Santander and Deutsche Fail Bank ‘Stress Tests’ – Risk of Bail-Ins

Stock-Markets / Credit Crisis 2015 Mar 12, 2015 - 02:24 PM GMTBy: GoldCore

- Largest banks in Germany and Spain fail Federal Reserve’s ‘stress tests’

- Largest banks in Germany and Spain fail Federal Reserve’s ‘stress tests’

- Stress tests designed to assess whether lenders can withstand another financial crisis

- U.S. subsidiaries fail Fed stress tests on ‘‘widespread and critical deficiencies’’ in identifying risks

- Deutsche and Santander bank fail on “qualitative” grounds

- 28 out of 31 banks passed the stress test, with Bank of America required to resubmit plans

- Both Deutsche and Santander passed questionable ECB stress tests in October

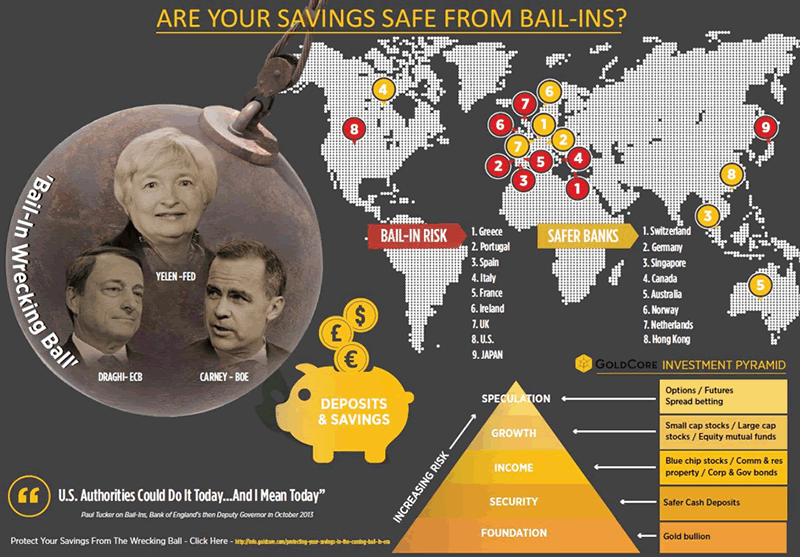

- Developing bail-in regime poses risks to depositors

The Federal Reserve has issued a stinging rebuke to two of Europe’s largest banks – Deutsche Bank and Santander.

U.S. operations of Deutsche, Germany’s largest bank, and Santander, the biggest bank in Spain and a large player in the UK market, were found to have serious deficiencies in capital planning and risk management, according to a senior Federal Reserve official.

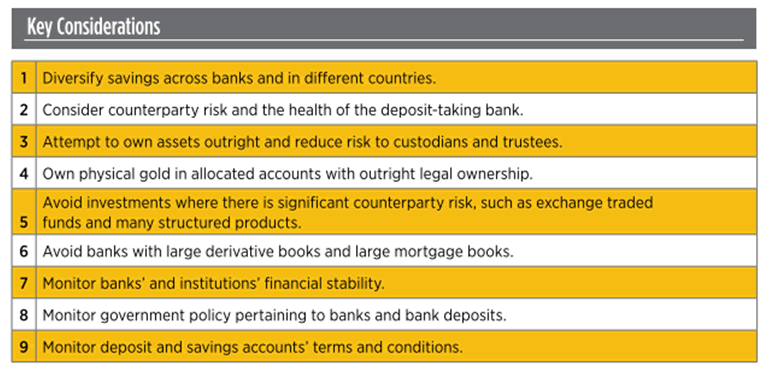

Key Bail-In Considerations

The systems by which European banks assess risk have been called into question following the failure of the U.S. subsidiaries of the two major European banks to meet criteria set out in the Federal Reserve’s stress tests.

The subsidiaries of both Deutsche Bank and Banco Santander failed the stress tests for “qualitative” reasons among which were their inability to accurately identify risk and to respond realistically to losses.

The annual Fed ‘stress tests’ aim to ensure banks are capable of functioning during periods of “financial stress”.

Of the 31 banks tested, 28 passed although the Wall Street Journal reports that some big banks “struggled”. Bank of America did not pass the test and has been asked to resubmit its plans.

It is unsettling that the two banks that failed the stress test are subsidiaries of European banks that comfortably passed the ECB’s stress test in October. As we pointed out at the time, the ECB test was of questionable value as it didn’t even model in a potential deflation scenario – despite early signs of and risks of deflation.

Within a few short months Europe was experiencing deflation, demonstrating a lack of competence and or foresight at the ECB. The health and viability of Europe’s banking sector would not appear to be as sound as the ECB has suggested to investors, depositors and the public.

Equally troubling, is the fact that Deutsche Bank, who have derivatives exposure of over a whopping €54 trillion – almost nine times the GDP of the entire Eurozone – has serious issues with risk management.

