Bondholders “Bailed In” In Austria – New Banking Crisis?

Stock-Markets / Credit Crisis 2015 Mar 03, 2015 - 02:14 PM GMTBy: GoldCore

- Auditors find €7.6 billion hole in Austria’s “bad bank”, Heta Asset Resolution AG

- Auditors find €7.6 billion hole in Austria’s “bad bank”, Heta Asset Resolution AG

- Austria’s government says it will not give Heta “a single euro”

- Emergency legislation passed last month means bondholders to be bailed in

- Risk of contagion high as other banks may hold Heta bonds

- “Bail-in is now the rule” – EU Finance Minister Noonan

- Austrian bondholders today … international depositors tomorrow …

There are signs that the debt induced banking-crisis which rocked the global economy in 2008 – only to be postponed with vast infusions of new unpayable debt courtesy of the taxpayer – may be set to resume.

Bondholders are feeling the painful impact of the EU’s new bank resolution regime and bank bail-ins for the first time after the Austrian government said it would pour no more money into its ‘bad bank’, triggering a fall of nearly 30 per cent in the value of some bonds.

Austria’s Financial Market Authority (FMA) has discovered a €7.6 billion capital shortfall on the balance sheet of Heta Asset Resolution AG, the “bad bank” that was formed from the remnants of failed lender Hypo Alpe Adria.

The Austrian government – who have heretofore plied Heta with €5.5 billion – held an emergency meeting to discuss the development. They concluded that they would not hand over “a single euro” to the bad bank.

Instead they have opted to use new legislation based on the EU’s Bank Recovery and Resolution Directive (BRRD). The legislation was, coincidentally, enacted in Austria last month despite the fact that other European countries are not due to ratify the directive until early next year.

The BRRD paves the way for bail-ins of bond-holders and bank deposits over a certain amount. Heta does not have depositors and so it is bond-holders who will incur the losses.

Bloomberg reports that among Heta’s bondholders are Deutsche Bank and UBS and Pacific Investment Management Co. (PIMCO). Whether these institutions are strong enough to absorb their losses remains to be seen.

We will begin to get an idea during the course of this month as Bloomberg reports:

“More than 9.8 billion euros worth of debt is affected, including senior notes worth 450 million due on March 6 and 500 million on March 20.”

If Deutsche Bank or UBS were to be significantly affected by the demise of Heta, we may see a renewed banking crisis and contagion concerns would reemerge.

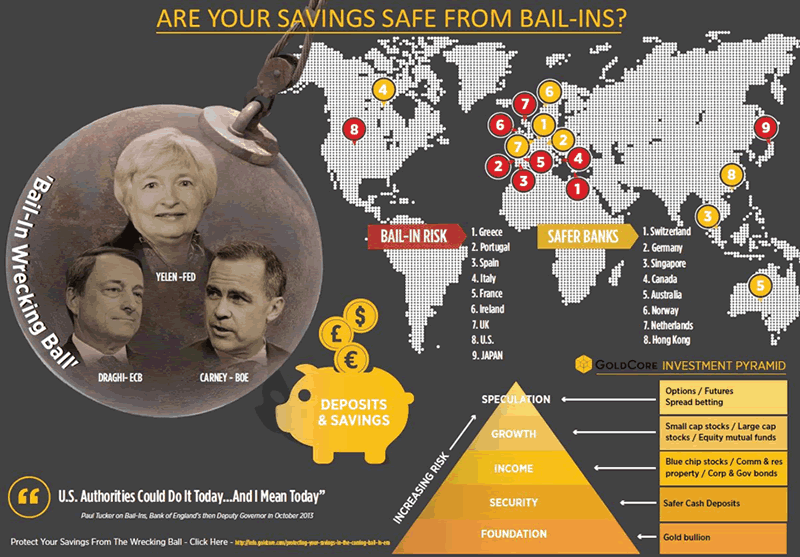

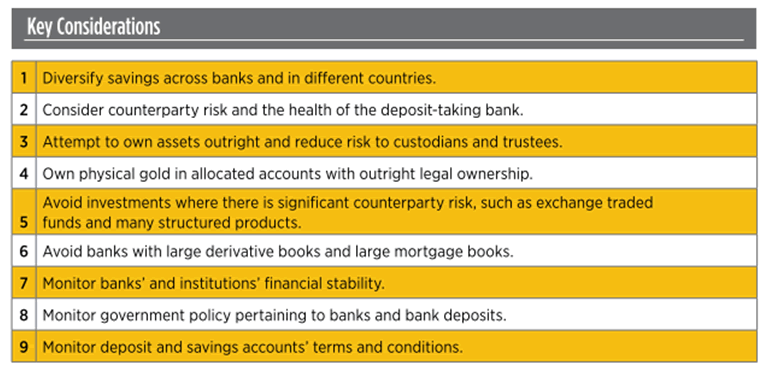

While the bail-in at Heta will only have immediate consequences for bond-holders, it is important to realise that the BRRD includes provisions for the confiscation of deposits of over a certain amount.

