Canada’s Central Banks Orders End to ‘Spocking’ Of Canadian Dollar - Defacing Debasing Currencies

Currencies / Canadian $ Mar 04, 2015 - 12:50 PM GMTBy: GoldCore

- From “Spocking” in Canada to overtly political imagery in Greece, paper currency is growing in popularity

- From “Spocking” in Canada to overtly political imagery in Greece, paper currency is growing in popularity

- Outpouring of affection for Leonard Nimoy has inspired the phenomenon of “Spocking” in Canada

- Greek artist Stefanos alters euro notes to deliver a political message

- Defacing notes is illegal and a criminal offence in the EU, U.S. and most countries

- Disgruntled citizens defaming already debasing currencies … this may catch on …

The death of Leonard Nimoy inspired a wonderful outpouring of affection across the world, and possibly beyond.

Nimoy was best known for playing the role of Dr. Spock in Star Trek, possibly the most beloved character in the sci-fi genre for several generations.

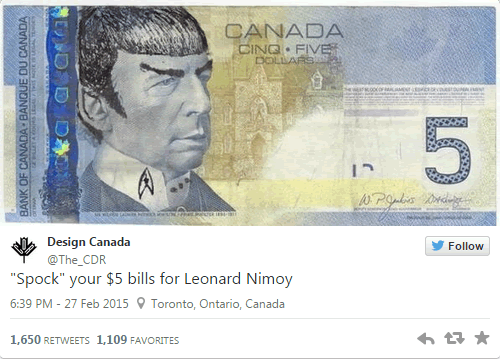

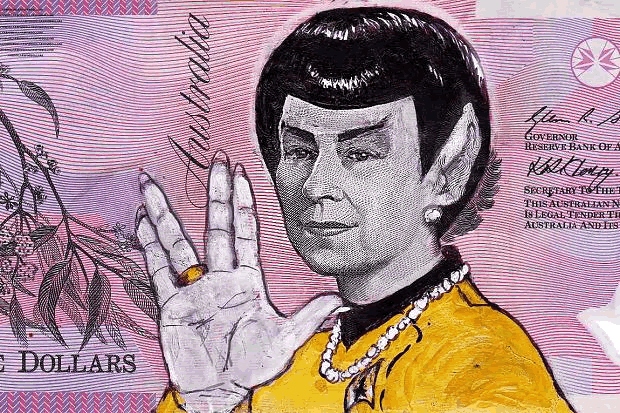

From our point of view, with our interest in the nature and history of money, the most interesting of these expressions is the resurgence of the phenomenon of “Spocking” in Canada.

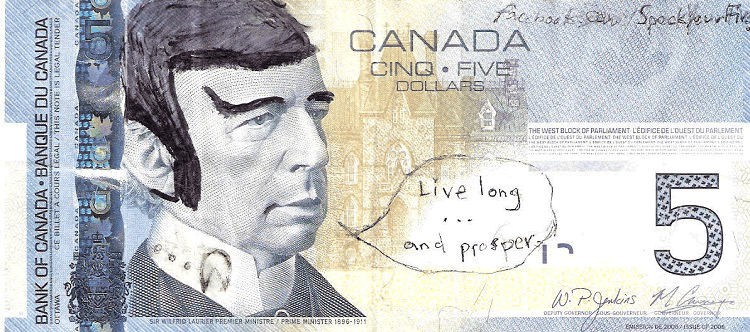

“Spocking” is the act of defacing the Canadian $5 note by superimposing the likeness of the half-Vulcan doctor onto the image of former prime minister, Sir Wilfred Laurier. There is quite a resemblance and therefore not much art is required to transform the former prime minister into the beloved Dr. Spock.

The trend, like all the most entertaining forms of mischief, is apparently illegal in many countries, but not so in Canada. Moral ambiguity has not deterred Canadians who for years have enjoyed replacing the unfortunate Sir with the likeness of Spock or Alan Rickman’s portrayal of professor Snape in the Harry Potter movies.

Enough Spocking was being done that the Canadian central bank felt compelled to act and said:

Yes, it’s legal, but it’s just not a very nice or Canadian thing to do. “Bank spokeswoman Josianne Menard said Tuesday that scribbling on bills is inappropriate because it defaces a Canadian symbol and source of national pride,” the Associated Press reports.

The practice of defacing paper notes will come to an end in November when the Bank of Canada will issue new plastic notes with a different image of Laurier.