Warren Buffett’s “financial weapons of mass destruction” – how are you?

Should Deutsche Bank or any other similarly exposed European bank suffer substantial losses it could trigger a major derivatives and or solvency crisis – and contagion in the financial system. With sovereigns and central banks having already badly damaged their balance sheets – another Lehman style crisis may be one which no nation or multi-national institution could resolve.

The best case scenario would involve bail-outs and bail-ins. The worst case scenario would involve currency devaluations internationally and a consequent destruction of wealth.

An allocation to physical gold outside of the banking system will protect savers and investors in such a scenario.

Download Protecting Your Savings In The Coming Bail-In Era (11 pages)

Download From Bail-Outs To Bail-Ins: Risks and Ramifications – Includes 60 Safest Banks In World (51 pages)

MARKET UPDATE

Today’s AM fix was USD 1,161.25, EUR 1,094.90 and GBP 774.48 per ounce.

Yesterday’s AM fix was USD 1,158.75, EUR 1,096.06 and GBP 769.42 per ounce.

Gold fell 0.63%percent or $7.30 and closed at $1,154.00 an ounce yesterday, while silver slipped 0.45% or $0.18 to $15.50 an ounce.

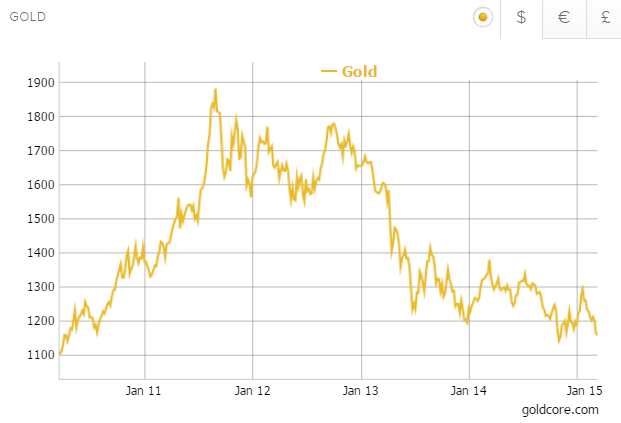

Gold in USD – 5 Years

In Singapore, bullion for immediate delivery rose initially prior to falling and was marginally lower at $1,160.05 an ounce.

In London, spot gold in late morning trading is $1,160.38 up 0.41 percent. Silver is $15.67, gaining 1 percent while platinum is $1,127.23, climbing 0.48 percent.

Gold rose above the key psychological level of $1,150 this morning after the U.S. dollar gave up some of the recent outsize gains against the euro. Gold’s gain could be attributed to speculators scrambling to cover shorts on the yellow metal and some seeing gold as good value at these levels.

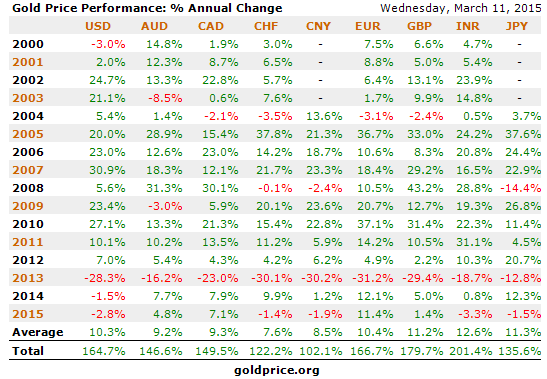

Gold has racked up an 8 day losing streak in dollars and is now showing a loss in dollars of nearly 3 percent for 2015 but gains of 11% in euro terms – see table.

Yesterday’s stock market free fall erased 2015 gains for the S&P 500 and Dow industrials, meaning that stocks too are negative for the year.

The S&P 500 closed 1.7%, lower at 2,044.2, it is biggest one-day percentage decline in nine weeks. Selling on Wall Street was broad based, with all 10 main sectors finishing with losses.

The Dow Jones Industrial Average dropped 1.9%, to 17,662.9, it is worst point drop since Oct 9, 2014.

The Nasdaq Composite ended the day down 1.7%, at 4,859.8, on the 15th anniversary of its all-time high.

Sentiment towards gold is very negative after the recent gains and gold is due a bounce.

Interestingly, according to Amanda Cooper of Thomson Reuters posting in the Global Gold Forum:

“Until yesterday, gold had fallen for 8 days in a row, which is pretty steep going even for the gold market when it gets gloomy. The last time gold fell that many days in a row was March 2009.

A closer look at the chart reveals that gold has only ever fallen by that many days in a row three times since the gold standard was abolished in the 1970s. Since Reuters gold data began in 1968, gold has only fallen for 9 days once, back in August 1973.”

It takes a brave or foolish investor to buy after such falls and will always caution never to “catch a falling knife”. However, an attractive buying opportunity looks set to soon present itself and dollar cost averaging into position remains prudent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.