France and Italy are the Next Causalities of the Credit Bubble

Stock-Markets / Credit Crisis 2015 Feb 27, 2015 - 05:39 PM GMTBy: EWI

Editor's note: This article is excerpted from The State of the Global Markets Report -- 2015 Edition, a publication of Elliott Wave International, the world's largest financial forecasting firm. Data is updated to December 2014. You can download the full, 53-page report here.

Editor's note: This article is excerpted from The State of the Global Markets Report -- 2015 Edition, a publication of Elliott Wave International, the world's largest financial forecasting firm. Data is updated to December 2014. You can download the full, 53-page report here.

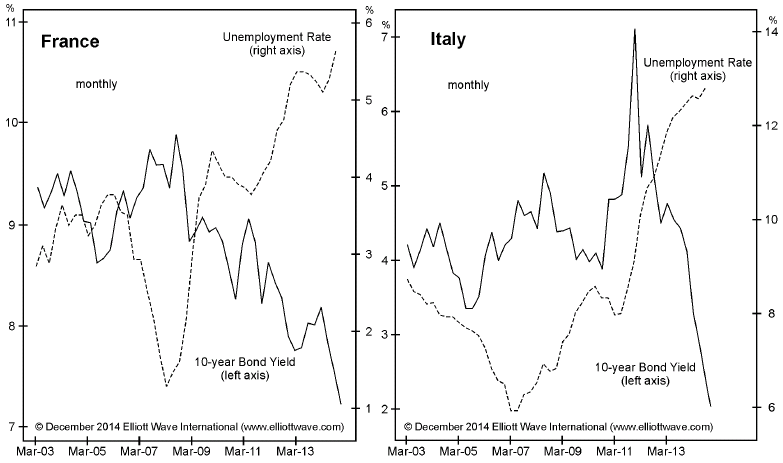

These two charts depict two imminent casualties of the credit bubble -- France and Italy -- where sentiment has decoupled from reality.

In November 2014, yields on 10-year French and Italian bonds fell to fresh multiyear lows (the sentiment), while unemployment pushed to record highs (the reality). In December, France reported the largest monthly spike in unemployment since February 2014, with more French workers now jobless than ever before. Italy, too, just got hit with a double whammy. At 13.2%, Italian joblessness also hit a new record, while CPI inflation came in at just 0.2%.

Keep in mind that these are Europe's second- and third-largest economies.

The data, meanwhile, confirms one of our longest-standing forecasts: that deflation will triumph over central bank stimulus, because consumers will delay purchases once they start to see that prices are falling. In November, a Reuters special report, "Why Italy's Stay-Home Shoppers Terrify the Eurozone," sought to explain why efforts to resuscitate Italy's moribund economy have failed.

Sure enough, the chief executive of a Milan-based shopkeepers association reports, "People aren't stocking up because they know prices will be lower in a month's time."

Moreover, shoppers are simply demanding steeper discounts. Italy's largest supermarkets, for instance, sell up to 40% of their products below their recommended retail price, yet the price cuts still routinely fail to increase demand. Says Reuters, "Italians are hoarding what money they have and cutting back on basic purchases...." Indeed, consumer prices in Italy have fallen on a yearly basis for the first time in half a century. Meanwhile, the country has lost 15% of its manufacturing capacity and more than 80,000 shops and small businesses since the country first entered recession back in 2008. "Those that remain are slashing prices in a battle to survive," Reuters reports.

Editor's note: This article is excerpted from The State of the Global Markets Report--2015 Edition, a publication of Elliott Wave International, the world's largest financial forecasting firm. For a limited time, you can download the full report, for free, and use its year-in-preview insights to prepare, survive and prosper through the global investment landscape of 2015 and beyond. Download the full, 53-page report here.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.