it’s in their interest to see you borrow as much money as possible to maximize their fees.

My wife and I recently bought a home and you should have seen the look on my banker’s face when I declined to take more than half of what I was approved to borrow!

Buy a smaller home or move to a less expensive area if you have to. And even if you don’t think you’ll qualify, check into home-buying assistance programs, especially if you’re a first time buyer, a veteran, or active duty military.

2) Don’t touch an Adjustable Rate Mortgage (ARM) unless you are fully prepared to pay it off in no more than 5-7 years.

These little gems are essentially residential versions of the low teaser rates that credit card companies offer as an enticement to sign up. Put bluntly, they’re little more than “bait and switch.”

But watch out. It’s commonly understood that ARMs adjust based on the prime rate or U.S. Treasuries, but they can also be “reset” at a rate that’s not only not always disclosed in advance, but which almost always increases.

In some cases, the low monthly payment you think is great when you sign on the dotted line can rise by 20-30% over just a few years on as little as a 3% interest rate bump. According to the Huffington Post and a 2007 AFL-CIO study, the average monthly increase accounted for 10% of after-tax income.

I’m not sure what that would be today, but with the Fed finally ready to raise rates, I wouldn’t be keen to find out either.

3) Pay off your mortgage as fast as you can.

Many homeowners fail to consider the true cost of ownership. I’ve given more than a few presentations where the audience gasped as I demonstrated why borrowing $250,000 at 4.3% will actually cost $445,384 over the life of the loan.

There are a few ways to do this. For instance, you can make an extra payment every quarter and pay off a 30-year loan approximately a decade early. Or, you can make bi-weekly payments that will shave anywhere from 4-6 years off your mortgage.

My favorite tactic with interest rates as low as they are today is to invest extra money in a choice like the PIMCO Strategic Income Fund Inc. (NYSE:RCS), which yields a stunning 8.6% according to Yahoo! Finance as of press time. Over time, you can use the incremental yield of 4.63% (8.6% yield minus the average 30-year rate of 3.97%) to accelerate your repayment.

Many people are concerned that choices like this will tank if the Fed raises rates, and rightfully so. But I think they’re making a mountain out of a molehill. The Fund’s managers will adjust holdings accordingly, so odds are that there will always be a differential spread you can use to your advantage.

You could also consider investing in a choice like the Williams Companies Inc. (NYSE:WMB), which currently yields 5% according to Yahoo! Finance. As the energy sector rebounds over time (and it will), you’ll have both the appreciation and cold hard cash needed to accelerate your mortgage and boost your wealth at the same time.

Obviously the incremental yield is not as high and there may be tax considerations unique to MLPs, but that does not change my point – you can use the market to fund your pre-payment schedule and help you get out of debt faster.

Especially if you’ve decided to buy a home and borrow money to do it.

Best regards for great investing,

Keith Fitz-Gerald

Source :http://totalwealthresearch.com/2015/03/time-ill-tell-debt-profitable/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.