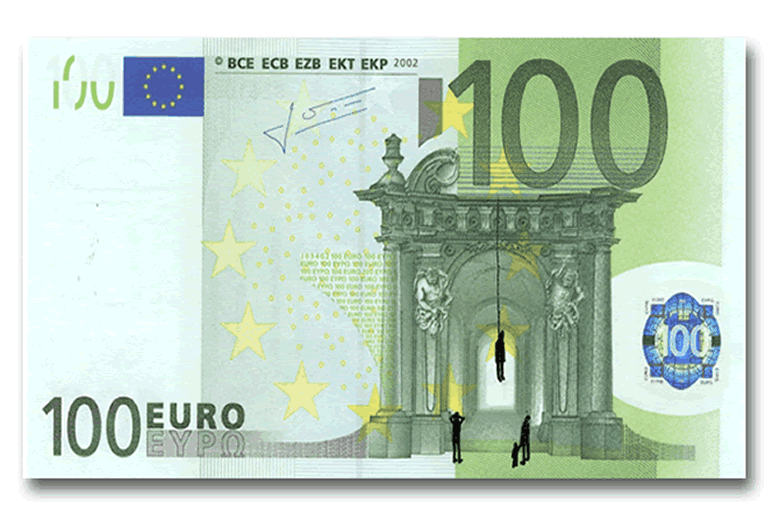

Meanwhile in Greece a different, overtly political, form of graffiti has started to emerge. An artist known as Stefanos has been defacing euro notes with images of little human figures in a painfully bleak depiction of life in Greece under austerity.

The €100 note is particularly poignant and shows an apparent suicide by hanging while bystanders, including a child look on.

The €10 seems to depict a black hole sucking people into it – a possible reference to the euro itself and the seemingly unending extraction of wealth from working people in servicing a debt from which they derived no benefit.

Other images refer to violent crime, police harassment and possibly football hooliganism. The grim reaper is shown on the €100 note and the €50 note features a figure who has been stabbed in the back while another looks on from the shadows – a possible reference to the betrayal of the people of Greece by their own elites.

It is a criminal offence to deface the euro in a manner that is deemed offensive, whatever that means. Cited as examples in law are pornographic or violent imagery.

Shop-keepers and lenders are obliged by law to accept legal tender and cannot refuse a note that has been defaced.

Stephanos defaced the notes, photographed them to circulate on social media and then released them back into circulation in the hope that the universal imagery would communicate a message across European state and linguistic boundaries.

It is an interesting phenomenon and bears watching. We expect the trend to grow in popularity as disaffection with the euro, the dollar and other paper currencies builds.

What if this sort of thing catches on and people begin to deface debt-based and increasingly debased paper currencies across Europe and the world? It could be a further factor leading to the penny dropping and a tipping point being reached regarding the intrinsically worthless nature of paper and digital currencies today.

Updates and Award Winning Research Here

MARKET UPDATE

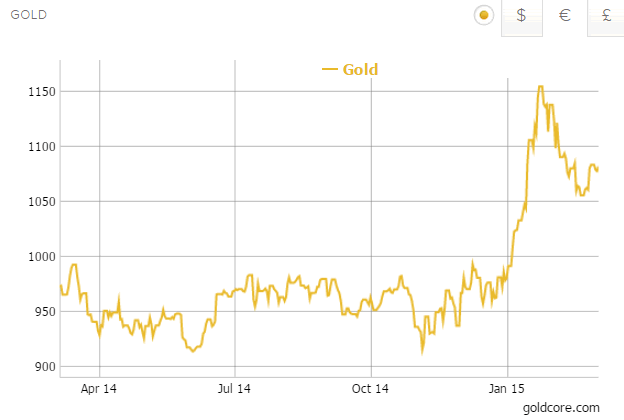

Today’s AM fix was USD 1,204.25, EUR 1,082.67 and GBP 785.19 per ounce.

Yesterday’s AM fix was USD 1,207.75, EUR 1,081.20 and GBP 786.14 per ounce.

Gold fell 0.19% percent or $2.30 and closed at $1,203.20 an ounce yesterday, while silver slipped 0.67% or $0.11 to $16.26 an ounce.

Gold in Euros – 1 Year

Spot gold edged up 0.1 percent to $1,204.74 an ounce in late Asian trading. Gold in Singapore climbed higher after two days of losses, limited by the U.S. dollar’s strength ahead of key economic data.

Outflows from SPDR, the world’s largest gold exchange-traded fund, showed a small dip of 0.35 percent to 760.80 tonnes yesterday. Monday the fund lost eight tonnes – its largest loss this year.

Market players are keeping a close watch on U.S. economic data for signs that the economy is doing well.

The European Central Bank (ECB) policy meeting is set for Thursday and it is expected that Draghi will begin the €1 trillion QE program of bond purchases this month. This monetary experiment is very bullish for gold – especially in euro terms.

Gold in the late morning in Ireland is trading at $1,254 or off 0.01 percent. Silver is $16.32 or down 0.01 percent and platinum is $1,178.89 or off 0.46 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.