“Bail-in is now the rule” as Irish finance Minister Michael Noonan warned in June 2013. Noonan admitted that the move to not maintain deposits as sacrosanct was a “revolutionary move.” That it was and yet investors and depositors remain blissfully unaware of the risks of bail-ins both to their own deposits but also to the wider financial system and economy.

Bail-ins are now the rule globally and this is the case in practice and is no is longer simply a theoretical talking-point. That the Austrian government rushed ahead in ratifying the directive last month suggests that there are rumblings beneath the surface and other governments could quickly follow suit.

Indeed, we expect other European countries, the UK, U.S., Canada, Australia and most western financial regulators and authorities to follow suit. If this does indeed transpire it should be seen as a warning sign for bond-holders and indeed depositors to take precautionary measures as soon as possible.

Should a resurgence of the global banking crisis occur it is likely to be worse than last time as the liabilities in the banks are much greater and the many large sovereign nations are in effect insolvent.

With interest rates at or below zero percent and many major central banks still engaging in QE, central banks have very few monetary tricks up their sleeves. they have pulled rabbits out of hats one too many times.

We urge readers to diversify deposit holdings and acquire allocated gold and silver held outside of the banking system to protect their wealth during the next phase of the banking crisis.

Austrian bondholders today … international depositors tomorrow…

Download Protecting Your Savings In The Coming Bail-In Era (11 pages)

Download From Bail-Outs To Bail-Ins: Risks and Ramifications – Includes 60 Safest Banks In World (51 pages)

MARKET UPDATE

Today’s AM fix was USD 1,207.75, EUR 1,081.20 and GBP 786.14 per ounce.

Yesterday’s AM fix was USD 1,216.75, EUR 1,084.93 and GBP 789.48 per ounce.

Gold fell 0.46% percent or $5.60 and closed at $1,205.50an ounce yesterday, while silver slipped 1.21% or $0.20 to $16.37 an ounce.

Gold in Singapore edged up at the end of trading on Tuesday, after bouncing back from a dip below $1,200 an ounce, as the U.S. dollar retreated from an 11-year peak against a basket of currencies.

Spot gold was up 0.2 percent at $1,209.60 an ounce towards the end of trading in Singapore after it dipped to a session low of $1,194.90.

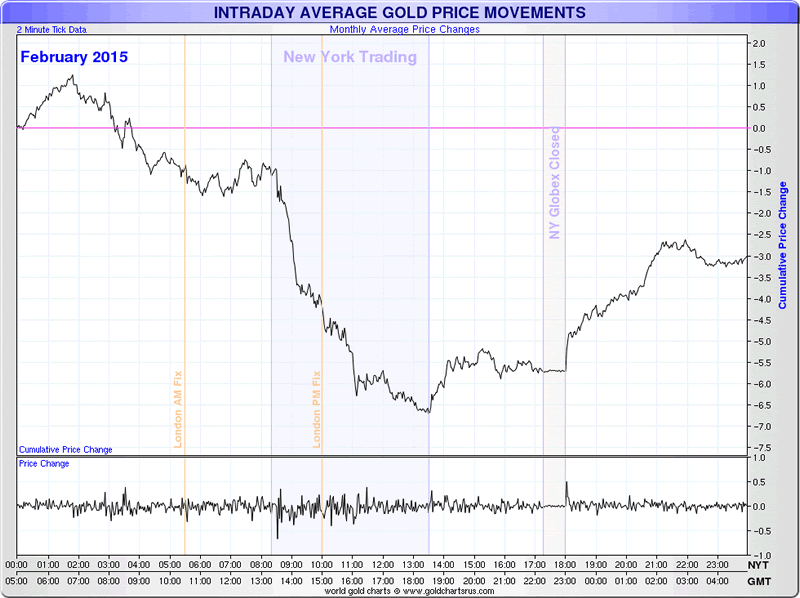

The trend of rising gold and silver prices in Asian trade and falling prices in European and U.S. trading continues.

Is this further evidence of manipulation? Many analysts increasingly think so.

Seven out of seventeen of the Fed’s members have now said they want the option of an interest rate hike in June on the table, or have lobbied for an earlier increase – in expectation that inflation and wages will jump higher.

In late morning trading in London, gold for immediate delivery is trading at $1,207.71 up 0.07 percent. Silver is trading at $16.39 down 0.15 percent while palladium is at $1,183.80 or down 0.28 percent.

Barclays noted in its 2014 annual report that it has been providing information for an investigation into precious metals by the U.S. Department of Justice (DoJ). The Wall Street Journal reported in an article last week that the DoJ and the Commodity Futures Trading Commission (CFTC) are investigating at least 10 major banks for possible rigging of the precious metals markets.

The banks involved in producing the fixes for global gold, silver, platinum and palladium benchmarks, said last year they would no longer administer the standards.

A new silver benchmark is operated by CME Group and Thomson Reuters, while the London Metal Exchange produces platinum and palladium benchmarks. The Intercontinental Exchange (ICE) will manage a new gold benchmark beginning March 20th.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.